Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Nov, 2025

By Allison Good

|

Independent power producer Constellation signed a 20-year agreement in June to supply Meta with output from the Clinton Power Station, above. The deal provides crucial financial certainty for the Illinois nuclear plant as state and federal incentives begin to expire. |

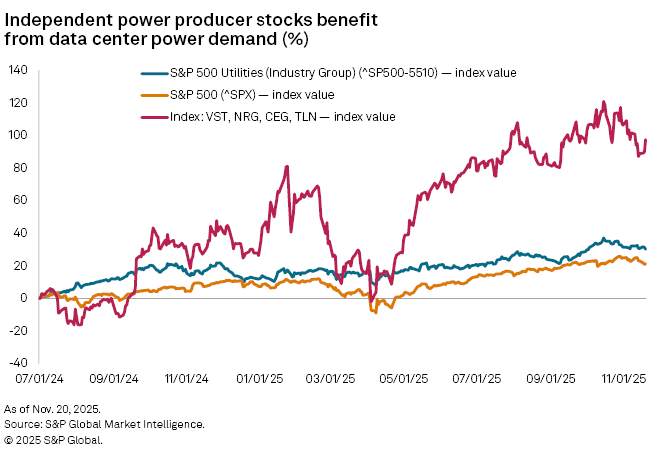

An artificial intelligence-fueled stock market bubble pop would be damaging for the share prices of independent power producers and reverse the regulated utility sector's transition into a growth play, industry analysts said.

"Without AI demand, power markets are not a very attractive investment opportunity in the current base environment," Morningstar Senior Analyst Travis Miller said in an interview with Platts, part of S&P Global Energy.

IPP stock prices are already hyper-sensitive to movements in data center contracting and expectations of substantially increasing demand. Constellation Energy Corp. saw shares soar in September 2024 after announcing a deal to supply Microsoft Corp. from a nuclear reactor it has agreed to restart, and NRG Energy Inc. enjoyed a similar bounce in May off of a deal to acquire a generation portfolio bolstering its presence in key power markets.

However, power producers like Vistra Corp. have seen shares sag when they failed to meet investor expectations for announcements of major supply deals.

In this environment, any significant AI pullback could erase the broader valuation gains those companies have made since early 2024, when Talen Energy Corp. signed a deal to supply an Amazon.com Inc. data center campus with capacity from its Susquehanna Nuclear plant in Pennsylvania.

"We really have not seen that many contracts, especially relative to the regulated utilities, so the thesis is all about selling that same electron or megawatt-hour for more than double the power price," Jefferies Managing Director Paul Zimbardo said in an interview.

Removing projected power demand by IPPs from data centers and other large-load technology customers would undercut both "the enhanced earnings and margin expansion and the re-rating piece of it," leaving Constellation, NRG Energy, Vistra and Talen Energy in a familiar position, Zimbardo added.

They would be "the IPPs of the 2010s, where power prices were very low and these companies structurally traded at 20%-plus free cash flow yields," Zimbardo said. "In contrast, they're trading at single digits now."

For now, investors are proceeding with increasing caution.

"They're asking a lot of questions around counterparty quality and protections on the downside than anyone was asking before a couple of months ago, when it was all just, 'How fast can you sign a contract?'" Zimbardo said.

'Pattern recognition'

As capital spending on electricity generation and infrastructure surges to accommodate anticipated demand from data center customers, some fund managers and investment firms warn that AI companies' skyrocketing share prices, increasing reliance on credit and circular funding deals mimic the technology and telecommunications bubble that popped in 2000.

"The pattern recognition is hard for us to ignore," Brown Advisory portfolio managers wrote in a Nov. 17 report.

"We're seeing circular funding exercises ... that are reminiscent of 2000-era investment behavior," they continued. "In short, it's not clear to us that the supply-demand activity that underlies traditional revenue contracts is holding."

NVIDIA Corp. and Microsoft on Nov. 18 announced plans to invest up to $15 billion combined in AI startup Anthropic PBC, which in turn committed to buying $30 billion of compute capacity on Microsoft Azure. Other industry heavyweights like OpenAI LLC, Oracle Corp., Meta Platforms Inc., CoreWeave Inc. and Alphabet Inc. have been involved in similar deal announcements.

But during a Nov. 18 panel discussion at the Schneider Electric Innovation Summit North America in Las Vegas, technology and power industry executives cited the Nvidia-Microsoft commitment as evidence reinforcing their view that electricity demand is set to skyrocket in the coming years.

In a November BofA survey, 45% of respondents out of 172 fund managers supervising a combined total of $475 billion named an AI bubble as the biggest tail risk to the economy. A majority of those participants also said companies are "overinvesting" for the first time in 20 years, "driven by concerns over the magnitude and financing of the AI capex boom."

Utilities retreat from mega-growth, but resilient

Should a bubble burst, the outlook for utility companies is much better than for competitive power providers.

The Edison Electric Institute estimates investor-owned utilities will spend $1.1 trillion over the next five years to accommodate load growth, with companies expected to spend $207.9 billion in 2025 alone. Many utilities are implementing new tariff structures that make large-load customers responsible for their projected energy usage, insulating existing customers from related costs.

Even absent an AI stock market bubble, concerns persist about electricity demand forecast revisions.

A new report from consulting firm Grid Strategies estimates that utilities and regional planning authorities could collectively be overestimating data center load growth by almost 40%.

Special rates with minimum volume commitments, among other regulatory mechanisms, prevent utilities from losing guaranteed income. American Electric Power Co. Inc. subsidiary Ohio Power Co., for example, received approval from state regulators in July to implement a new tariff that holds large new data center customers responsible for at least 85% of the energy they are subscribed to use, regardless of actual usage.

"These hyperscalers are about as credit-worthy of a counterparty that you could possibly hope for," Scotiabank Managing Director Andrew Weisel said in an interview, acknowledging those types of provisions.

While any significant reduction in projected AI demand would cause utility stocks to pull back, most utilities have signed enough data center contracts to secure revenues through the next few years, Jefferies' Zimbardo and Morningstar's Miller noted.

But in that scenario, "I think you start seeing investors treat utilities as they always have: as a steady income type of investment," Miller said. "The idea of a super-sized long-term growth outlook for utilities is an aberration in history."

The average utility EPS is growing 7% on average — "almost entirely due to data centers" — compared to a 5% average over the last decade, and some utilities are growing in the low double digits, according to Zimbardo.

Without data centers, utilities would still have "long-term secular trends" like resiliency, reliability and decarbonization to rely on for smaller growth rates, Scotiabank's Weisel said.