Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2025

By Zoe Sagalow and Zuhaib Gull

US banks' brokered deposit totals would decline under two pieces of legislation related to how banks calculate reciprocal and custodial deposits.

Historically, the regulatory community has looked at brokered deposits negatively because of their perceived higher risk during economic downturns. Banks' ability to limit the amount of deposits that qualify as brokered would offer advantages, including lowering deposit insurance premiums and avoiding hits to the liquidity portion of CAMELS ratings, said Patrick Haggerty, a partner at Klaros Group LLC who formerly worked at Discover Financial Services and in the Office of the Comptroller of the Currency's Law Department, in an interview.

Bank executives, who say brokered deposits can sometimes be more stable than other sources of funding, would welcome the relief.

"You know exactly how much you can get, you know exactly what it costs, and you know exactly how long you're going to have it, and it's not going to run. It's a contract," Kish Bank President and CEO Gregory Hayes said, speaking about brokered deposits during a Federal Reserve community bank conference Oct. 9. "To go out and raise $20 million in my community means I'll probably have to spend a lot on marketing. I don't know exactly how much I'll get. I don't know when I'll get it. And I'll probably end up repricing a lot of my market rate deposits by doing it."

Reciprocal deposits

The reciprocal deposit-focused US House bill would create a graduated scale for calculating how much of a bank's reciprocal deposits are considered brokered based on its asset size. Rep. Tom Emmer (R-Minn.), the House Republican whip, introduced the bill, which was approved by the House Financial Services Committee in a bipartisan, unanimous vote Sept. 16.

Reciprocal deposits are a way for banks to place customers' money with other banks to provide insurance coverage beyond the $250,000 FDIC maximum. Generally, regulators have treated reciprocal deposits more favorably than other kinds of brokered deposits.

The FDIC defines reciprocal deposits as deposits received by an agent institution through a deposit placement network with the same maturity, if any, and in the same aggregate amount as covered deposits placed by the agent institution in other network member banks. Brokered reciprocal deposits, on the other hand, are reciprocal deposits that are not excluded from an institution's total brokered deposits based on general and special caps.

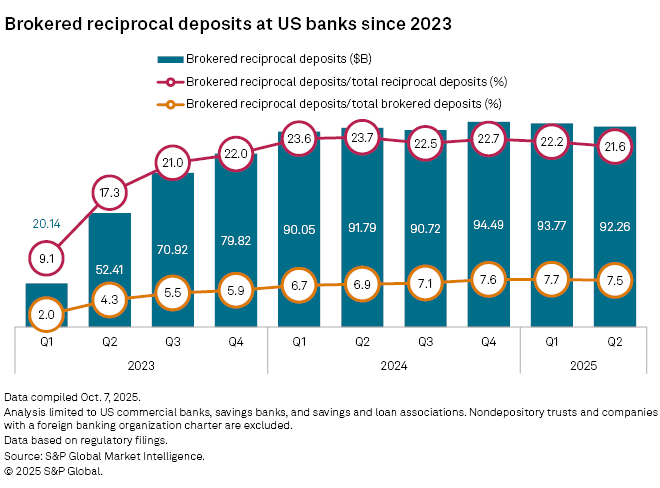

Brokered reciprocal deposit totals rose sharply after the regional bank failures in early 2023 brought attention to uninsured deposits. In the second quarter, brokered reciprocal deposits at US banks totaled $92.26 billion, up from $20.14 billion in the first quarter of 2023.

The spring 2023 bank failures reignited debates over the FDIC's deposit insurance maximum and whether the limit should be raised. Deposit insurance reform was the topic of a Senate Banking, Housing and Urban Affairs Committee hearing in September, and Treasury Secretary Scott Bessent voiced support for the reform at the Fed conference Oct. 9.

