Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Oct, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Buy-and-build strategies are driving a flurry of private equity add-on acquisitions targeting heating, ventilation and air conditioning businesses.

Steady growth driven by regular repair and replacement cycles makes the HVAC services industry an appealing investment for private equity. Similarly, private equity-backed platforms are actively vying with strategics to consolidate a fragmented industry.

Global private equity add-on transactions targeting HVAC service providers rose 88% year over year through June 9, with private equity firms and platforms combining for 39 of the 77 HVAC M&A deals recorded over that period, according to a midyear report issued by investment bank Capstone Partners LLC.

In the US, the residential HVAC services segment is about midway through a consolidation cycle, while the commercial HVAC services segment is still in the early stages, according to PKF Investment Banking. PKF Director Alberto Sinesi said private equity fund managers have multiple value-creation levers to pull to grow HVAC platforms.

"They could pursue different geographies, different service lines, different types of end markets. You name it," Sinesi said.

Read more about add-on activity driving private equity HVAC deals.

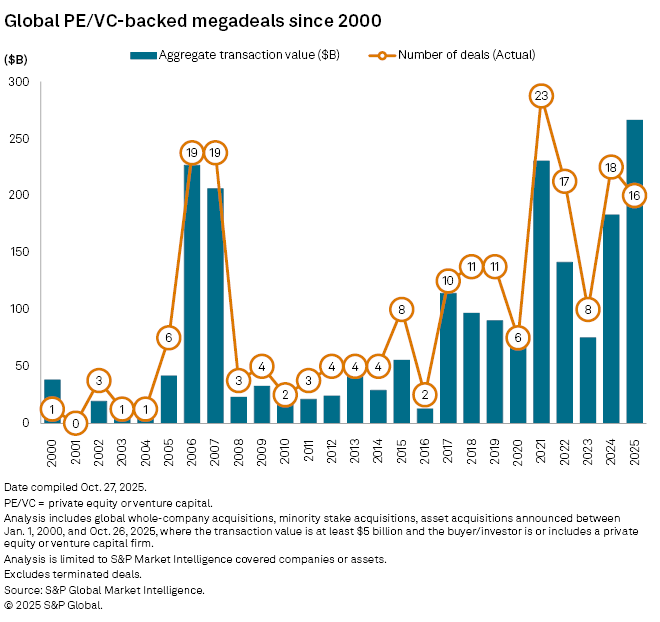

CHART OF THE WEEK: Megadeals in record territory

⮞ The aggregate value of private equity- and venture capital-backed transactions worth at least $5 billion stood at $266.27 billion globally this year as of Oct. 26, higher than any annual total going back to at least 2000, according to S&P Global Market Intelligence data.

⮞ The private equity megadeal record appeared to be in reach by late summer, when Thoma Bravo LP agreed to acquire Dayforce Inc. in a transaction valued at $12.3 billion. Additional megadeals were announced since then, bringing the year-to-date total to 16 as of Oct. 26.

⮞ The rise in megadeals reflects the strategy of the largest asset managers, which prefer to pay premium valuations for large, stable companies with earnings that can withstand the impact of global trade tensions and a muddled macroeconomic outlook.

Top deals

– Thermo Fisher Scientific Inc. agreed to buy clinical trial data solutions company Clario Holdings Inc. from a shareholder group led by Astorg Asset Management SARL, Nordic Capital, Novo Holdings A/S and Cinven Ltd. for $8.88 billion in cash.

– Francisco Partners Management LP agreed to buy Jamf Holding Corp., a provider of management and security solutions for Apple products, in an all-cash transaction valued at about $2.2 billion. Citigroup Inc. is the financial adviser to Jamf, while Kirkland & Ellis LLP is Jamf's legal adviser. RBC Capital Markets LLC is lead financial adviser and Goldman Sachs & Co. LLC and Deutsche Bank Securities Inc. are additional advisers to Francisco Partners. Simpson Thacher & Bartlett LLP is the legal adviser to Francisco Partners.

– Asset manager Janus Henderson Group PLC received a nonbinding acquisition proposal from Trian Fund Management LP and General Catalyst Group Management LLC to acquire all outstanding ordinary shares not already owned by Trian for $46.00 per share in cash.

– Ares Management Corp. reached a deal to acquire London-based fixed income manager Bluecove Ltd.

Top fundraising

– Lexington Partners LP closed its Lexington Co-Investment Partners VI LP at $4.6 billion. The fund targets equity co-investments alongside private equity and growth sponsors primarily in North America and Europe.

– Healthcare-focused GHO Capital Partners LLP raised more than €2.5 billion at the close of GHO Capital IV LP. The fund will invest in middle-market healthcare companies.

– Armira Beteiligungen GmbH & Co. KG closed on €1 billion for its latest fundraising program. The firm aims to invest in entrepreneur-led and family-owned companies.

– Speyside Equity Advisers LLC secured $300 million for Speyside Equity Fund II LP at final close. The firm acquires underperforming manufacturing businesses in the lower middle market.

Middle-market highlights

– Accel-KKR LLC invested in manufacturing and supply chain software company LeanDNA Inc.

– Great Hill Partners LP made a strategic growth investment in philanthropy-focused technology company Ren Inc. Houlihan Lokey was Great Hill's financial adviser on the deal, while Goodwin Procter LLP was legal counsel.

– Advanced Solutions International Inc., a management software company serving associations, trade unions and nonprofit customers, secured investment from Incline Management LP.

Focus on: Venture capital's AI investment frenzy

During the first three quarters of 2025, venture capital firms invested $73.60 billion in generative AI startups. This figure is on track to more than double the total of 2024, according to a Market Intelligence analysis.

During the same period, venture capitals invested $27.47 billion in AI infrastructure, which includes companies providing AI development platforms, data management services, semiconductors and cloud infrastructure. The total in 2024 was $30.31 billion.

Total venture capital investment across the entire GenAI and AI value chain so far this year is $110.17 billion.

"The deals are getting more expensive, and valuations have skyrocketed," Advika Jalan, head of research at early stage venture capital firm MMC Ventures Ltd., told Market Intelligence.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private debt newsletter