Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Oct, 2025

By Nick Lazzaro and Vanya Damyanova

Newsmax Inc. CEO Chris Ruddy and former New York City Mayor Rudy Giuliani ring the opening bell at the NYSE on April 3, nearly a week after Newsmax completed its IPO on March 28. The company's stock price climbed more than 730% from its offer price on its first day of trading. Source: Michael M. Santiago/ Getty Images News via Getty Images. |

Pent-up investor demand has driven more US IPOs this year to larger initial trading surges.

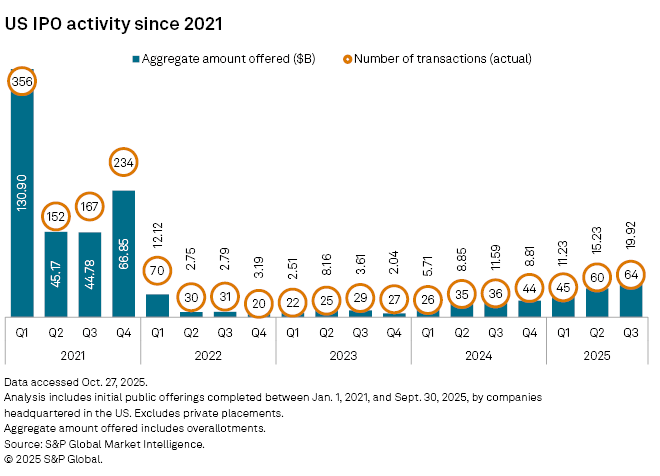

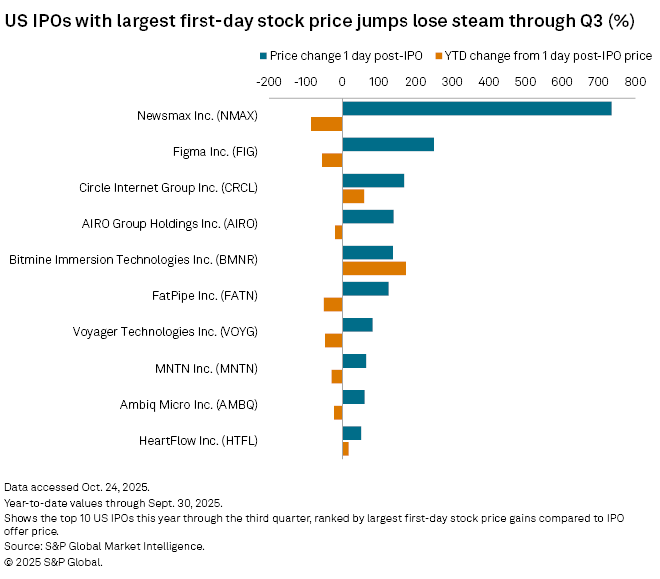

In the first three quarters of 2025, 10 US IPO stocks achieved gains of more than 50% on their first day of trading, with six seeing increases of over 100%. In full year 2024, only five stocks recorded gains exceeding 50%, and just two saw increases of 100% or higher, according to S&P Global Market Intelligence data.

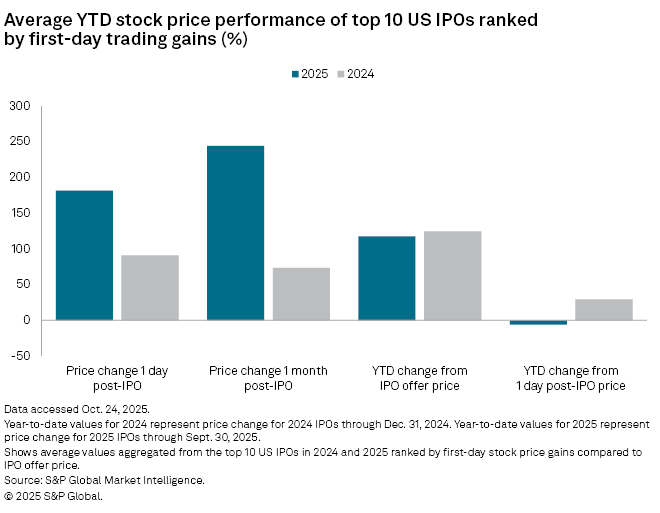

The 10 best-performing first-day stocks among the 169 US IPOs completed through the third quarter recorded average gains of nearly 182% from their IPO price on their first day of trading. This is double the average first-day gain of almost 91% that was achieved by the 10 best-performing first-day IPO stocks in full year 2024.

