Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Oct, 2025

| The state of Wyoming is part of a lawsuit alleging asset managers colluded to keep coal prices high and supplies down at the expense of customers. Pictured above is Peabody Energy's North Antelope Rochelle mine in the state. Source: Peabody Energy Corp. |

This is the first of two articles on the lawsuit. Read Part 2 here.

A landmark antitrust case brought by 11 Republican attorneys general against three of the world's largest institutional investors could lead to a significant financial divestment from publicly traded US coal companies.

The state attorneys general filed a lawsuit in November 2024 against BlackRock Inc., Vanguard Group Inc. and State Street Corp., accusing them of colluding to artificially reduce coal supplies by leveraging significant holdings in US mining companies. Conservative organizations and politicians have criticized the case, citing potential damage to coal company finances as states challenge environmental, social and governance investment as a broader concept.

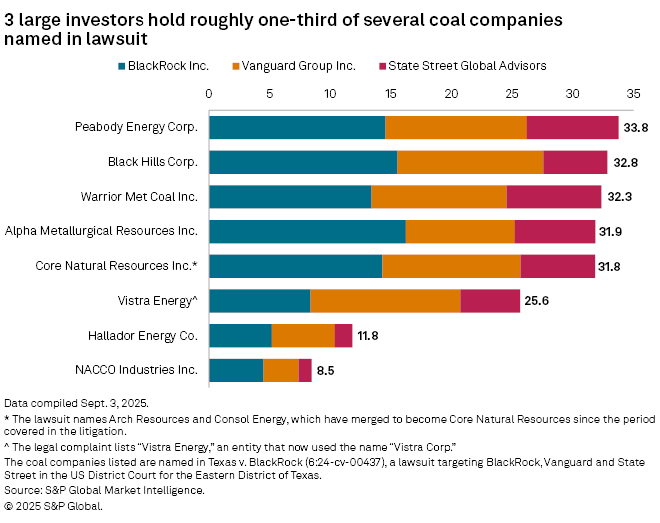

The suit is progressing as coal demand rises and producers show renewed optimism about the market, but coal companies could be at risk if the asset managers are forced to make large divestments. As of Oct. 1, the asset managers' share in the coal companies named in the suit totaled $22.83 billion in market value — modest change for the multitrillion-dollar asset management industry but a major blow to coal producers.

"Such a ruling would be very harmful to the American coal companies that depend on asset managers — particularly those managers that invest their clients' assets in multiple coal companies — for much-needed capital, as well as to the American investors who are relying on their investments in US energy to provide investment returns," Melissa Barosy, the director of public affairs for the Investment Company Institute, told Platts, part of S&P Global Commodity Insights.

The Investment Company Institute has filed as a friend of the court in support of the asset managers in the suit.

Large holdings in coal

The companies named in the suit, but not party to either side of the litigation, are among the largest producers of coal in the US: Peabody Energy Corp., Arch Resources, NACCO Industries Inc., Consol Energy, Alpha Metallurgical Resources Inc., Hallador Energy Co., Warrior Met Coal Inc., Black Hills Corp. and Vistra Corp. (referred to as Vistra Energy). Since the period covered by the lawsuit, Arch and Consol have merged into a new entity known as Core Natural Resources Inc.

