Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Oct, 2025

By Karl Angelo Vidal and Shambhavi Gupta

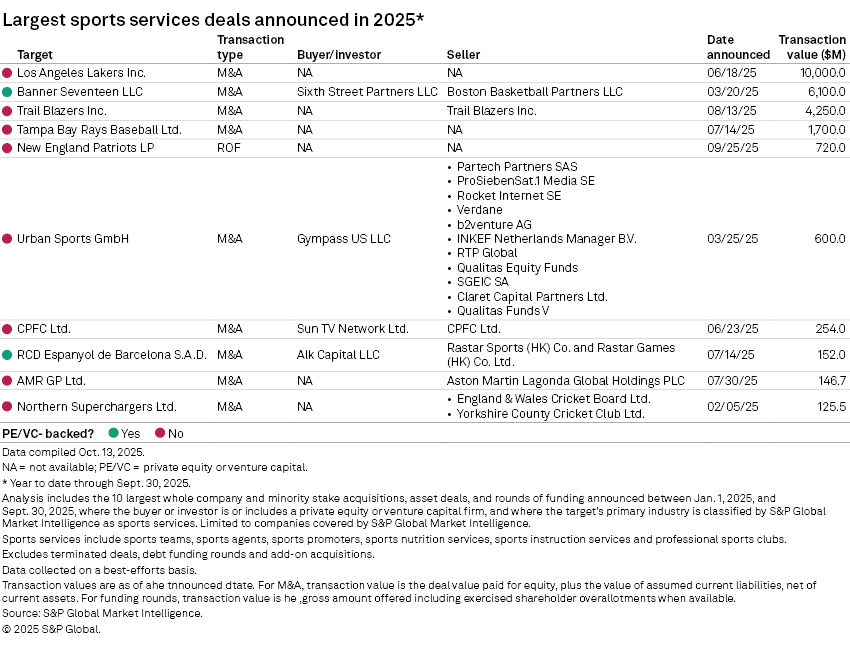

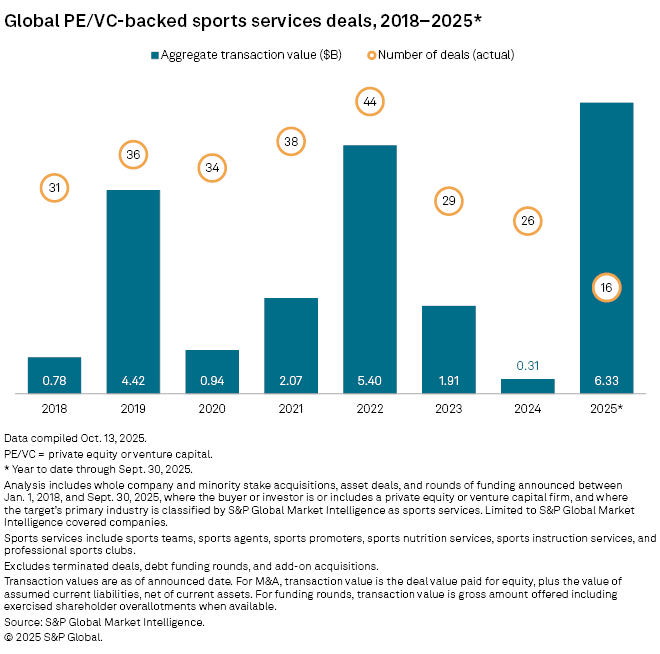

Private equity and venture capital-backed transactions in sports services totaled $6.33 billion globally in the first three quarters of 2025, the highest in at least eight years, according to S&P Global Market Intelligence data.

The analysis includes sports teams, agents, promoters, sports nutrition services, instruction services and professional sports clubs.

Private equity involvement helped drive overall sports team acquisitions to record highs in 2025, with aggregate value at $23.60 billion through August, according to Market Intelligence data.

"The valuations [are] getting so incredibly high and frothy that select few can invest. There are rules on the amounts and thresholds that they can invest. It creates a very closed market," Dan Malone, co-head of M&A and private equity at law firm Haynes and Boone LLP, said in an interview.

Malone said private equity investments in sports teams tend to be exclusive to elite firms, given the high valuations and specific investment rules.

Additionally, stakes allowed for sale in sports teams are often small. For example, in August 2024, the NFL allowed its teams to sell up to a 10% stake to a preapproved list of private equity funds.

– Download a spreadsheet with data in this story.

– Read about global private equity entries in the third quarter.

– Explore more private equity coverage.

Private equity firms have nonetheless been searching for opportunities in sports teams and ancillary services and products such as media distribution, advertising, fan experiences and real estate, which can be lucrative due to overwhelming sports fan interest.

"Even in down economies, you see folks investing discretionary income into these live experiences, which create opportunities on the margins for things like food and beverage sales, merchandising and other adjacent services that are around focused on the stadium," Malone said.

Largest deals

So far in 2025, two of the 10 largest investments in the sector involved private equity.

In March, an investor group including Sixth Street Partners LLC agreed to acquire a majority stake in Banner Seventeen LLC, the owner and operator of the NBA team Boston Celtics, for $6.10 billion.

Velocity Sports Ltd., the sports investment arm of Alk Capital LLC, agreed in July to acquire Spanish soccer club operator RCD Espanyol de Barcelona SAD for $152 million.

Malone expects more deals in leagues such as women's professional soccer.

"There are new cities and franchisees that are popping up, looking to capitalize both on the otherwise exclusive direct ownership that some of the established leagues have already had, but also on all important ancillary adjacent," Malone said.