Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Oct, 2025

By Nick Lazzaro

| A view inside the empty US Capitol Visitor Center while it is closed to visitors on the first day of the US government shutdown in Washington, DC, on Oct. 1, 2025. Stock and bond markets showed little volatility in response to the shutdown, with equities rising and bond yields steady. Source: Brendan Smialowski/AFP via Getty Images. |

Investors are so far brushing off a US government shutdown, with stocks extending an ongoing climb and bond markets standing nearly still.

Major US large-cap equity indexes finished in the black Oct. 1 with the S&P 500 rising more than 0.3%, according to S&P Global Market Intelligence data. Stocks were little changed in early trading Oct. 2. Movements in the bond market were also mild. The yield for the 10-year US Treasury note dipped 4 basis points to 4.12%, while the option-adjusted spread for the S&P 500 Investment Grade Corporate Bond Index widened just 1 basis point to 65.

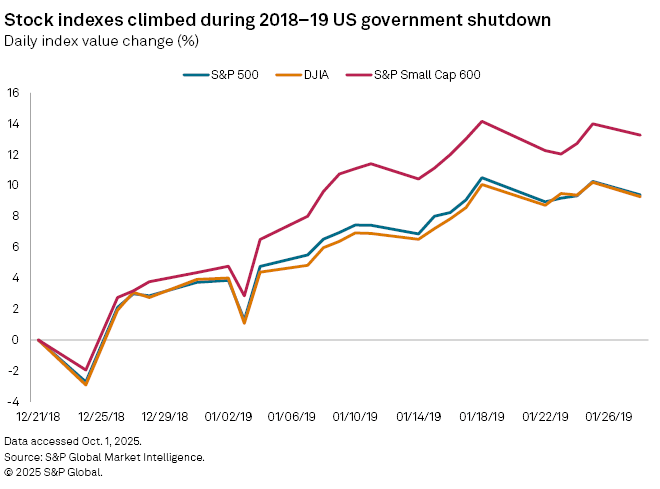

Analysts expect markets to move undeterred, given the lack of significant downturns during previous government shutdowns. The nation's last shutdown during President Donald Trump's first administration was the longest on record, spanning 35 days from late December 2018 to mid-January 2019. The S&P 500 initially dipped in the early days of the deadlock but ultimately climbed more than 9% during the period.

"Market participants have been through this type of experience plenty of times over the past 15 years," Mark Gibbens, president and chief investment officer of Gibbens Capital Management, told Market Intelligence. "The longer the shutdown carries on, the more damage will be done to the financial markets, but assuming the shutdown is short-lived, investors will not fret much."

Congress will also likely be incentivized to limit the duration of the shutdown as risks for government employment rise.

"Talks about significant permanent cuts to government agency employment mean at least some furloughed workers will not have a job and back pay to which to return," Steve Wyett, chief investment strategist at BOK Financial, said in an email. "This raises the stakes and could add additional pressure to reach a resolution quicker."

Any market sell-off that may occur during the shutdown is likely to be temporary and "should be viewed opportunistically," Wyett said.

Economic implications related to the government labor force would extend beyond Washington, DC, but the damage would be limited and subject to a quick recovery.

"If this shutdown is brief, and we believe it likely will be, economic activity may simply shift from October into November or December as wages are restored following the shutdown," said Matt Stephani, president of Cavanal Hill Investment Management, in an email. "Regions with a high concentration of federal workers may feel a more pronounced short-term impact for services as employees begin missing checks, but past shutdowns have shown minimal long-term economic consequences."

Volatility was subdued during the Oct. 1 trading day. The CBOE Volatility Index, which measures the 30-day expected volatility of the US stock market, spiked early in the day but settled almost flat from the prior-day close and was below recent peaks at the beginning of August and September.

Impact on Fed policy

The government shutdown could delay the release of economic data such as the upcoming US labor market report due Oct. 3 or inflation reports later this month. Both datapoints are vital for the US Federal Reserve's decision-making process when determining potential increases or decreases to its benchmark short-term interest rate range.

