Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Nov, 2025

By RJ Dumaual and Katherine Dela Cruz

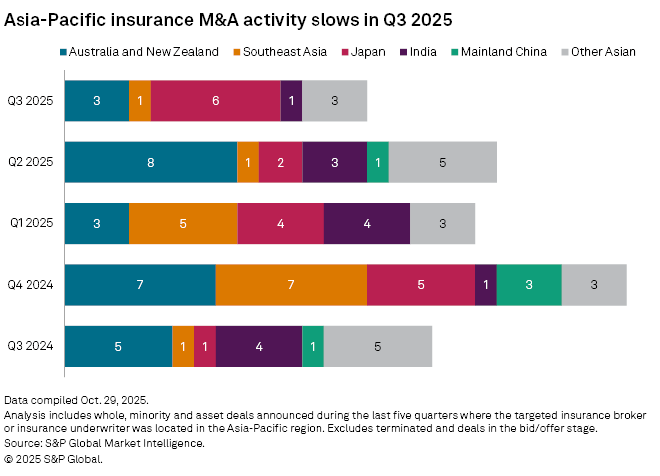

The third quarter was relatively quiet for Asia-Pacific insurance M&A activity, according to an S&P Global Market Intelligence analysis.

There were 14 M&A transactions in the period: six in Japan, three in Australia and New Zealand, and one each in India and Southeast Asia.

Deal count was down on both a sequential basis and year over year. Twenty deals were recorded in the second quarter: eight in Australia and New Zealand, three in India, two in Japan and one each in mainland China and Southeast Asia. The region saw 17 deals in the third quarter of 2024, led by Australia and New Zealand with five and India with four. Southeast Asia, mainland China and Japan all had one M&A deal in the year-ago period.

Deal activity accelerated in the final quarter of 2024 when 26 transactions were logged in the region, with seven deals in Australia and New Zealand and Southeast Asia.

International expansion continues

While Asia-Pacific insurance M&A activity in the region slowed in the third quarter, Asian insurers' ongoing international expansion continued.

Sompo Holdings Inc.'s proposed acquisition of Aspen Insurance Holdings Ltd., agreed to in August, came amid a trend of Japanese insurers expanding into the US market. South Korea's DB Insurance Co. Ltd. capped off the quarter with an agreement to acquire The Fortegra Group Inc. for approximately $1.65 billion in cash from Tiptree Inc. and Warburg Pincus LLC.

|

– Use the screener to access M&A data on the S&P Capital IQ Pro platform. – Click here to – Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay. |

DB Insurance is looking to establish a broader presence in the US specialty insurance market and enter European specialty markets as part of its efforts to become a leading insurance group by 2033, according to a statement from Fortegra. For its part, DB Insurance touted Fortegra's stable combined ratio through a balanced portfolio and disciplined underwriting, supported by the high growth of the US specialty insurance and MGA markets.

The proposed acquisition is in line with DB Insurance's strategy to expand and diversify overseas amid slowing growth in the domestic property and casualty market, S&P Global Ratings analyst Chang Sim wrote in a report, estimating that the contribution from overseas operations to the insurer's gross premiums written could rise to 20% to 25% of the total if Fortegra is consolidated. This compares with 3% to 5% in 2024.

The rating agency also expects DB Insurance to continue to expand Fortegra's specialty insurance business following the acquisition.