Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Oct, 2025

By Hailey Ross

Share of only a handful of large-cap US insurers finished the week in negative territory while the majority of insurers were either flat or saw gains as Congress failed to reach an agreement to keep the federal government open.

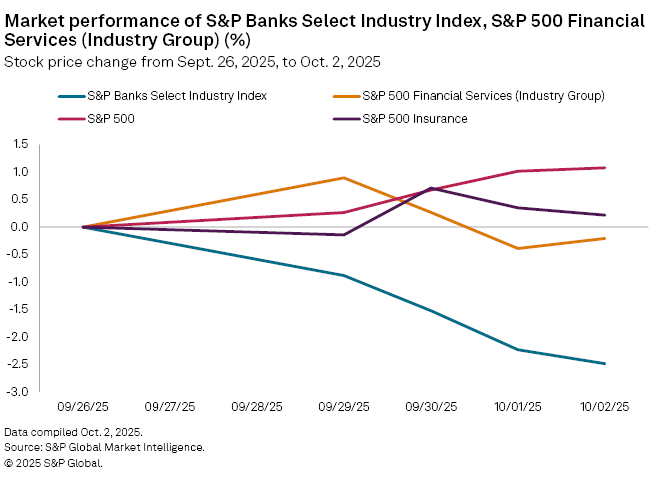

The S&P 500 was up about 1.1% for the week as of close of business Oct. 2 as the broader market seemed to brush off concerns associated with the shutdown. Meanwhile the US BMI Insurance Index was up 0.2%. The US BMI Banking Index was down 3.2%.

Analysts widely agree that insurance companies are not heavily impacted by a government shutdown. Piper Sandler analyst Paul Newsome said in an interview that insurers are largely able to run their day-to-day business without needing much of anything from the government.

"The states regulate insurers, so even the regulatory process is unaffected," Newsome said. "I suppose if you wanted to avoid the stocks of companies affected negatively by the federal government shutdown, you would find the insurance stocks relatively attractive."

Company performance

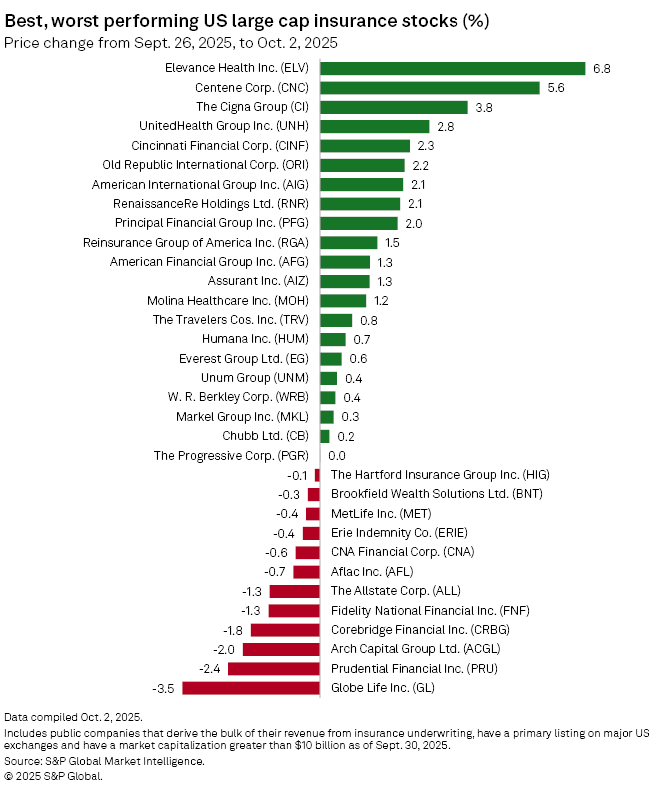

Of the large-cap US insurers, many of the top performers this week were managed care companies.

Elevance Health Inc., Centene Corp., The Cigna Group and UnitedHealth Group Inc. found a place near the top of the group. Elevance saw its stock tick up 6.8% for the week as of close of business Oct. 2. Centene and Cigna shares were up 5.6% and 3.8%, respectively, while UnitedHealth saw gains of 2.8% for the same time period.

The government shutdown has in large part hinged on debate over whether to extend pandemic-era increases to Affordable Care Act tax credits, which are set to expire on Dec. 31. Analysts say, however, that most managed care insurers have already factored for the potential loss of the subsidies as they filed rates with the government for higher premiums.

On the flipside, several life insurance companies were trading down with Globe Life Inc. and Prudential Financial Inc. finding spots at the bottom of the list of large-cap insurers. Globe Life's stock was down 3.5% for the week as of close of business Oct. 2, and Prudential's shares dropped 2.4%.

Impact of the shutdown

The government's funding lapsed at midnight on Wednesday, Oct. 1 after the House and the Senate failed to pass legislation that would allow the federal workforce to continue to operate and receive payment for services.

Legislators also failed to reauthorize the National Flood Insurance Program (NFIP), which had an expiration date of Sept. 30. CFRA analyst Cathy Seifert noted in an interview that the biggest impact to property and casualty insurers is probably due to the halting of flood policies by the NFIP as new policies can no longer be purchased. Flood policies also are unable to be renewed at this time.

The National Association of Insurance Commissioners (NAIC) sent a group of state regulators to Washington, DC, to meet with members of the Federal Emergency Management Agency Review Council at the White House on Oct. 1, to advocate for long-term reauthorization of the NFIP.

Congress has passed 33 short-term NFIP reauthorizations since 2017, according to the NAIC. The regulatory body also supports a long-term reauthorization of the NFIP that would last for a minimum of 10 years.

If the shutdown extends into the long term, Seifert flagged that there could be ramifications for the overall health of the economy.

"Indirectly, though, a prolonged shutdown could negatively impact business and consumer confidence and ultimately economic activity," Seifert said. "While this slowdown in economic activity could depress demand for commercial insurance, personal lines insurance is relatively economically defensive since it is legally mandated or required in most cases."