Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Oct, 2025

By Adrian Jimenea and Cheska Lozano

|

|

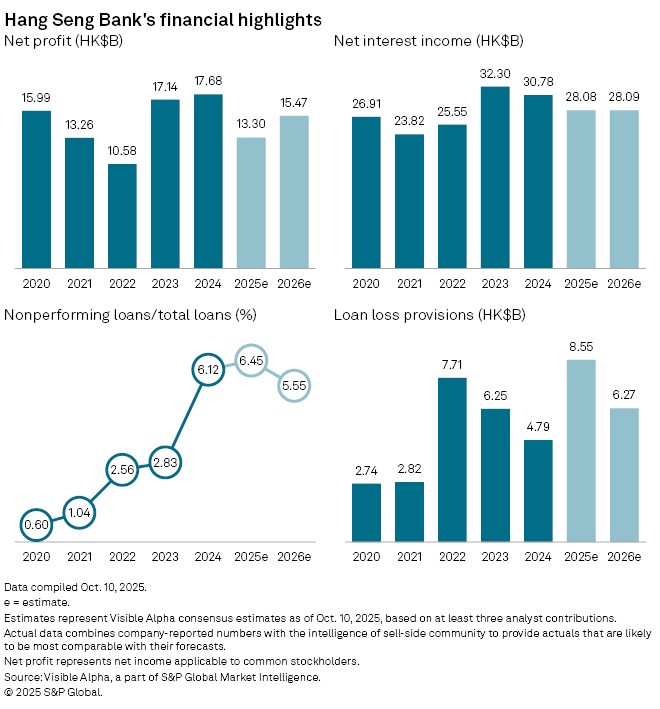

Hang Seng Bank Ltd., the Hong Kong unit that HSBC Holdings PLC is seeking to take private, is poised to book its highest annual loan loss provision since at least 2020, according to Visible Alpha estimates.

The bank's annual loan loss provisions are expected to increase to HK$8.55 billion, almost 80% higher than the HK$4.79 billion it set aside in 2024. At the same time, its ratio of nonperforming loans to total loans is projected to worsen to 6.45% by the end of 2025.

Elevated credit risks have eroded earnings, with the bank reporting a 30% decline in its profits for the first six months of 2025. For the full year, Visible Alpha estimates net profit will total HK$13.30 billion, down by nearly a quarter year over year.

Hong Kong's real estate sector has been in a downturn for several years amid declining house prices, elevated interest rates and a weaker economy. Hang Seng is exposed to property developers of different sizes in the middle of an oversupply, Jason Ku, a primary credit analyst at S&P Global Ratings, said in an email interview. Demand has also not kept up yet with supply, despite leasing activity somewhat recovering through 2025.

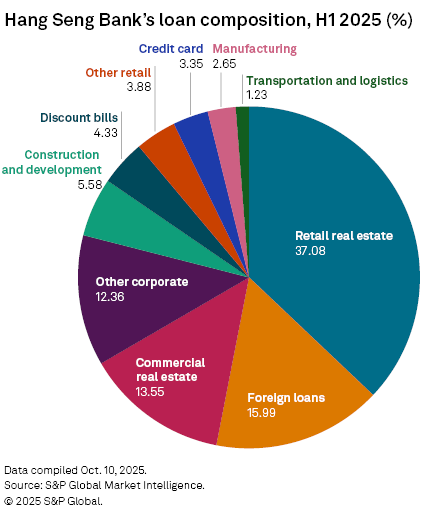

As of June 30, more than half of Hang Seng's total lending portfolio comprised property loans. About 37% of total loans were retail real estate loans and 14% were commercial real estate (CRE) loans.

Hang Seng is the fourth-largest bank by consolidated assets in Hong Kong with assets of HK$1.82 trillion. Given its size, diversified business, adequate risk management and healthy capital ratios, the bank can absorb the impact of its elevated stock of problem loans, Ku said. Coverage of Hong Kong CRE nonperforming loans exceeds 100%, and the rate of increase in the NPL ratio has slowed, according to its latest earnings presentation.