US IPO activity slowed over the past three years following a surge in 2020 and 2021, partly as more companies stayed private longer while navigating a volatile economic landscape. An uptick in US IPOs this year has since been met with enthusiastic investors. While these initial trading pops for many companies may fall off, the market response thus far speaks to greater demand for new issuance.

"There simply haven't been enough credible venture-backed IPOs for public investors to buy, so when a well-positioned name finally lists, demand floods in," Ryan Keating, partner at Eisner Advisory Group, told Market Intelligence. "The median first-day pop this year has been close to 19%, the highest since 2020. That's not irrational exuberance. It's pent-up capital chasing credible growth."

By staying private for longer, more companies have been able to enter the public sphere with quality assets and stronger foundations, which has justified increased investor interest.

"They're companies that have spent the past few years proving they can grow, generate cash and operate responsibly without the luxury of unlimited venture funding," Keating said. "That survival period created stronger, more resilient IPO candidates, and investors are rewarding that."

Retail investor participation

Retail investors in recent years have gained greater access to IPOs, which were traditionally reserved for institutional investors. This shift has altered supply and demand dynamics and introduced new drivers for price volatility.

However, companies have largely welcomed retail participation in their IPOs, as these investors often support the company's brand and anticipate stock ownership.

"Companies want more retail customers who are the fans of the company because they're the ones using the product and they're the ones who are passionate," Steve Quirk, chief brokerage officer for Robinhood, said in an interview. "Many retail investors who participate in IPOs hold those stocks and don't flip them. If I'm a company that's going public and I have a strong fan base that likes my company, I want my stock in their hands, and companies are realizing that."

Price slumps post-IPO

Despite investor enthusiasm, many IPO stocks that climbed the most on their first day of trading experienced significant pullbacks in the subsequent months.

"Part of it is market dynamics and mechanics," Quirk said. "When something hasn't been traded before, it's going to be more volatile because now you have more people covering it and starting to dig into it and understand the company at a deeper level."

The 10 US IPO stocks with the highest first-day gains declined an average of just over 6% in subsequent trading leading up to the end of the third quarter. In contrast, the 10 IPOs in 2024 with the most pronounced first-day price spikes gained an average of more than 29% after the first day of trading through year-end.

Potential risks could emerge when stock valuations are not in sync with financial models, which can pressure a company's post-IPO momentum, according to Ran Ben-Tzur, partner and co-lead for the capital markets and public companies group at Fenwick. Still, post-IPO stock price declines are common, despite wider fluctuations this year.

"Most recent IPOs have maintained strong performance, even if some of the year's highest flyers have come back down to earth relative to the trading immediately after the IPO," Ben-Tzur told Market Intelligence. "Significant pops in the days following the IPO also tend to moderate over time as the company releases earnings and the stock starts trading on fundamentals, as opposed to trading based on IPO hype."