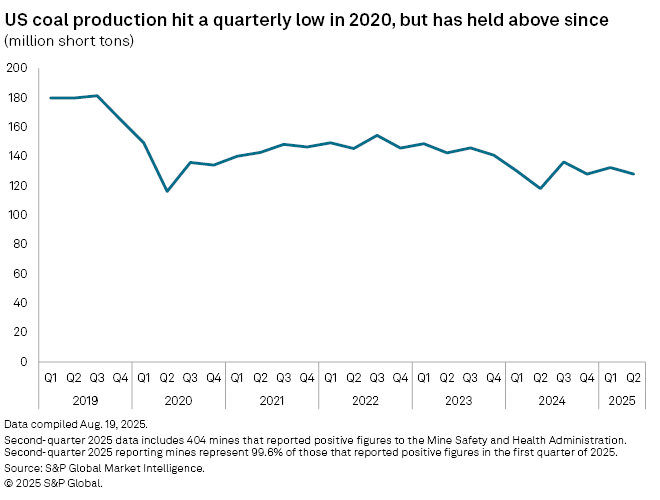

From 2019 to 2022, Paxton and the other attorneys general say coal production fell while prices rose. However, US coal production totaled 706.0 million short tons in 2019, according to S&P Global Market Intelligence data. Output fell to 535.6 million short tons in 2020, as the nation dealt with reduced economic activity from the COVID-19 pandemic. Overall US coal production increased again in both 2021 and 2022, to 577.7 million short tons and 594.8 million short tons, respectively.

Much of the complaint focuses on Powder River Basin coal. The Thermal Coal FOB Powder River Basin Rail 8,400 BTU price as assessed by Platts did see a significant spike in the fall of 2021 as producers struggled to deliver coal due to what had been described as a "meltdown" in rail service. Rail companies struggled to find enough workers. The price ranged between $8.50 and $10 per short ton for years before it climbed to over $26 in early November 2021. However, the spike was steep and short-lived, and prices fell below $15 per short ton by early March 2022. Prices drifted further to about $12 per short ton by late 2022 and have since stayed in that range.

Meanwhile, the complaint notes Peabody's profits soared the most in the period, growing by 853.9%, or $1.59 billion, while the company's production decreased 25.5%. Several others reported triple-digit percent growth while production declined, though some companies' gains were more modest. Few producers seemed willing to take the risk of increasing production, given the short-lived nature of the price increase and that much of the increase was driven by logistics issues preventing sales. In addition, utilities often hold large stockpiles of coal and do not make purchases unless necessary when prices are high, and coal mines require a long lead time to bring online in response to increased demand.

Common ownership theory

Texas Attorney General Ken Paxton is leading the plaintiffs in the lawsuit. According to Paxton, the investors' actions, including participating in climate pledge initiatives, led to artificially constrained supply and raised consumer prices while producing "cartel-level profits."

Several states where the Republican party is typically a reliable ally of the coal industry joined Paxton's complaint, including West Virginia, Wyoming, Alabama and Montana. None of the participating states, including Paxton's office, responded to a request for comment.

The case is the first of its kind built on what is known as "common ownership theory," said Florian Ederer, a professor of markets, public policy and law at Boston University. The theory posits that large investors owning shares in multiple competing firms in the same industry can lower competition.

"This is an easy case to win if, in discovery, it emerges that there were really these clear and direct agreements between the asset managers and their portfolio companies," Ederer said. "If, on the other hand, this does not exist, then you're relying much, much more on indirect effects, and then it becomes very difficult to disentangle them exactly from these other [market] developments that are also happening exactly at the same time."

In a statement about the case, BlackRock said the attorneys general are undermining the Trump administration's goal of American independence.

"This case is based on an absurd theory that coal companies conspired with their shareholders to reduce coal production," BlackRock said.

Vanguard "looks forward to the opportunity" to defend itself from the claims, and State Street said the states are advancing a "new and dangerous antitrust theory."

A potential divestment, one of the remedies called for by the attorneys general in their complaint, could have a severe impact on the coal sector. The three institutional investors own nearly one-third of the shares of Peabody, Black Hills, Warrior Met, Alpha and Core Natural Resources, according to S&P Global Market Intelligence data as of Sept 3. The investors own smaller, but still substantial shares in Vistra, Hallador and NACCO at 25.6%, 11.8% and 8.5%, respectively.

NACCO and Peabody declined to comment on the case and the rest of the producers did not respond. More than two dozen financial analysts covering the industry also did not respond to requests for comment or interviews about the potential impact of divestment.

