Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Oct, 2025

By Ben Dyson

Munich Re's third-quarter 2025 profit is expected to double year-on-year after an unusually low level of catastrophe claims industrywide in the quarter.

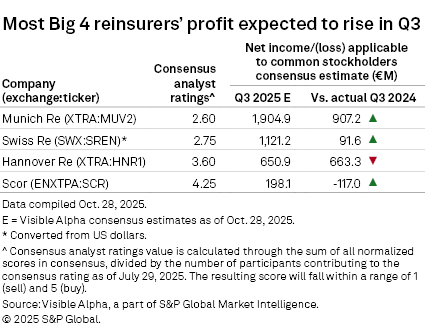

Analysts predict net income attributable to common shareholders at the world's largest reinsurer will more than double to €1.90 billion, up from the restated €907 million Munich Re reported in the third quarter of 2024, according to consensus estimates from Visible Alpha, a part of S&P Global Market Intelligence.

Munich Re's third-quarter 2024 profit was hit by what the company described as above average natural catastrophe claims. The company's property and casualty reinsurance division paid out €1.38 billion for natural catastrophes in the quarter, compared with €535 million in the third quarter of 2023.

This loss burden is unlikely to repeat in the third quarter of 2025, when catastrophe losses industrywide were relatively light. Total insured losses were $12 billion in the quarter, 72% below the 21st-century average, according to Aon PLC.

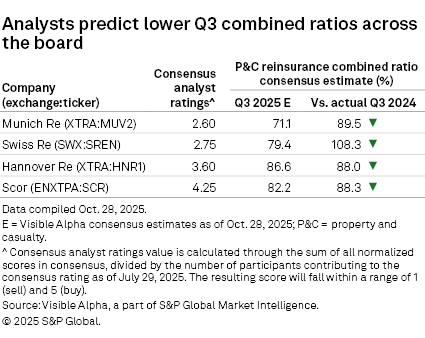

Analysts are expecting lower catastrophe ratios — catastrophe claims as a percentage of net insurance service revenue — at all four of the big reinsurers in the third quarter.

Profit, estimate trends

Swiss Re AG, the second-largest reinsurer, will see the biggest boost to third-quarter earnings. Analysts expect Swiss Re to report a profit of €1.12 billion, more than 12 times the €91.6 million profit it made in the third quarter of 2024.

In addition to natural catastrophe payouts, Swiss Re's third-quarter 2024 profit was slashed by a $2.4 billion reserve strengthening for the US casualty business in its property and casualty reinsurance division. The strengthening was designed to ensure no further increases were needed for the US casualty business, where insufficient reserves for older underwriting years have been an industrywide problem.

French reinsurer Scor SE, which recorded a €117 million loss in the third quarter of 2024, is expected to report a €198.1 million profit in the same quarter of 2025, thanks in part to the absence of the life and health reinsurance reserve strengthening that marred its 2024 results.

Only Hannover Re is expected to buck the trend of higher profits. Analysts predict it will report a €650.9 million profit for the third quarter of 2025, 1.9% below the €663.3 million profit it recorded in the same period of 2024.

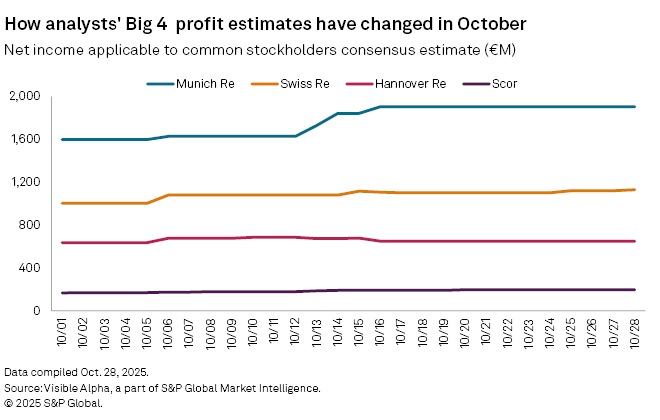

The consensus profit estimate for Hannover Re shifted over the course of October. Between Oct. 6 and Oct. 15, consensus estimates suggested the reinsurer would report a higher third-quarter profit year-on year. Hannover Re announced a change to its dividend policy on Oct. 5, raising the payout of its regular dividend to 55% of net income from the 46% it paid out in 2024, and stating that the payout each year would be at least the level of the previous year. The reinsurer held an investor day Oct. 9.

Of the four reinsurers, Munich Re's profit estimate increased the most during the month, by around €300 million. Its profit estimate started at €1.60 billion in early October.

The reinsurer predicted that demand for reinsurance generally would remain high in an Oct. 16 presentation at the Baden-Baden reinsurance conference, and it announced Oct. 9 that its specialty business would be expanding to the German primary specialty market.

Better underwriting

Given the lower natural catastrophe bills for the third quarter, all four reinsurers' property and casualty reinsurance businesses are expected to report improved underwriting results.

Swiss Re is expected to show the largest improvement, with its combined ratio, a measure of property and casualty underwriting performance, falling 28.9 percentage points to 79.4% from 108.3%, likely because of the non-recurrence of casualty reserve strengthening and lower catastrophe claims. A combined ratio above 100% indicates an underwriting loss.

Munich Re is expected to report the next largest improvement of 18.4 percentage points, with analysts predicting a third-quarter combined ratio of 71.1% for the world's largest reinsurer — the lowest among the four reinsurers.

Life & Health

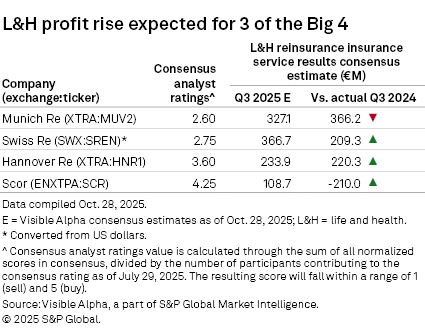

Life and health reinsurance is also predicted to perform well, with analysts expecting increases in insurance service result, a measure of underwriting profit under the IFRS 17 accounting regime, for all but Munich Re.

Analysts expect Munich Re's life and health reinsurance division's insurance service result for the third quarter of 2025 to be €327.1 million, 10.7% lower than the €366.2 million Munich Re reported in the same quarter of 2024.

Scor's return to profitability in life and health reinsurance after the 2024 reserving issues will continue in the third quarter of 2025, consensus estimates suggest, with a positive insurance service result of €108.7 million, versus the negative €210.0 million Scor reported in the same quarter of 2024.

Swiss Re's life and health reinsurance profit is also expected to improve significantly, up 75.2% to €366.7 million.

Investment returns, however, will generally not be as strong. Only Hannover Re will record a year-on-year increase in investment returns, according to consensus estimates, gaining 19.4% to €520.3 million.