Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Oct, 2025

NXP Semiconductors NV (NASDAQ: NXPI) is expected to report another quarter of subdued results on Monday, October 27, with analysts forecasting signs that the Dutch chipmaker’s prolonged slowdown may finally be nearing an end.

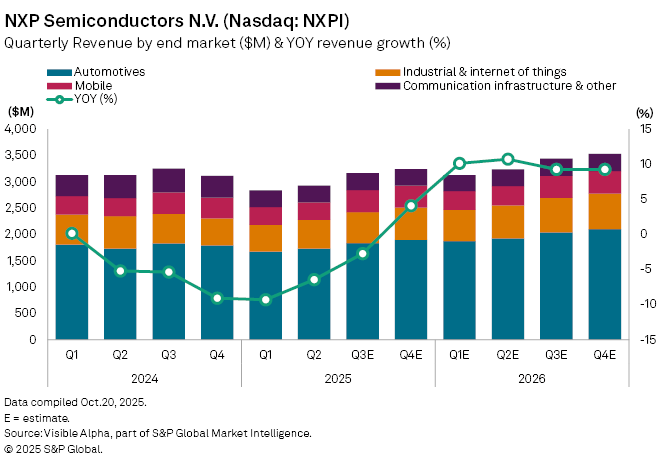

Visible Alpha consensus estimates show third-quarter 2025 revenue at $3.2 billion, down 3% from a year earlier — the sixth straight quarterly decline — as inventory corrections among automotive clients and weak communications infrastructure spending continue to weigh on demand. Still, analysts expect the trough to be short-lived, projecting revenue to rise 4% in the fourth quarter and 10% in the first quarter of 2026, suggesting that NXP’s recovery is gaining traction.

The Automotive business, which contributes over half of group sales, is expected to remain steady at $1.8 billion as Tier 1 suppliers in Europe and North America complete inventory adjustments. The Industrial and IoT (Internet of Things) division is seen improving modestly, rising 5% to $593 million after an 11% drop last quarter, while Mobile sales are forecast to edge 2% higher to $414 million. The Communications Infrastructure unit, however, remains a drag, with sales set to fall 29% year-on-year to $321 million amid muted carrier investment and intensifying competition from Chinese chipmakers.

Analysts view the current weakness as cyclical rather than structural, pointing to soft end-market demand and macroeconomic headwinds rather than share loss. Longer term, they remain upbeat about NXP’s positioning in automotive semiconductors — particularly in advanced driver-assistance systems (ADAS), electric vehicles, infotainment and secure connectivity. Recent acquisitions, including TTTech Auto and CoreRide Vision, and the pending purchase of Kinara, are expected to strengthen the company’s capabilities in software-defined and AI-enabled vehicle systems.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for CapIQ Pro.

– Access Visible Alpha estimates on NXP Semiconductors NV.

– To receive email alerts for future articles, select Visible Alpha Data Snapshots under the Authors section.