Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Oct, 2025

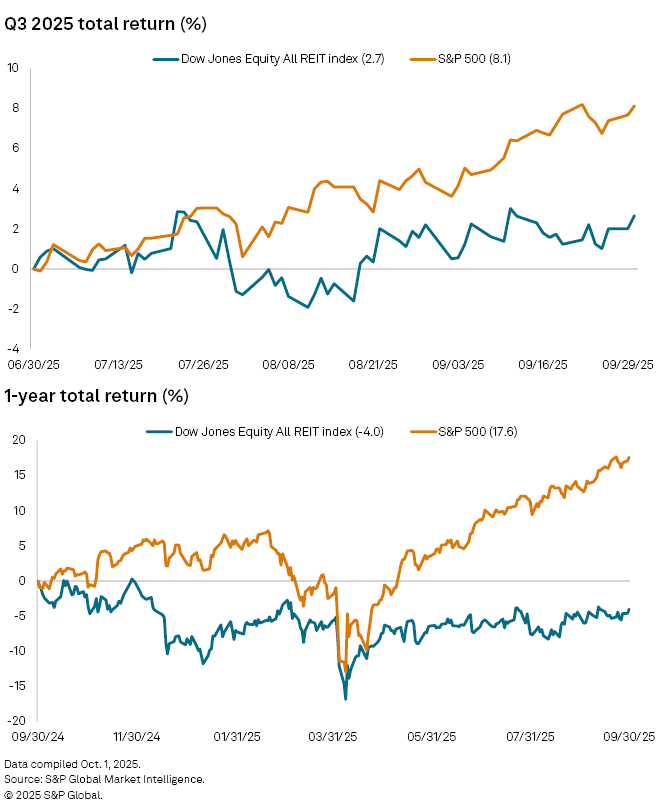

US equity real estate investment trust stocks underperformed the broader stock market during the third quarter of 2025, according to data compiled by S&P Global Market Intelligence.

The Dow Jones Equity All REIT index closed the recent quarter with a 2.7% total return, compared to a much stronger 8.1% return for the S&P 500.

The spread between the two indexes is much larger when expanding out to a one-year basis, with the S&P 500 posting a strong 17.6% return compared to a negative 4.0% return for the Dow Jones Equity All REIT index.

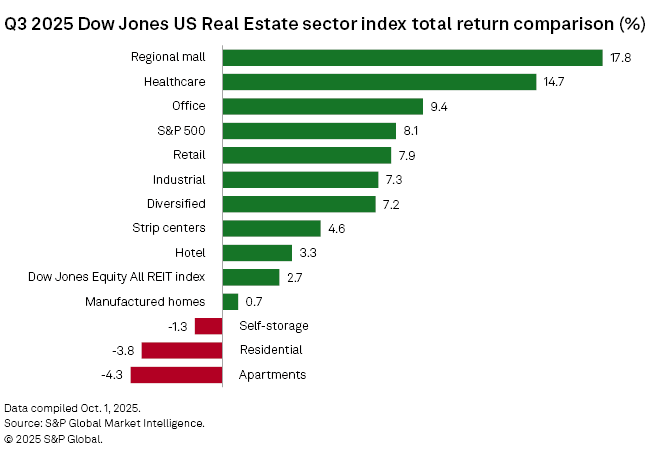

Among the Dow Jones REIT property sector indexes, the regional mall REIT index was the top performer in the third quarter, posting a 17.8% return. The healthcare and office REIT indexes ranked next with returns of 14.7% and 9.4%, respectively.

On the other hand, the apartment REIT index logged a return of negative 4.3%, the worst-performing index for the quarter. Other REIT indexes that closed in the red during the recent quarter included the residential REIT index at negative 3.8% and the self-storage REIT index at negative 1.3%.

