Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Oct, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Warning lights are flashing for listed US companies in two sectors of the economy: healthcare and consumer discretionary.

The healthcare and consumer discretionary sectors have vied for the top spot in S&P Global Market Intelligence's quarterly analysis of US public sector risk all year. The analysis considers several indicators of risk, and in the third quarter, the median probability of default ran highest in the healthcare sector while the consumer discretionary sector racked up the most credit ratings downgrades.

The risk analysis aims to provide some context for private equity investment and monetization trends. Risk tends to pull down valuations, which could prompt private equity managers to seek bargain entry points in exposed sectors. On the flip side, weakening valuations could prompt managers to delay exits from mature portfolio company investments.

Other data points confirm the turbulence in both the consumer discretionary and healthcare sectors. The sectors combined to account for 22 of the 52 US private equity portfolio company bankruptcies recorded in the first half of the year.

Read more about signs of US public sector risk in Q3.

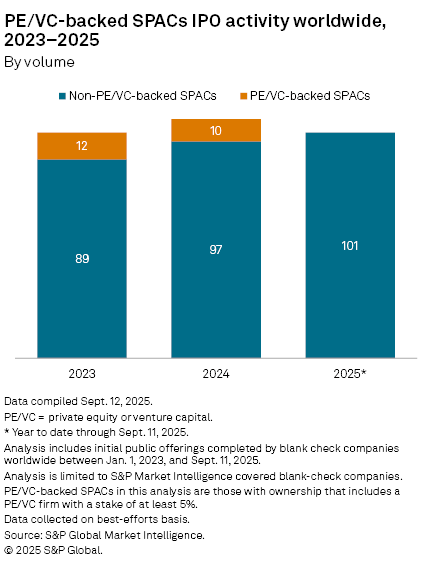

CHART OF THE WEEK: Private equity sits out SPAC rebound

⮞ Private equity and venture capital firms didn't back any of the 101 special purpose acquisition companies to file for an initial public offering between Jan. 1 and Sept. 11, according to S&P Global Market Intelligence data.

⮞ Private equity sponsored 10 of the 107 SPACs to file for an IPO in 2024 and 12 of the 101 SPACs that filed for an IPO in 2023.

⮞ The value of global SPAC IPOs between Jan. 1 and Sept. 11 totaled $18 billion, more than the previous two years' totals combined.

TOP DEALS

– An investor consortium comprising Saudi Arabia's sovereign wealth fund Public Investment Fund and private equity firms Silver Lake Technology Management LLC and A Fin Management LLC agreed to acquire Electronic Arts Inc. in an all-cash transaction valuing the video game company at approximately $55 billion. The deal involves acquiring 100% of EA, with PIF rolling over its existing 9.9% stake.

– Prosus NV unit OLX Global BV agreed to acquire auto Groupe La Centrale SAS, a French autos classifieds platform, from Providence Equity Partners LLC for €1.1 billion.

– Ares Management Corp. acquired Meade Pipeline Co. LLC from affiliates of XPLR Infrastructure LP for about $1.1 billion in cash. Meade owns roughly 40% of a 180-mile natural gas pipeline linking Northeast Pennsylvania to demand centers in the Northeast, mid-Atlantic and Southeast US.

TOP FUNDRAISING

– Gemspring Capital LLC raised $1.1 billion at the first and final close of Gemspring Growth Solutions II LP fund. The oversubscribed fund seeks to make non-control and growth investments in middle-market businesses.

– Kedaara Capital Investment Managers Ltd. raised $300 million at the close of its first continuation fund, Bloomberg News reported, citing people familiar with the matter. The firm is moving partial stakes in Lenskart Solutions and Care Health Insurance to the new vehicle, according to the report.

– Hughes & Co. Investment Partners LP raised $260 million at the close of Hughes Growth Equity Fund II LP. The firm invests in software and technology-enabled services within the healthcare sector.

– Hamilton Lane Inc. launched an evergreen investment fund that seeks to make growth and venture investments in the private markets. Hamilton Lane Global Venture Capital and Growth Fund will be available to certain individual investors and institutional investors in parts of Europe, Asia, Latin America and the Middle East, as well as in Australia, New Zealand and Canada.

MIDDLE-MARKET HIGHLIGHTS

– Catchment Capital LP agreed to make a majority investment in Fidus Systems Inc., a company specializing in electronic and embedded system design. The deal is expected to close in October, subject to customary closing conditions. TD Cowen is financial adviser to Catchment, with Blakes Cassels & Graydon LLP and Gibson Dunn & Crutcher LLP as legal counsel. Sampford Advisors is financial adviser to Fidus, with LaBarge Weinstein LLP as legal counsel.

– Sheridan Capital Partners invested in medical custom molded plastics business Currier Plastics Inc. McDermott Will & Schulte LLP was legal adviser and William Blair was financial adviser to Sheridan Capital Partners. Stout Capital was financial adviser and Benesch Friedlander Coplan & Aronoff LLP was legal adviser to Currier.

– Amulet Capital Partners LP sold biotech consultant SSI Strategy LLC to Triton portfolio company Clinigen Ltd. Terms of the deal were not disclosed. Guggenheim Securities and Harris Williams were financial advisers to SSI and Davis Polk & Wardwell LLP was legal adviser.

FOCUS ON: EUROPE PENSION FUND ALLOCATION TO VENTURE CAPITAL

Pension funds across Europe have been slowly turning to venture capital for investment opportunities to diversify their portfolios amid an unstable geopolitical environment, according to a report commissioned by Venture Connections, European Women in VC and Pensions for Purpose.

Pension funds are still in the early stages of understanding how best to incorporate venture capital into long-term portfolios. As a consequence, funds commit to the asset class through their existing private equity allocations without setting a dedicated target, according to the report.

The funds also diversify investments within venture capital, allocating capital across various fund stages, managers and geographies to mitigate the high-risk, high-reward profile of venture capital.

European pension funds manage more than €3 trillion in assets, yet only 0.12% is allocated to venture capital, according to the report.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter