Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2025

| US President Donald Trump with Australian Prime Minister Anthony Albanese in Washington, DC, on Oct. 20, 2025 Source: Anthony Albanese/X. |

The recent critical minerals partnership between the United States and Australia will require substantial government subsidies and face significant timeline challenges before meaningfully reshaping global supply chains, industry experts said.

The Oct. 20 agreement aims to unlock an $8.5 billion pipeline of mineral projects through existing policy tools, such as strategic mineral reserves, and existing mining and processing operations, as well as "new capacity to be made available in 2026," according to the text of the agreement. Each government committed to invest at least $1 billion in mineral projects across both countries within six months.

The partnership follows

"The US-Australia pact has meaningful potential to reshape the rare earths sector over time, not because it will overturn China's dominance overnight, but because it makes projects bankable," said Pini Althaus, a managing partner at Cove Capital, which operates and invests in mining projects in Australia and Central Asia.

"Instruments such as price-floor offtakes, government guarantees, and export-credit support convert geology into more predictable cash flow," Althaus told Platts, part of S&P Global Commodity Insights. "That, in turn, lowers the cost of capital, addresses investors' risk concerns, and helps unlock private financing that can ultimately supplant government funding."

The Trump administration is facilitating talks between Cove Capital and the Government of Kazakhstan about access to a large tungsten deposit, Bloomberg reported Oct. 22.

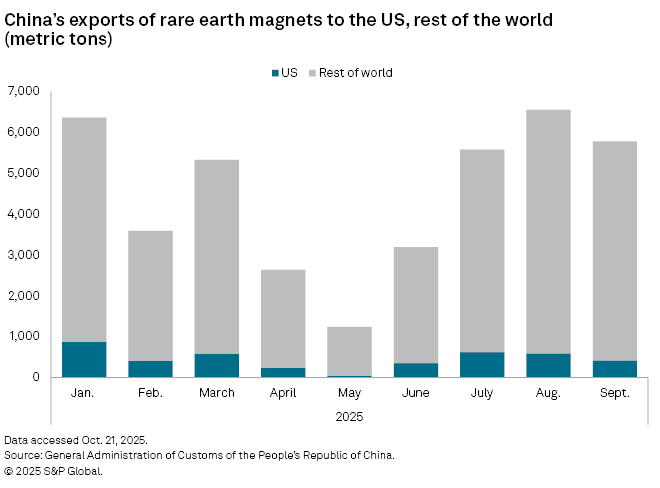

China's exports of rare earth magnets recovered from lows recorded in May and June, but shipments slipped again ahead of the Oct. 9 announcement of new restrictions.

Debate over support mechanisms

Australia ranks as the fourth-largest producer of rare earths globally, according to the Center for Strategic and International Studies. The country hosts 89 active exploration projects — more than Canada, Brazil and the United States combined. But miners Down Under have been facing a tough three-year downturn in initial public offerings, S&P Global Market Intelligence data shows, constraining capital raising opportunities for exploration and development.

Experts say that price-support mechanisms such as price floors and implicit government guarantees built into the agreement can provide long-term market certainty that investors and lenders require before committing capital to expensive, multiyear mine developments.

"If you're going to develop a mine, it's very expensive and it takes a long time, and one of the biggest risks you assess is the pricing risk," said Scot Anderson, a partner at the Womble Bond Dickinson law firm in Denver. "You need to know that after your mine is up and running, you will get a price for your materials in the marketplace that actually gives you a return on investment."

The deal with the US has boosted companies further along in their developments: At least five Australian miners received financing offers from the US Export-Import Bank worth hundreds of millions of dollars, and the S&P/ASX 300 Index hit a record high on Oct. 21.

The price support mechanisms become particularly important given the broader trade environment. China has been known to deliberately flood markets where it has gained significant leverage with excess supplies, pushing prices so low that production lines are no longer viable in countries such as the United States and Australia.

"The major issue all non-Chinese companies are facing is the ability to compete with China on pricing," Althaus said. "What exacerbates the issue is that China has such a strong control on certain, very much needed critical minerals, which allows it to manipulate the price through dumping practices."

In July, the US Commerce Department found that China was dumping graphite into the US market, undermining the development of the graphite industry in the US.

Market distortion

Some industry experts warned that governments risk

"Many governments don't have the capacity to assess material supply chains — in the US, we don't have a wealth of experts in this sector, and to have a limited bureaucracy make decisions quickly increases the risk of buyer's remorse," said David Abraham, director at Three Legged Capital, a mining investment advisory.

"There are a lot of bad projects out there," Abraham said, highlighting the risk that countries might subsidize resources that are already plentiful or make winner-and-loser decisions without a thorough market analysis.

A lot of critical mineral projects require significant government backing to remain viable.

"Many of these projects require trade protections and, in some cases, financial backing or the implicit bailout guarantee of a state equity position to be viable," Nick Trickett, a research analyst at Commodity Insights, told Platts. "These are a useful tool, but unless it's an essential input for national security or a tiny market, they are best designed with an end date in mind to force companies to be efficient."

The debate ultimately reflects broader policy choices about state intervention in strategic sectors, such as rare earths and critical minerals.

"It is a decision that any government's going to have to make about whether it's willing to invest some of that country's capital in serving that need," Anderson said. "And the Trump administration has clearly made a decision that that's worth an investment."

No immediate respite

Even with the mineral deal, which is viewed by many as a bold step towards diversifying mineral supply chains, the US is "10–20 years behind China in developing a secure, independent mineral supply chain," Althaus said.

"The agreement is a really good start," Althaus added. "But it's not going to give the United States mineral independence from China."

Abraham advocated for expanding bilateral arrangements into multilateral frameworks that could more effectively challenge China's market position. The current approach of individual agreements may prove insufficient for creating the scale and coordination needed to establish viable alternatives to Chinese supply chains.

"My hope — as I've argued previously — is that we can evolve dialogue into something broader, like an International Materials Agency, rather than a collection of bilateral price floors and deal commitments," Abraham said. "Getting people in the same room and coordinating with important players will make this a strong step forward."