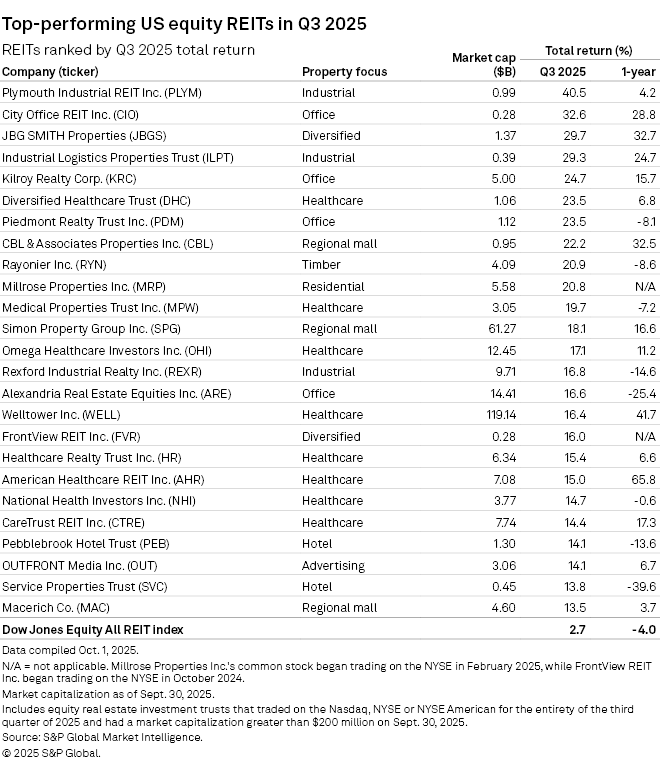

Top-performing REITs

Plymouth Industrial REIT Inc. was the top-performing REIT stock with market capitalization above $200 million for the third quarter, posting a 40.5% total return. The industrial REIT's share-price spiked on Aug. 19 after receiving an unsolicited, nonbinding proposal from Sixth Street Partners LLC to acquire all outstanding common shares of the REIT for $24.10 per share, representing a 64.6% premium compared to its closing price the day prior.

City Office REIT Inc. ranked second with a 32.6% return for the quarter. On July 24, City Office REIT announced that it entered into a definitive merger agreement with affiliates of Elliott Investment Management LP and Morning Calm Management LLC to sell all of the issued and outstanding common shares of the REIT for $7.00 per share in cash.

Washington D.C.-focused JBG Smith Properties ranked third with a total return of 29.7% for the quarter.

Industrial REIT Industrial Logistics Properties Trust and office REIT Kilroy Realty Corp. rounded out the top five performing REIT stocks for the quarter with returns of 29.3% and 24.7%, respectively.

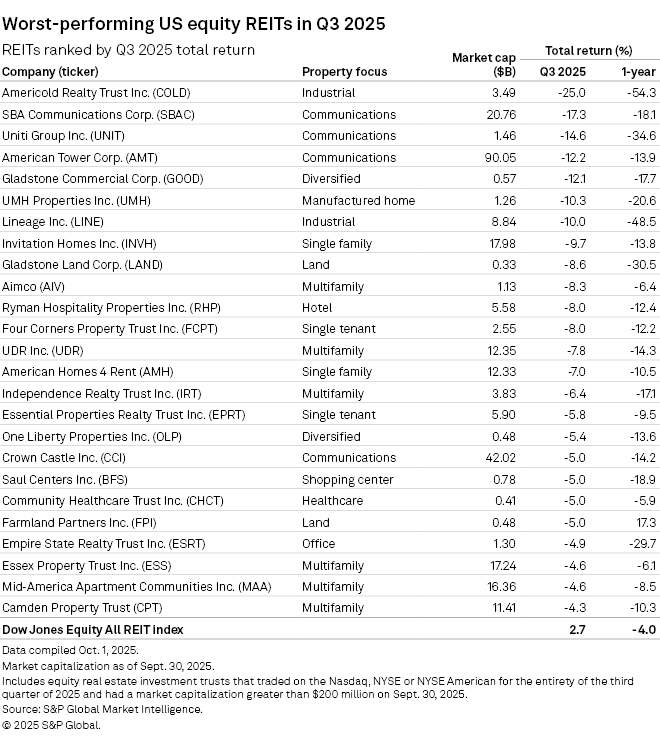

Worst-performing REITs

On the other end, cold-storage-oriented Americold Realty Trust Inc. was the worst-performing REIT stock for the third quarter with a return of negative 25.0%.

Americold and another cold-storage REIT, Lineage Inc., reported outsized headwinds from tariffs on their second-quarter earnings calls, each taking more conservative outlooks for the second half of the year.

On its recent earnings call, Americold said tenants remain hesitant to build inventory in an environment with uncertain demand. The company noted that with lower inventory levels across the supply chain, customers are taking the opportunity to leverage available capacity in their own infrastructure rather than utilizing third-party cold storage providers.

Lineage ranked as the seventh-worst-performing REIT stock for the quarter with a return of negative 10.0%. On the REIT's second-quarter earnings call, Lineage forecast reduced inventory for the latter half of the year, citing persistently higher food prices, interest rates, tariffs and a "general sense of uncertainty" among its tenants.

The three communications REITs — SBA Communications Corp., Uniti Group Inc. and American Tower Corp. — ranked as the second, third and fourth worst-performing REIT stocks, with returns of negative 17.3%, negative 14.6% and negative 12.2%, respectively.