Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Oct, 2025

By Allison Good

|

A solar energy facility under construction, above. The renewables industry is bracing for disruption as federal incentives begin to phase out. |

Deal flow involving renewable energy resources is ramping back up after months of uncertainty surrounding federal budget legislation signed July 4 and US Treasury guidance released in August, but developers and financiers remain apprehensive about the longer-term fallout from disappearing wind and solar incentives that spurred record investments in clean energy.

At the same time, a turbulent transitional period looks inevitable for smaller and midsize developers as excess revenues dry up, renewables developers, financiers and experts said in interviews with Platts, part of S&P Global Commodity Insights.

"If nothing else, it gave us clarity on what the parameters are now going forward," Mike Lorusso, who heads First Citizens Bancshares Inc.'s energy finance unit, said. "The financing market now seems to be back to business as usual."

Peter Gardett, head of energy transition research at financial services platform Karbone, added that deal volume has "picked up significantly even since Labor Day," accounting for both the backlog of projects that would have otherwise secured financing during the first half of the year and projects developers now plan to speed up.

Under the budget legislation, wind and solar projects that begin construction by July 4, 2026, will receive 100% of the tax credits' value and a safe harbor allowing them to keep full credit eligibility, provided the projects enter service within four years. All other wind and solar resources would have to enter service by the end of 2027 to qualify for the credits.

On Aug. 15, the Internal Revenue Service removed the 5% safe harbor rule for wind and utility-scale solar energy projects, a better-than-expected outcome for the construction-start rules that propped up solar stocks and initiated a sprint to meet the July 2026 deadline.

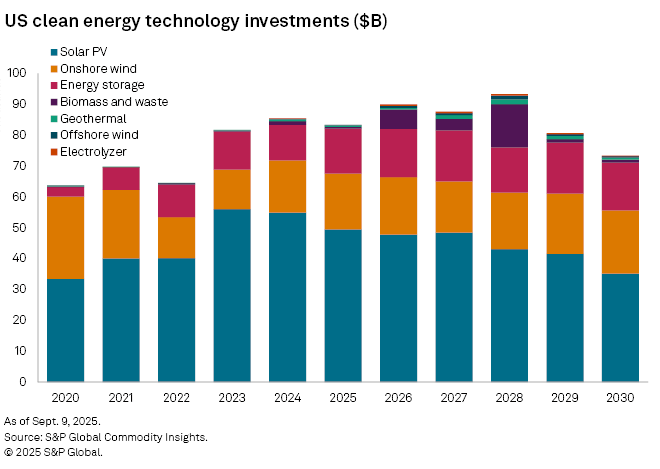

"[T]he tighter timeline to qualify for wind and solar tax credits is actually expected to push additions higher in the near term as developers pull forward projects to capitalize on expiring tax credits, increasing solar capacity additions by as much as 8% in 2026–30 over our previous outlook," Commodity Insights analysts forecast in a Sept. 11 report.

"There's some projects that we will actually accelerate and others that we will just kill," small-scale solar and energy storage developer CleanCapital LLC CEO Thomas Byrne said. "The ones that we'll kill don't start construction for another couple of years."

Market consolidation

Other developers with projects that will not make the construction deadline are handing them off to better-capitalized firms.

"You've seen more M&A-type activity in the last month than we had in any prior month that I can recollect," Byrne said.

Renewables marketplace operator LevelTen Energy Inc. surveyed 86 US developers after the budget bill was enacted, with 86% of respondents looking to "either accelerate construction timelines or reprioritize assets," and 52% anticipating a focus on buying other projects.

The legislation "turned everyone into either a buyer or a seller," said Darren Van't Hof, a principal at Oakland Capital Partners LLP's newly launched outside strategic and advisory arm, Oakland Capital Solutions. "I don't think any company is in status quo mode anymore."

"If you are unable to secure capital for your long-term assets, how viable is it to develop your current assets?" Van't Hof added. "Meaning, those are the ones that are becoming likely to be for sale pretty quickly."

In a Sept. 12 note to clients following the RE+ trade show in Las Vegas, BofA analysts noted that smaller developers unable to safe harbor equipment at scale "face 20[%] to 25% project kill rates tied to capital constraints, permitting, [power purchase agreements] and tariff overhangs" from recent policy changes.

Industry participants also expect consolidation at the corporate level as access to capital changes.

Bloomberg reported Sept. 8 that Pine Gate Renewables LLC, which, according to S&P Global Market Intelligence data, owns more than 6,300 MW of planned, under construction and operating mostly solar resources, is consulting financial advisers about balance sheet concerns. The week before, Asheville, North Carolina-headquartered Pine Gate disclosed plans to lay off 517 people in North Carolina as it winds down its engineering, procurement and construction subsidiary Blue Ridge Power LLC. The business has helped build 8 GW of solar resources in 14 states and has over 1 GW under construction.

"Blue Ridge Power has experienced market headwinds similar to those impacting the entire renewable energy industry," the company said in an emailed statement to Platts.

Karbone's Gardett said he expects Pine Gate's woes to be just the beginning of the financial fallout from federal legislation and Trump administration policies.

"So many firms have borrowed at high rates," Gardett said. "While energy fundamentals remain quite strong, they borrowed with the expectation they would be able to pay down debt using the extra revenue that was tied to tax credits that aren't going to be there, or [Renewable Energy Certificate] price curves that aren't paying off in the way that they thought."

"This is one of those instances where market strain will show who is overleveraged," Gardett added.

Sector-wide changes

The industry faces some disruption as it adjusts to building wind and solar projects without tax credits.

"As tax credits phase out, the financial model for these projects will increasingly rely on higher electricity margins and [Renewable Energy Certificate] revenue to sustain economic viability," Commodity Insights analysts wrote in a recent report. "In markets such as PJM Interconnection LLC East, solar projects are expected to see a rise in power purchase agreement prices to $70–$75/MWh post-2030, with [Renewable Energy Certificate] revenue expected to compensate for approximately 50% of the lost tax credit revenue."

But with data-center-driven electricity demand bolstering the power sector, "even in a tax credit-free world, renewables still have a seat at the table," Marathon Capital LLC Managing Director Matt Shanahan said in an interview.

"As far as a sectorwide washout, the fundamentals of demand and supply would have to change," Gardett added.

Larger developers such as AES Corp. and Clearway Energy Inc. reassured investors during their second-quarter earnings calls that bigger customers like hyperscalers and regulated utilities can absorb higher offtake prices.

Still, small and midsized developers are bracing for a period of uncertainty that capital markets will eventually "solve around," according to Oakland Capital Solutions' Van't Hof.

"What I have really noticed is increased anxiety," Van't Hof said. "Not so much that there won't be a solution … but that there will be disruption as things change."

In the meantime, federal policy could shift to favor renewables again with elections in 2026 and 2028.

"The administration could change, Congress could change, and this wouldn't be the first time in the last 20 years that the tax credits were phasing out and they got reinstated again," First Citizens' Lorusso said.