Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2025

By Brian Scheid and Annie Sabater

|

The Trump administration's tariffs, including a 100% levy on computer chips, have yet to have a significant impact on US consumer prices, government data show. |

The wave of new tariffs that the Trump administration has been imposing on US trading partners this year has yet to significantly impact consumer prices, the latest government inflation data shows.

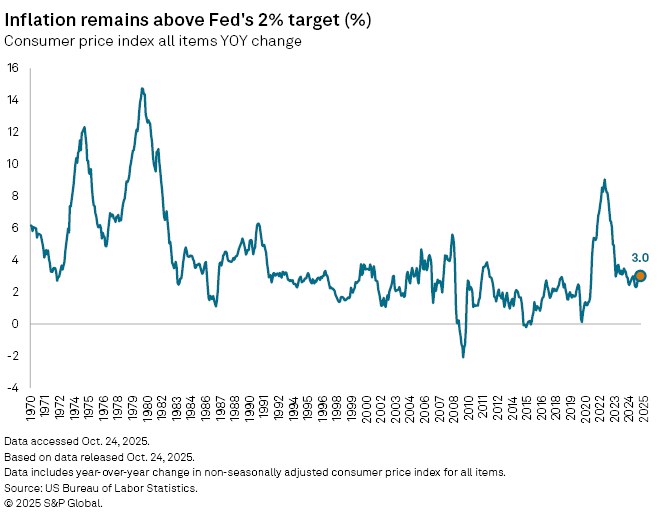

The consumer price index, the market's preferred inflation gauge, increased 3% from September 2024 to September 2025, the largest annual jump since January. Core CPI, which strips out volatile food and energy prices, also increased 3%.

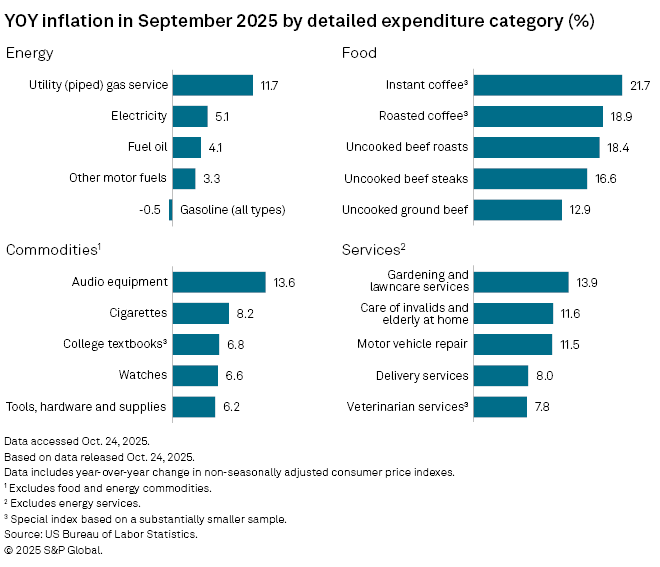

Many categories forecast to be hardest hit by US tariffs remained at or below the 3% inflation mark. Apparel prices, for example, fell 0.1% in September, and sporting goods prices were unchanged. Toy prices edged up 0.2%, and new vehicle prices grew by 0.8%. Computer prices posted a 0.7% decline.

Overall, inflation growth remained above the Federal Reserve's 2% target, and several categories saw substantial increases in prices, such as beef and veal, which jumped 14.7% from a year ago, and roasted coffee, which soared 18.9%.

Still, the data shows that tariffs' impact on consumers has been relatively marginal so far. While this is expected to change, it is uncertain how long it will take.

"Given the complexity of supply chains and the aggressive front-loading of merchandise, it's difficult to know how quickly tariffs will trickle through to consumer prices," said David Russell, global head of market strategy at TradeStation. "However, in certain items and categories, it's hard to avoid."

Tariffs will likely soon start to have deeper impacts on the prices of furniture, appliances and apparel as companies deplete their pre-tariff inventories while the new tariffs remain in place, Russell said.

"This will appear across general merchandise items and could make holiday shopping less jovial," Russell said.

Gregory Daco, chief economist at EY-Parthenon, said tariffs stand to increase CPI by 0.8% by early 2026.

Tariff passthrough

US customs revenue and goods import numbers imply a realized tariff rate of about 10%, below the 18% rate estimate based on announced country and sector tariffs, said James Knightley, chief international economist with ING. With the realized tariff rate lower than expected, the tariffs' effects have been weaker. In addition, the effects have been delayed due to company concerns over pricing power in a cooling consumer demand environment, Knightley said.

"Companies have chosen to pass the cost increases on relatively slowly," he said.

Tariffs could start to have a more pronounced effect on prices over the next three months, but timing remains uncertain.

"The longer this takes to come through, the more time for the disinflationary forces to exert their downward influence and mitigate the overall impact on inflation rates," Knightley said.

Expectations that retailers will pass through price increases from tariffs to consumers while domestic manufacturers boost their prices and capture more margin have yet to be realized, said Thomas Simons, chief US economist at Jefferies. While some imported goods prices have increased, these have been relatively modest, and few of the increases have repeated month to month. There has been little evidence of higher goods prices from tariffs spilling into services, Simons said.

While a tariff hit to consumer prices could be nearing, its effect is now expected to be far less than initially feared.

An Oct. 12 report from economists at Goldman Sachs found that, as of August, US consumers were absorbing 37% of tariff costs, and US businesses were absorbing 51%, with the rest going to foreign exporters and potential tariff evasion. By the end of this year, however, these economists forecast that US consumers will take the hit on 55% of tariff costs, with US businesses absorbing 22%.

In August, Goldman economists had forecast that US consumers would absorb 67% of tariff costs by late 2025, with US businesses absorbing 8%.

Data delay

The CPI data was released Oct. 24 amidst an ongoing federal government shutdown, which began Oct. 1, and has led to the suspension of much government data and releases, including the monthly jobs report. The September CPI report was released due to its connection to an annual cost of living adjustment process for Social Security benefits. The October CPI report is expected to be delayed if the shutdown continues.