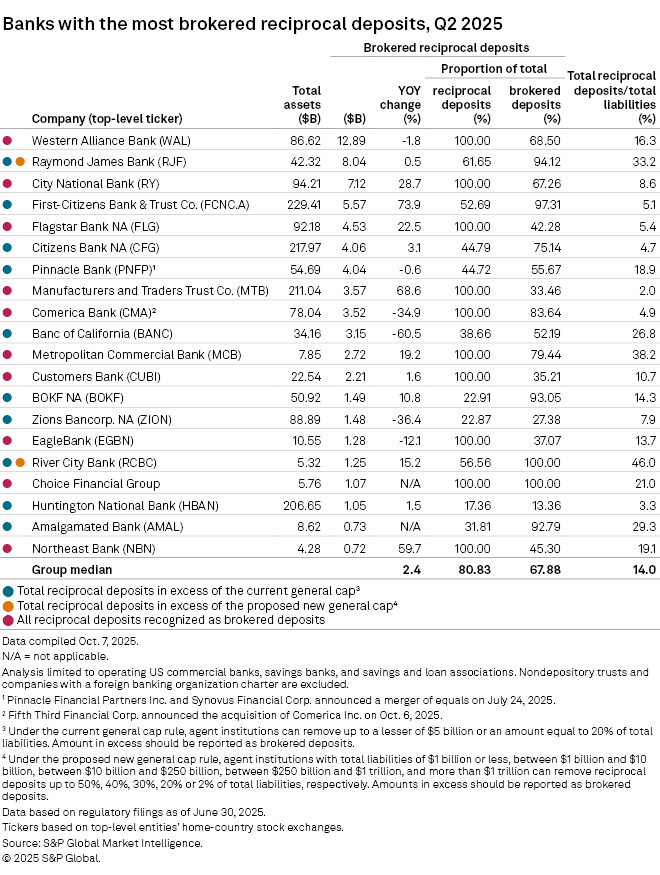

Western Alliance Bank had the most brokered reciprocal deposits among US banks in the second quarter with $12.89 billion, followed by Raymond James Bank with $8.04 billion. Brokered reciprocal deposits made up 68.5% of Western Alliance's total brokered deposits at June 30.

Western Alliance faced stress after the regional bank failures in 2023, and it utilized reciprocal and collateralized deposits to improve its proportion of insured deposits.

Under a second bill introduced by House Financial Services Committee Chairman French Hill (R-Ark.), banks with less than $10 billion in assets would be able to exclude custodial deposits from their brokered deposits total as long as those deposits do not exceed 20% of the institution's total liabilities and the bank is in good regulatory standing. That bill was also approved Sept. 16 by a bipartisan committee vote of 48-2.

Custodial deposits are a type of brokered deposit that banks hold on behalf of another party.

The custodial deposit bill "would make it clear that some portion of those are not brokered, which is great — [it] adds clarity to the complicated broker deposit regime that is currently in place," said James Stevens, partner and co-leader of Troutman Pepper Locke LLP's Financial Services Industry Group, in an interview.

While traditional banks also have custodial deposits, these deposits are commonly used in banking-as-a-service (BaaS) relationships, in which banks partner with fintechs and agree to hold the customer funds.

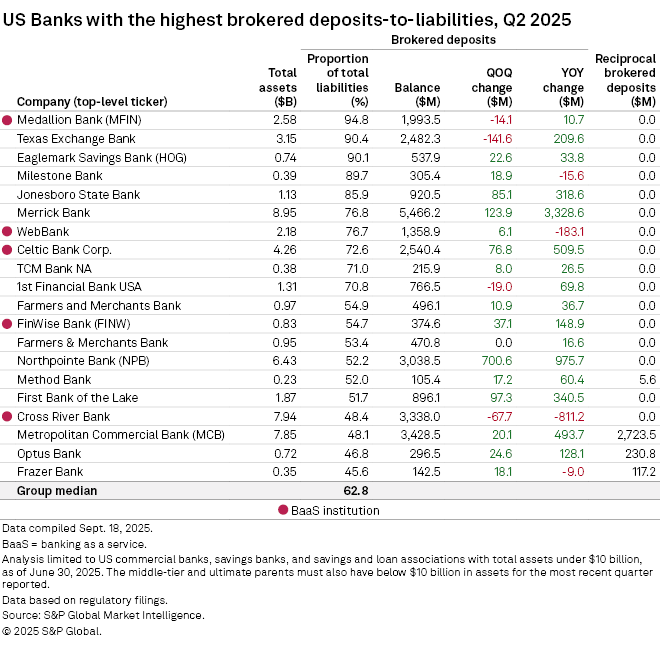

Among the top 20 banks with the highest proportion of brokered deposits to total liabilities, one-quarter were BaaS banks.

However, there is "probably broader purpose than just banking-as-a-service fintech banks as it's typically thought of, but those banks would definitely be among the group that benefits from" the bill, said Haggerty of Klaros.

Medallion Bank, a subsidiary of Medallion Financial Corp., had the highest proportion of brokered deposits-to-liabilities as of June 30 with 94.8%. Texas Exchange Bank had the second highest at 90.4%, following a year-over-year increase of $209.6 million. Eaglemark Savings Bank was third with 90.1%. Of those three banks, only Medallion is a BaaS institution.

Likelihood of enactment

Despite bipartisan support for the custodial deposit bill and the reciprocal deposit bill, Washington policy experts do not expect the legislation to gain much traction outside of committee. Right now, Congress is largely focused on other policy areas and on resolving a government shutdown.

"In general, these bills going through the committee need a larger legislative vehicle to latch onto in order to become law, and the chances of that aren't very good," Ian Katz, managing director at Capital Alpha Partners LLC, said in an email. "It isn't impossible, but it doesn't happen very often."

Also, the Senate committees have not approved any similar legislation.

Without "Senate action, you can't get overly optimistic on any financial services bill," said Ed Mills, a managing director and Washington policy analyst at Raymond James & Associates, in an interview.

Policy analysts expect that any relief in brokered deposit reporting will more likely come from regulatory action.

"The help for community banks is more likely to come from the regulators themselves rather than these pieces of legislation, which will have probably a tough time becoming law," Katz said in an interview.