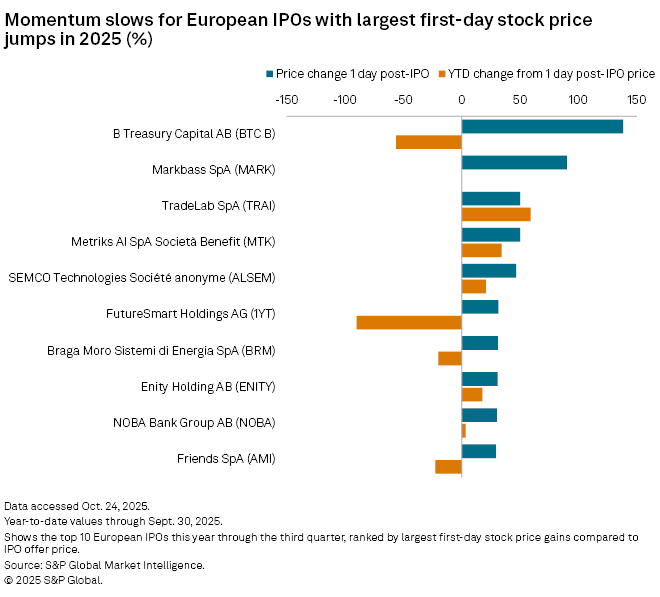

European IPOs see more moderate first-day trading

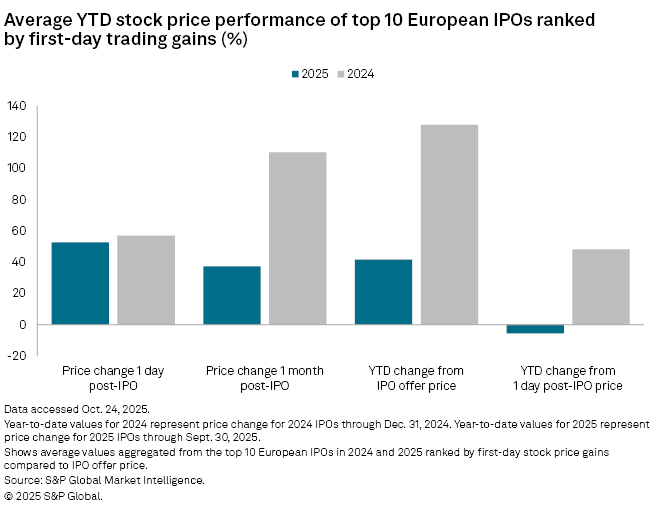

In Europe, the first-day performance of new IPO stocks has been more moderate than in the US.

Through the third quarter of this year, the 10 best-performing first-day stocks among European IPOs recorded an average gain of nearly 53%, compared to an average gain of 59% for the region's 10 best-performing first-day IPO stocks in full year 2024.

After their first day of trading, the 10 best-performing first-day European IPO stocks in the first three quarters of 2025 had declined an average of more than 5% by the end of September. In contrast, the 10 best-performing first-day European IPO stocks of 2024 saw prices increase more than 52% on average by the end of that year.

IPO share price performance in Europe has lagged other regions. All European IPOs this year as of Sept. 24 posted an aggregate one-month increase of 4.6% from their offer prices, the lowest rate among global regions, according to EY's IPO report for the third quarter.

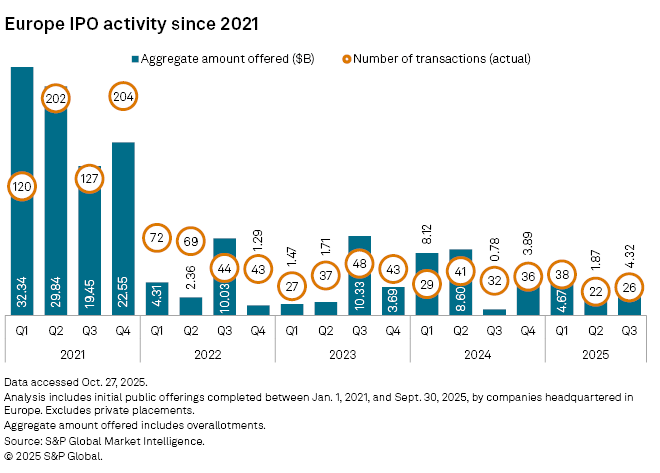

European IPO activity has slowed in 2025, driven mainly by uncertainty around US trade policy, macroeconomic uncertainty, geopolitical headwinds and heightened market volatility. 86 European companies made their stock market debut during the nine-month period ending Sept. 30, down from 102 a year ago. The aggregate amount offered by the listings dropped nearly 38% year over year to $10.86 billion.

However, IPO issuance picked up in the third quarter and may maintain momentum in the coming quarters.

"A strong IPO pipeline across diversified sectors is also a positive indicator," EY said in its IPO report. "Market participants are starting to see more high-profile and profitable companies advancing through the pipeline. Industry discussions with intermediaries suggest some further increased activity levels are expected in the fourth quarter."