Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Oct, 2025

By Brian Scheid

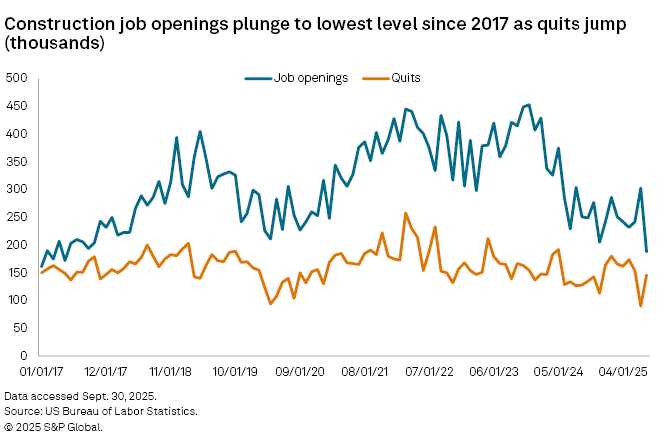

US construction job openings have sunk to the lowest level in more than eight years as a sudden spike in workers quitting has taken place, both signs the industry is straining under the weight of tariffs, high mortgage rates and an ongoing immigration crackdown.

In August, the number of construction job openings fell to 188,000, a 38% drop from July and the lowest level since May 2017, the Bureau of Labor Statistics reported Sept. 30. Meanwhile, the number of quits in the construction industry jumped to 146,000, up 62% from July.

The quits rate, a measure of the number of workers quitting as a percent of employment, increased to 1.8% in the construction industry in August, up from 1.1% in July and 1.5% a year earlier.

The overall quits rate for all nonfarm employment was 1.9% in August, but that is down slightly from 2% a year earlier.

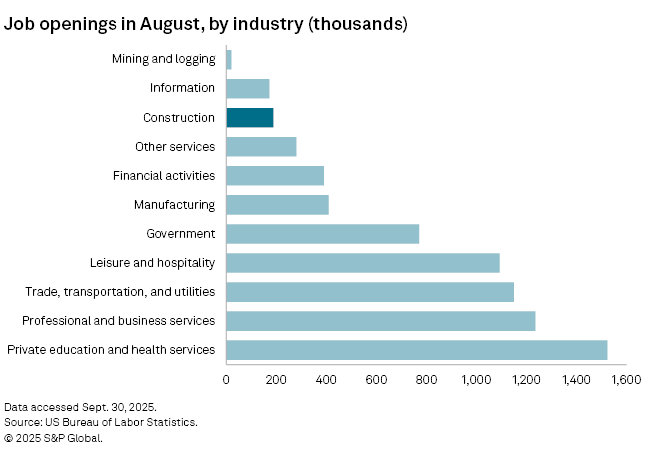

In the overall domestic job market there were nearly 7.23 million job openings in August, essentially unchanged from July, but down nearly 6% from a year earlier.

Declining job openings and rising quits are clear signals that the construction industry is "aggressively softening," said Anirban Basu, chief economist with Associated Builders and Contractors, a national construction industry trade association.

"That speaks to a construction labor market that's really deteriorating quite rapidly," Basu said.

