Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Nov, 2025

| Larvotto Resources' Hillgrove gold-antimony project in New South Wales, Australia, which has attracted interest from a US government supplier. |

➤ Antimony demand is rising with its growing usage in solar panels and as various conflicts fuel the need for artillery.

➤ The critical role of antimony in defense was key to US President Donald Trump's talks with Australian Prime Minister Anthony Albanese in October.

➤ Larvotto Resources expects to pay dividends from its Hillgrove gold-antimony project in the second year of production amid high prices for both commodities.

|

| Ron Heeks, managing |

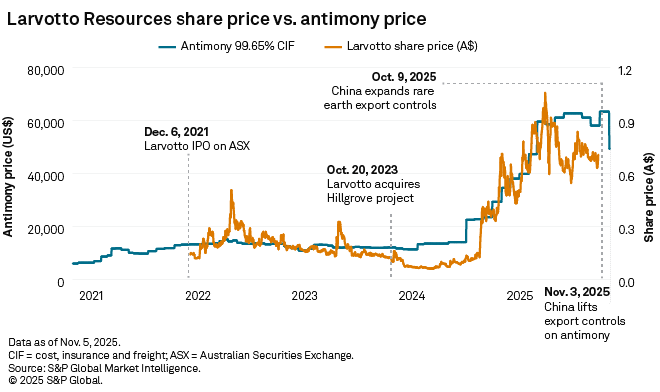

Larvotto Resources Ltd. listed on the Australian Securities Exchange in December 2021 with only copper and gold projects in Australia and New Zealand in its portfolio. In October 2023, the company entered the antimony space with its acquisition of the Hillgrove gold-antimony project in New South Wales, Australia.

On Oct. 27, Larvotto rejected a takeover offer from United States Antimony Corp. (USAC), which has a US$245 million contract to supply the US government with antimony for defense purposes.

The price of antimony, which is on the critical mineral lists of Australia, the US, Japan and Canada, then plunged by over 22% from its record high to US$49,250 per metric ton on Oct. 31 following Trump's Oct. 30 announcement that China had agreed to postpone planned restrictions on rare earths exports. On Nov. 1, the White House confirmed China would issue general licenses for exports of antimony and other critical minerals.

Platts, part of S&P Global Commodity Insights, spoke to Ron Heeks, managing director of Larvotto, on the antimony market's evolution and outlook given current geopolitics. This interview has been edited for clarity.

Platts: What is the broader significance of USAC's offer for Larvotto in light of current geopolitics around antimony?

Ron Heeks:

There was a shipment of antimony stuck in China earlier this year; it was on its way to USAC, then it was returned to Australia. You're talking 50 metric tons of antimony concentrate for a sea container load. We will produce 50 metric tons an hour.

To meet the US government contract, USAC has to get it from somewhere, so calling us was a pretty obvious place to go. There's nowhere else you can really call. We are the only one with a serious mine using a production plant that's coming online in the next four to five years.

What is driving demand?

What's driving it are solar panels. That's the be-all and end-all. Everything else is just helping.

There has been a rapid rise in the use of antimony in solar panels as a hardener to make them lighter and thinner. It's also used in telescopes, night-vision goggles, anything with really high-quality optics because it takes all the micro-bubbles out of the glass, which makes the glass a much better medium — and that's what it does in solar panels.

The solar panel becomes more efficient because it lets in the ultraviolet light that you want and stops the ultraviolet light that you don't want. If you put about 40 grams of antimony into a panel, which is worth about US$3 or US$4, you get between 2% and 4% more efficiency from your solar panel.

Every bit of military lead also has somewhere between 2.5% and 6.5% antimony as a hardener — so every bullet, shell and everything has that.

There is a pretty serious war with more shells flying around Ukraine daily than there were through World War II, plus what's going on in Palestine, along with Trump getting everybody to rearm and boost defense spending.

One of the main reasons the US hasn't been able to supply more military equipment to Ukraine is that it doesn't have the antimony to replace what they're using. They can't make more bullets. That's why it's absolutely critical, and is part of the reason why our Prime Minister Anthony Albanese spoke to Trump about critical minerals, and antimony would have been top of the list.

Every lead-acid battery also has antimony in the cells that makes the lead walls harder so they don't collapse. That demand is increasing with the population and has incredible recycling opportunities because most lead-acid batteries are recycled. While there's only about 2% new antimony going into the lead-acid battery market currently, every electric car also has a lead-acid battery that runs the systems.

Antimony has also been a traditional fire retardant for clothing that firefighters wear, and we use a lot of it in the colored liquid dropped on bushfires in Australia.

With all those factors, there has been an increase in demand of somewhere between 40,000 metric tons per year to 60,000 t/y over the last seven years, while production declined by about 60,000 t/y.

All these have boosted the antimony price from US$9,000/t to US$60,000/t. So there's a huge antimony use there.

What is the timeline for the Hillgrove project?

We will supply north of 7% of the world's antimony after we start production in the second quarter of 2026. If Hillgrove does what we're telling people it does, we couldn't spend the cash flow fast enough on exploration to be quite honest. You're talking about A$300 million free cash flow a year from antimony and gold. So we'll do it the old traditional way of paying it back to shareholders, most likely in the second year of production.

Hillgrove will cost about A$150 million to build, and we raised more than that with US$105 million via a senior secured bond issue and a A$60 million equity raise in July, plus A$10 million in a share purchase plan.

We raised more because we've got other projects too, including a very interesting copper project and rare earths project, which is [at a] very early stage. The one thing about building anything these days is that it's going to cost a bit more than what you thought. So we just made sure we're truly covered.