Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Oct, 2025

By Brian Scheid

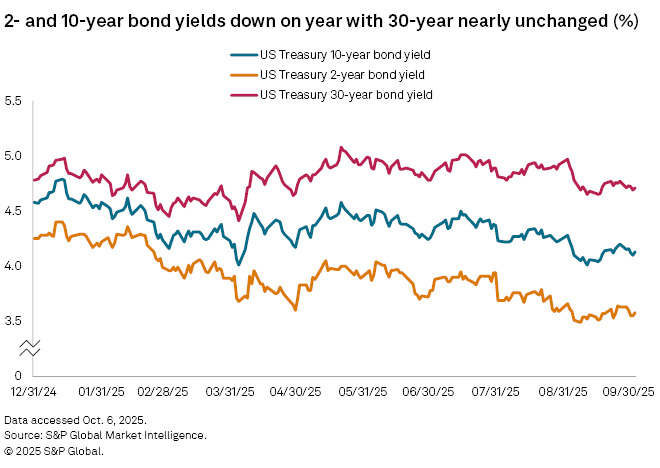

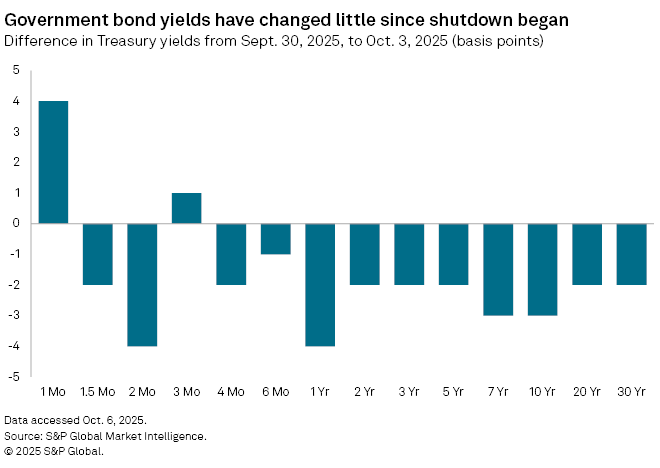

Six days into a shutdown of the federal government, the US Treasury bond market is mostly shrugging, with yields mostly unmoved despite few signs of a near-term resolution to the impasse.

Bonds could see some volatility if the shutdown drags on, though how long appropriations would need to remain lapsed before yields begin to move meaningfully remains unclear.

"We don't expect much of a market impact," said Gennadiy Goldberg, head of US rates strategy at TD Securities. "The longer the shutdown proceeds the more likely investors are to worry a bit about the impact on economic growth, but we're still in early days and the market is struggling to figure out key catalysts in an unexpectedly data-light environment."

The most substantial impact of the shutdown on government bonds will be the lack of official economic data, including the now-delayed September jobs report, as well reports on housing, unemployment claims and others metrics. "The biggest problem for investors is that we are flying half-blind as key economic data is not being released," Goldberg said.

The ultimate impact of the shutdown on rates hinges on how long the shutdown lasts, said Daniela Hathorn, a senior market analyst with Capital.com.

"

That could lead to short-term interest rates falling faster than long-term rates, further widening the gap been them, pushing the yield curve to steepen further.

During the first three days of the shutdown, bond yields moved little. The three-month yield was down just one basis point, the 2-year yield down just two points, and the 10-year down just three basis points. This lack of movement may be indicative of what is to come for the bond market as yields stay steady without new government jobs and inflation data, said Kathy Jones, chief fixed income strategist with the Schwab Center for Financial Research.

"There isn't enough new data to shift expectations about Fed policy, economic growth or inflation," Jones said.

Investors may also be looking through the shutdown as temporary, with no need to adjust market strategy.

"For the bond market, there is still tension between the outlook for the job market and the outlook for inflation," Jones said. "That suggests to us that yields probably won't move much for the time being."

For now, rates are unlikely to respond to the shutdown as any impact are expected to be short-lived with an "immaterial" loss of potential output, said Garrett Melson, portfolio strategist at Natixis Investment Managers.

"We've been here before," said Melson. "Of course, the risk of disruptions grows the longer the shutdown persists. That's all well-known at this point and investors have been trained to look through any short-term brinksmanship and political theater."

The funding battle which led to the ongoing shutdown is not convincing with a debt ceiling impasse, which will likely further limit the market reaction, Melson said. Even an extended shutdown could be a non-event for bonds.

"The broader macro outlook has full control of the rates markets and that's likely to remain the case with only marginal effects from the shutdown to the extent that we see exacerbation to the downside labor market risks," Melson said. "And even that could be marginal."