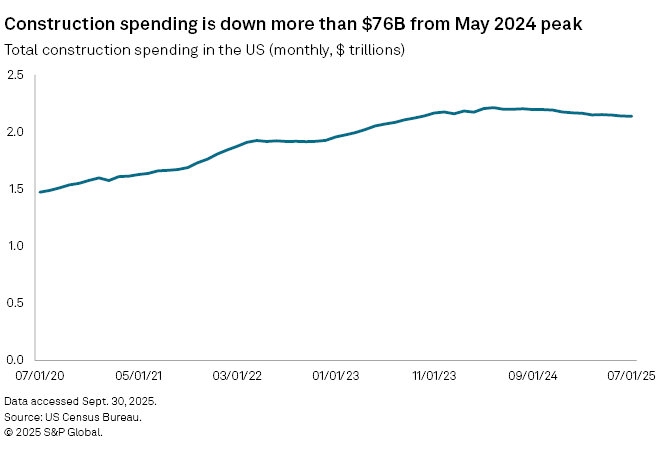

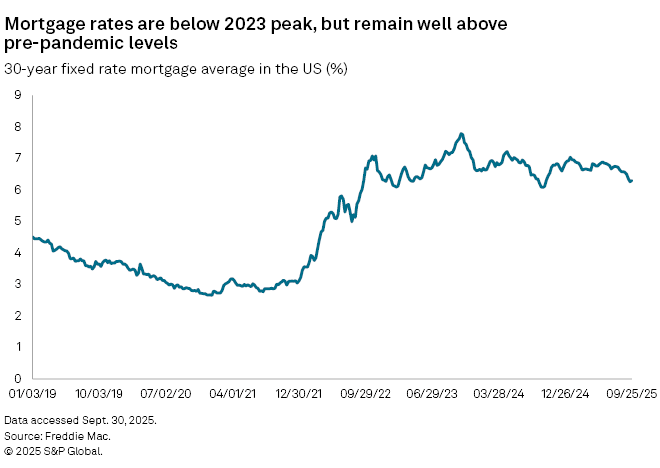

Job openings have slipped as demand for construction has declined with tariffs driving up materials prices and relatively high interest rates driving up project financing costs, Basu said.

US construction spending has fallen for three straight months through July and is more than 3% below its peak in May 2024.

"Construction activity has definitely slowed down, particularly when it comes to new openings," said Allison Shrivastava, an economist at Indeed. "Rising costs for materials, labor, and overall project expenses are likely making developers and investors more cautious. At the same time, potential buyers and businesses may be hesitant to commit to large purchases or expansion projects given the current economic uncertainty."

Meanwhile, more stringent immigration enforcement likely has more significantly impacted the industry, which tends to rely more on foreign-born labor, Basu said. Threats of raids by Immigration and Customs Enforcement have likely boosted quits, while rising uncertainty throughout the industry may have compelled other workers to seek employment in other industries.

The diminishing employment opportunities in construction "highlights the stresses faced by the sector," said James Knightley, chief international economist with ING.

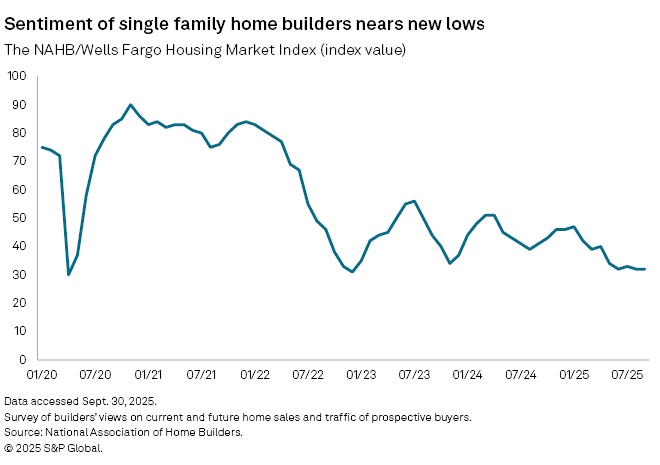

With construction spending in consistent decline, residential builders are now as pessimistic as they were during the depths of the pandemic, Knightley said.

The NAHB/Wells Fargo Housing Market Index, a survey of builders' views on current and future home sales and traffic of prospective buyers, has hardly moved since June, staying about 65% below where it was at its peak in November 2020, when near-zero rates sparked a wave of housing demand.

"Unfortunately, there is little news to be positive about in the near term," Knightley said.

While mortgage rates have dropped slightly as the Federal Reserve has begun to cut rates, households have grown increasingly nervous about the economic outlook and future employment prospects, triggering reluctance towards major purchases.

"As such, construction activity is likely to remain soft in the near term, reducing the need for additional workers," Knightley said.