Hang Seng has sufficient internal capital generation capacity and has taken steps to mitigate the risks from its CRE portfolio, such as writing down loans and limiting refinancing, Ku said. The majority of its Hong Kong CRE book is also secured, providing a cushion if prices and rents further sink.

Boosting the 'home market'

HSBC group, through its wholly owned The Hongkong and Shanghai Banking Corp. Ltd. (HSBC Asia-Pacific) unit, is already the majority investor in Hang Seng and plans to pay close to $14 billion to acquire the shares it does not currently own. It is offering HK$155 per share, valuing Hang Seng at HK$290 billion on a value equity basis.

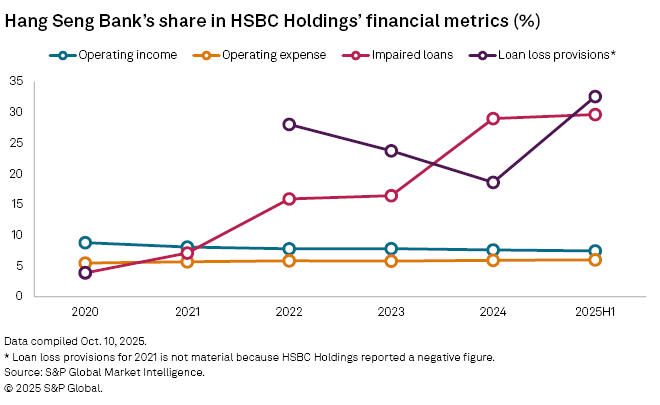

In HSBC's financial statements, Hang Seng and HSBC Asia-Pacific are grouped together as the "Hong Kong" business, which is the single largest contributor to group revenue and profit. Hang Seng, on its own, accounted for about 7.5% of HSBC's group operating income in the first half. Its share of the group's loan loss provisions and impaired loans was 32% and 30%, respectively.

Focusing on Hong Kong and Asia is one of the key drivers in the ongoing restructuring spearheaded by HSBC CEO Georges Elhedery.

"With the opportunities that we identify in Hong Kong as a home market, strategically, the time is right for this decision," Elhedery said during an analyst call about the transaction. "It's also a decision that's meant for the next many, many years, so this is not a short-term consideration or a timing choice. This is more of a strategic, commercially driven decision."

Capital allocation questions

Some analysts questioned the deal, particularly because HSBC will suspend share repurchases for the next three quarters to self-finance the deal from existing financial resources. In its announcement, the group said it expects the Hang Seng privatization to be accretive to its EPS, without providing details.

The logic behind the deal is not immediately clear, KBW analysts said in a note, questioning how the price of 15x the group's 2027 estimated earnings would be positive versus buying back shares at consensus.

During the call, Elhedery said that while the math favors buybacks versus paying to acquire shares — buybacks would reduce the bank's share count, thereby increasing EPS — other factors to be taken into consideration, such as revenue synergies and efficiencies, must also be considered. He said Hang Seng has structurally high pre-provision margins.

The factors "are materially more in favor" of the deal, Elhedery said. "I can stand behind the statement that this is more accretive for our shareholders in the medium- to long-term. This is not a one-year analysis."

Meanwhile, some analysts welcome the deal, particularly for Hang Seng. Full ownership would eradicate structural constraints in integration and "enable more efficient capital and resource allocation across the group's Hong Kong franchise," Fitch Ratings said in a commentary. The synergies are also achievable in the medium term, given HSBC's "strong execution record."

Estimates indicate that buying out Hang Seng's minority investors would cost HSBC about $13.6 billion, but Elhedery said the bank would be consuming about $10.5 billion partly due to the removal of capital deduction related to noncontrolling interests.

"We view the proposed transaction as a strategic redeployment of the substantial excess capital [HSBC] is generating," S&P Global Ratings said in a bulletin.

HSBC's UK and Hong Kong teams did not respond to requests for comment.

Visible Alpha is an S&P Global company.