Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Oct, 2025

By Tyler Hammel

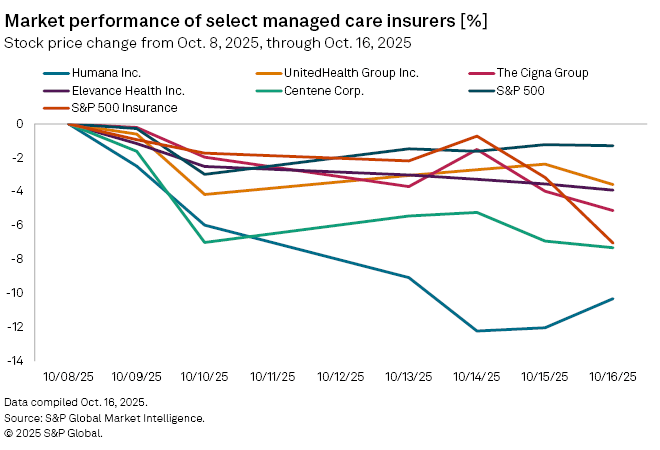

US managed care insurers were trading down this week ahead of earnings season as the release of Medicare ratings and federal tax credit uncertainty appeared to weigh on stock prices.

Since Oct. 8 — the day prior to the release of updated Medicare Advantage ratings — shares of nearly every major publicly traded US managed care insurer has fallen, with Humana Inc. experiencing the sharpest decline.

The Louisville, Kentucky-based insurer was down trading at 262.17 a share as of market on Oct. 16, down 12% from Oct. 8.

During the same period, fellow insurers Centene Corp. and The Cigna Group experienced declines of 6.9% and 4%, respectively, while Elevance Health Inc. and UnitedHealth Group Inc. experienced more modest declines of 3.5% and 2.4%, respectively.

The S&P 500 and S&P Insurance Index similarly declined, falling 1.29% and 7.03%.

While the government shutdown remains ongoing, the conversation around extending tax credits for Affordable Care Act (ACA) plans may have shifted, J.P. Morgan analysts wrote in a note.

"We believe that sentiment has improved around the possibility of an [ACA tax credit] extension as the GOP shows an increasing willingness to engage in a negotiation of some form," the analysts said.

Mixed stars ratings

Humana's sharp decline comes after the release of the Centers for Medicare & Medicaid Services' Medicare star ratings on Oct. 9. The government body annually issues quality ratings of Medicare Advantage offerings, which impact bonus payments insurers receive from the US government.

The insurer revealed via a Form 8-K that approximately 1.2 million of its members, or 20% of its Medicare membership, were enrolled in plans rated four stars or higher for 2026. This figure is down from 25% for 2025 and was later confirmed by a CMS release.

Humana did not respond to a request for comment but described the ratings as "generally in line with the assumptions utilized in its multiyear financial planning," in its Form 8-K.

Investors have dialed back their expectations for Humana's 2027 bonuses, which result from the ratings released in 2025, and Humana's response appears to indicate that a recovery will occur next year, the J.P. Morgan analysts said.

"Humana indicated that it remains 'confident' in its 2026 [Medicare Advantage] pricing and benefit design, which includes the assumption that the company will double individual Medicare Advantage pretax margin in 2026 (ex-Stars), and that it will return to membership growth in 2026," the analysts said.

However, Humana's decline also comes amid the dismissal of its second lawsuit against CMS over the allegedly "arbitrary and capricious actions" it committed when calculating its 2024 star ratings.

The initial lawsuit was dismissed by a federal judge in Texas for being premature, as Humana had not exhausted the administrative appeals process. The second lawsuit was effectively dismissed after the same judge granted CMS' motion for summary judgment, siding with the body's claims that it operated correctly per its procedure in lowering Humana's ratings following several disconnected and unreturned customer service calls.

"Humana agreed that if it failed as a matter of law, the record supports finding that the decision is supported," the judge wrote. "Because the no-callback policy is lawful, the agency's decision to rate the dropped calls as unsuccessful was not arbitrary and capricious."

Not all insurers saw their star ratings for 2026 decline. The overall average Medicare Advantage Star Rating for 2026 was 3.66, largely the same as 2025's average rating of 3.65, CMS data shows, and UnitedHealth and Elevance had around 78% and 55%, respectively, of their members in plans rated four stars or higher, per a Reuters report.

ACA funding

The stock price decline among managed care insurers also comes amid an ongoing government shutdown hinging on efforts by the Republican majority to do away with COVID-era tax credits for ACA plans.

The enhancements, including broadened eligibility for the ACA tax credits, expire on Dec. 31 and, absent an extension by Congress, enrollees will see significant premium hikes when open enrollment for 2026 begins Nov. 1. The ACA, known colloquially as Obamacare, also allows individuals to enroll in plans via a state-based marketplace rather than through an employer.

While Democrats in Congress have argued that the extensions are necessary to offset rising costs for lower-income Americans, the tax credits have become the latest target of broad cuts pushed by the Republican majority.

Due to the uncertainty, most managed care insurers have already filed rates with the government for materially higher premiums, according to Leerink analyst Whit Mayo.

Comparing it to the recent spate of Medicaid redeterminations — during which states decided who met qualifications for government-subsidized Medicaid health plans after years of COVID-related delays — Mayo said millions of people could either lose their health insurance or face much higher premiums.

"It's a very similar population [to Medicaid], the healthy people that probably could go without health insurance decide not to keep it and then the sick people and those that need healthcare will retain it," Mayo said. "Therefore, you see a deterioration in your risk pool and more volatility in your cost trends."

Both the ACA credits and Medicare star ratings are expected to be discussed during the upcoming third-quarter managed care earnings season, which kicks off with Elevance on Oct. 21.