Concerns for coal and beyond

The lawsuit is reminiscent of the time 2016 Democratic presidential hopeful Hillary Clinton drew the ire of Republicans and America's coal country by saying, "we're going to put a lot of coal miners and coal companies out of business," Thomas Aiello, senior director of government affairs for National Taxpayers Union, a conservative-leaning group, told Platts. Clinton later apologized, saying the comment had been taken out of context.

"I don't really think that I can find any positives of what could actually happen if he's successful here," Aiello said. "I think what they're doing is very much contrary to the president's agenda because we want to produce more traditional energy sources."

The Energy Evolution podcast from S&P Global Commodity Insights explores the shifting energy landscape. In the episode above, co-hosts Taylor Kuykendall and Eklavya Gupte explore the latest trends in coal in the United States. Subscribe on Apple Podcasts and Spotify.

If the attorneys general are successful, it could also have "devastating consequences" for regulated funds and their investors, Barosy told Platts. Restricting institutional investors from holding stock in competing firms or even creating risks around the practice could upend common investor strategies that enable companies to diversify at a low cost.

"Imposing legal liability and granting sweeping equitable relief (including forced divestitures from companies) based on institutional investors' common ownership of minority stakes in competing companies could harm millions of American investors, companies and capital markets, causing crippling effects beyond the coal sector and this lawsuit," Barosy said via email.

Division among conservatives

The lawsuit is also splitting opinions on the political right.

President Donald Trump aims to support the coal sector and has implemented policies that increase coal production, reduce operational costs for mining companies, and otherwise promote coal as an energy source. Trump has also been working to counteract previous environmental regulations that threatened the industry's viability. However, the administration has also sometimes inadvertently made things complicated for the sector.

For example, Trump's US trade representative proposed a rule aimed at encouraging US domestic shipbuilding, but scrapped the rule a few weeks after the coal industry and other sectors rallied against it, warning of potentially devastating effects for the sector. The case is now being overseen by Trump appointee Judge Jeremy Kernodle of the US District Court for the Eastern District of Texas, who ruled Aug. 4 to allow the case to proceed against motions to dismiss.

The White House did not respond to Platts' request for comment on the lawsuit.

Meanwhile, prominent Republicans have publicly called on the attorneys general to back away from the suit.

Rick Perry, a former Texas governor and the US Department of Energy secretary during Trump's first term, wrote an opinion piece published Aug. 20 in the Washington Times that said the "misguided" lawsuit risks branding Texas as "hostile to capital."

"Lawsuits like this one only distract from the mission and risk slowing down the very momentum Mr. Trump has worked so hard to build," Perry wrote.

Former US Rep. Ken Buck wrote in a Bloomberg Law opinion piece that Paxton's suit was a "witch hunt" and, if believed, leads to the "logical conclusion" that coal companies were co-conspirators in "the phantom pressure of the three asset managers." Buck once sat on the House Judiciary Committee and was the ranking Republican on the Antitrust Committee.

"The likely outcome of Paxton's frivolous complaint is that the plaintiff's bar will bring private antitrust actions against coal companies and other fossil fuel producers in Texas," Buck wrote.

On the other hand, the lawsuit has garnered the official support of the Trump administration's Federal Trade Commission and Department of Justice, as evidenced by their statement of interest in the case. FTC Chairman Andrew Ferguson, a Trump appointee, cited Trump's support of coal in a May 22 news release about the case. The FTC did not respond to a request for comment, including questions about the potential negative consequences of the case on the nation's coal producers.

"President Donald Trump understands the importance of coal for our energy security and has vowed to fight left-wing ideologues who seek to make us weaker and poorer under the guise of ESG," Ferguson said in the May 22 statement. "These companies allegedly blocked the production of American coal in the name of climate change scaremongering, all so they could take money out of the pockets of American consumers and put it in theirs."

The US District Court case is Texas v. BlackRock (6:24-cv-00437).