Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Oct, 2025

By Brian Scheid

One of the worst US dollar performances in decades has been at least temporarily halted by the federal government shutdown which has given the greenback a surprising boost.

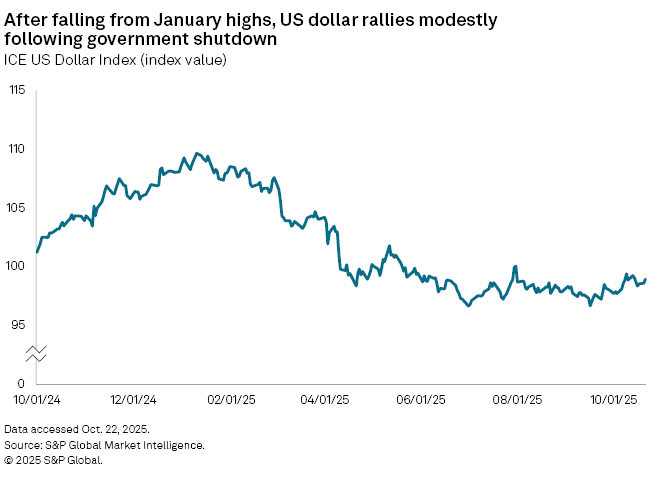

The US dollar index, which tracks the dollar against some of its currency peers, fell nearly 12% from its most recent high in January to about mid-September. But since the federal government formally shut down on Oct. 1, the dollar has been on a modest rally, rising as much as 1.7% with little to no sign that a resolution could be near.

Still, the shutdown is not necessarily a positive development for the US dollar, Francesco Pesole, a foreign exchange strategist at ING, said in an interview. However, the rallies in foreign currencies such as the euro against the dollar were starting to run thin and needed more negative US data to be sustainable. With the shutdown, the government has halted most of its economic data releases, such as the monthly jobs report, leaving currency markets with little to move on.

"The shutdown helped indirectly the dollar by halting most releases," Pesole said. The dollar, at least for now, remains in a holding pattern, he noted.

"The shutdown usually has limited impact on markets as services usually return to normal once it is lifted with little material impact on the economy," Daniela Sabin Hathorn, a senior market analyst with Capital.com, said in an interview. "However, at a time when the dollar was weighed down on increasing odds of a sustained period of easing from the Federal Reserve given the weakening economic data, having less data to price in has been positive for the dollar's recovery."

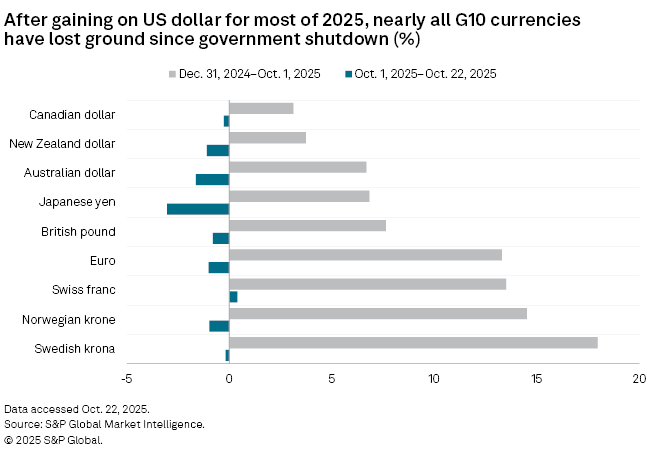

The move higher has also been supported by demand for the dollar as a safe haven investment and some shift away from other currencies, including the euro and yen, due to their own domestic concerns, Hathorn said. The sustainability of the US dollar's move higher may hinge on yield differentials and risk appetite.

The US dollar has been the best performing G10 currency both since about mid-September and since the beginning of October, Jane Foley, head of foreign exchange strategy at Rabobank, said in an interview.

While the dollar could be "in limbo" in anticipation of new evidence of economic developments, Foley said this could lead to an increase in volatility once the delayed data is ultimately released. The consumer price index report for September, scheduled for release Oct. 24, will have a "heightened level of interest," according to Foley.

"The inflation data have the potential to shatter the [dollar's] recent better tone if they are very weak or, if they are firm, to trigger further dollar gains," Foley said. "On a risk-reward basis, the latter scenario is attractive on the basis that the market is already priced for an aggressive reduction in Fed rate cuts by the end of next year."