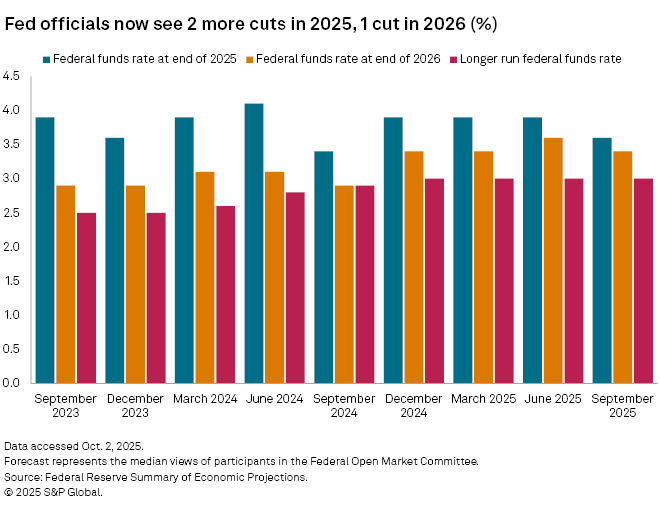

Markets are pricing in a near 100% probability that the Fed will issue a 25-basis-point cut to its policy rate in October and a near 87% probability of an additional cut by year-end, according to CME Fedwatch data as of Oct. 1. The two cuts, if they occur, would bring the midpoint of the Fed's benchmark rate to 3.6%. This would align with the Fed's median projection among its board members and regional presidents for its policy rate at year-end, according to its most recent projections.

However, the Fed's median view for 2026 suggests only one interest rate cut, while market views vary. A long-term government shutdown and consequent lack of data could further cloud interest rate policy outlook for 2026.

"If this government shutdown goes too long and that data gets delayed, that uncertainty about what happens with rate cuts in 2026 starts to become blurrier, and we're already in a really tough time of the year as October is traditionally one of the most volatile times of the year," Todd Stankiewicz, president and chief investment officer of Sykon Capital and portfolio manager for Free Markets ETF, said in an interview.

Impact of long-term shutdown

If the government shutdown persists longer than expected, the temporary closure of specific programs and agencies, along with their respective services, would begin to weigh on economic activity.

"For example, during past shutdowns, the Small Business Administration ceased some of its lending and investment programs, denying important financing for small businesses and limiting their ability to hire or invest," James McCann, senior economist at Edward Jones, told Market Intelligence. "Similarly, the time taken for approval on infrastructure projects will rise, causing costly delays."

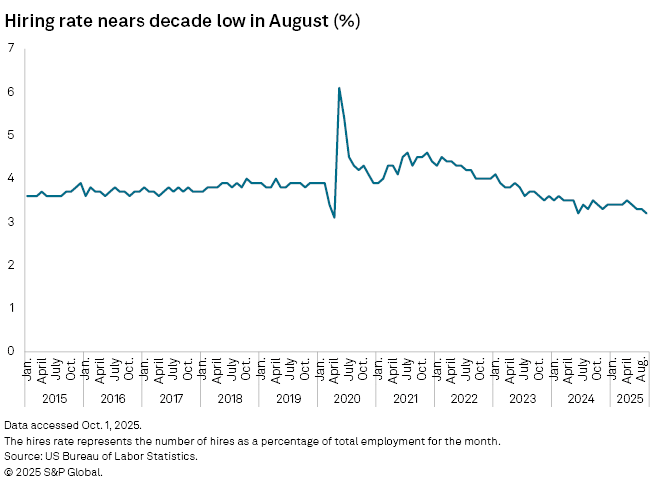

These negative impacts would come at a time when the US labor market is signaling growing weakness. For instance, new hires represented 3.2% of total employment in August, according to the US Bureau of Labor Statistics Job Opening and Labor Turnover report released Sept. 30. This was a tick above the lowest hiring rate over the last decade, a 3.1% clip recorded in April 2020 at the start of the COVID-19 pandemic.

"We know hiring is already unusually weak in the US economy right now, and these disruptions could make it harder for those Americans out of work to find a new job in coming weeks," McCann said.