Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Oct, 2025

By Tyler Hammel

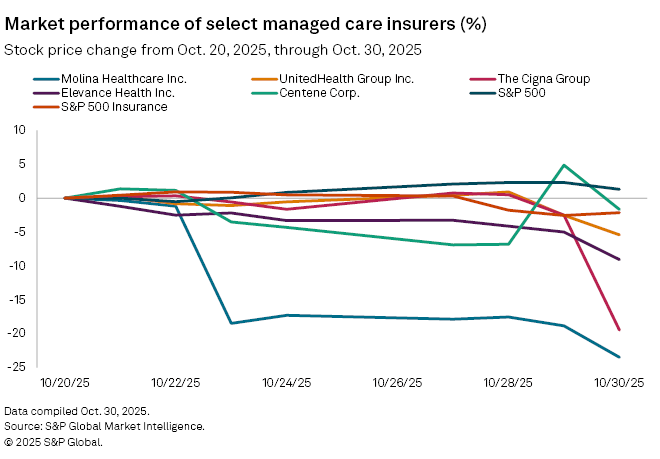

Shares in US health insurers struggled after the release of third-quarter results, which were marked by rising costs and political uncertainty.

Of the five largest publicly traded US managed care insurers, all but Humana Inc. have released their third-quarter results since the earnings season began Oct. 21 with Elevance Health Inc.

Since Oct. 20, Elevance, UnitedHealth Group Inc. and The Cigna Group saw their stock prices fall 9.1%, 5.4% and 19.5%, respectively. The sharpest decline among managed care insurers was recorded by Molina Healthcare, Inc., which fell 23.5%.

The drops exceeded the declines in the S&P 500 and the S&P Insurance Index, which fell 2.47% and 2.15%, respectively, during the same period.

Costs on the rise

A common issue affecting the sector's third-quarter earnings calls is ongoing cost pressure, primarily related to government-subsidized Medicaid and Medicare Advantage plans.

After a challenging 2025 for industry leader UnitedHealth, the managed care insurer again highlighted the high costs associated with its Medicaid plans, which experienced heightened acuity levels since state-led procedural disenrollment resumed in March 2023 following the COVID-19 pandemic.

The path to Medicaid recovery will be challenging, as states have not funded the program in line with actual cost trends, according to comments made during an Oct. 28 earnings call by Tim Noel, CEO of UnitedHealthcare, UnitedHealth's insurance arm.

"While we're making steady progress in bridging this gap with states, the mismatch between rate adequacy and member acuity will likely extend through 2026," Noel said.

Similarly, Molina CEO Joseph Zubretsky lamented a "very challenging medical cost environment" during an earnings call and said that Medicaid rates may not be adequate.

"Our early 2025 rate increases were sufficient at the beginning of the year, but as medical cost trends increased beyond those rates, our [medical cost ratio increased each quarter]," Zubretsky said. "The rate updates we received later in the year and risk corridors did not provide an adequate buffer."

Molina's Medicaid medical cost ratio reached 92% during the quarter, according to Zubretsky, while its senior-aimed Medicare plan hit 93.6% as high levels of utilization continued. However, even Molina's marketplace plans were not immune to rising costs, as plans purchased through state exchanges had a medical cost ratio of 95.6%, significantly higher than expected, according to the CEO.

ACA issues loom

Rate issues are not limited to Medicaid, as UnitedHealth joined a growing chorus of insurers expecting to be affected by changes in the Affordable Care Act (ACA) markets.

ACA plans, which are offered through state-based marketplaces and directly from insurers rather than through an employer, have been under scrutiny as the extension of tax credits to lower plan costs has become a key issue for the ongoing federal government shutdown. While the issue remains unresolved, most insurers have already priced in the expectation that the tax credits will not be extended.

UnitedHealth's insurance arm submitted rate filings in nearly all of the 30 states where it offers ACA plans, reflecting an average rate increase of over 25%, according to Noel. Consequently, the company expects its ACA membership to drop significantly, Noel said.

"Where we are unable to reach agreement on sustainable rates, we are enacting targeted service area reductions," Noel said. "We believe these actions will establish a sustainable premium base, while likely reducing our ACA enrollment by approximately two-thirds."

Despite these challenges, analysts at J.P. Morgan ranked the insurer's stock "overweight," noting that the company expects to expand margins in 2026 through improvements in Medicare Advantage and commercial plans, which will offset the expected margin contraction in Medicaid.

"We see this as not necessarily dissimilar from commentary in the second quarter; however, with the benefit of several more months of claims/trend progression, we think the incremental visibility underlines this positive commentary," the analysts wrote.

The ACA rate repricing may prove to be a more significant challenge for Centene Corp., which has a disproportionately large number of members in the plans compared to its similarly sized competitors.

During a third-quarter earnings call, Centene CEO Sarah London touted the benefits of extending ACA tax credits and said Centene believes "these tax credits offer critical support for hard-working Americans, small business owners and rural healthcare infrastructure."

Centene received a "neutral" rating from J.P. Morgan and analysts cautioned about ongoing cost impacts.

"On balance, we continue to view Centene an execution story with wide error bars in 2026, albeit one showing progress on execution, and we expect much of the focus will be on proving out assumptions and how Centene is able to recover ACA Exchange margins in 2026, with both factors needing to see further progress before investors turn more constructive," the analysts wrote.