Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Oct, 2025

The aggregate transaction value of global private equity and venture capital deals jumped in the third quarter as pressure from limited partners to deploy capital grows.

Deals announced between July and September with disclosed transaction values amounted to $258.52 billion, up 42.6% from the $181.34 billion recorded in prior-year period, according to data compiled by S&P Global Market Intelligence.

The number of deals announced totaled 3,131, a decrease from 3,345 in the third quarter of 2024.

In the first nine months of 2025, the total transaction value reached $633 billion, up from $509.97 billion in the same period last year. Deal volume dropped to 9,587 from 10,000.

– Download a spreadsheet with data in this story.

– Read about global private equity entries in August.

– Explore more private equity coverage.

Private equity and venture capital firms have been more active in pursuing deals as their investors put more pressure to deploy capital, Scott Abramowitz, partner at Ropes & Gray LLP's private equity transactions practice group, said in an interview.

The gap between buyers' and sellers' expectations when it comes to valuations has also narrowed.

"We've seen a little bit of an acceptance from some sellers that the assumptions or the expectations around multiples and around returns that they've been holding on to for the last couple of years may not get there," Abramowitz said.

Dealmakers have also become more confident in pursuing other kinds of transactions including carve-outs, noncore disposals, continuation funds and secondary deals as the IPO market remains challenging as an exit route, Tom Lin, an M&A-focused partner at Clifford Chance LLP, said in an interview.

Largest deals

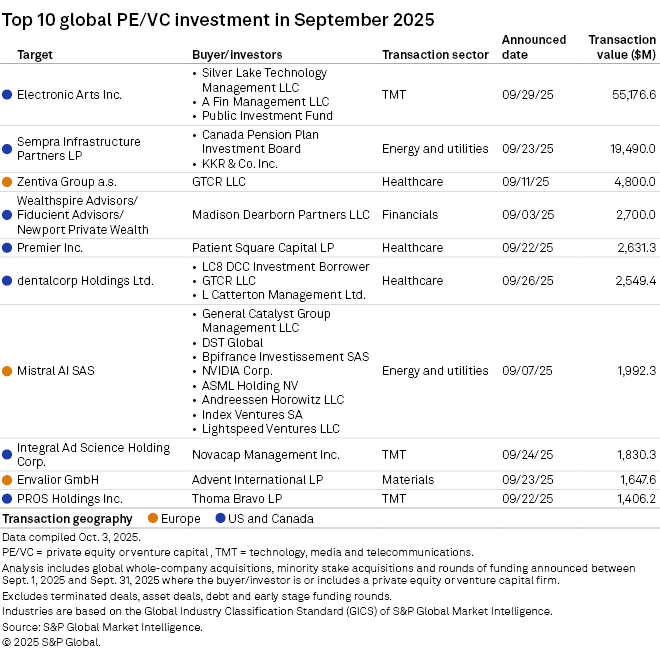

There were 13 announced deals in September with transaction values of at least $1 billion.

In the largest deal of the month, private equity firms Silver Lake Technology Management LLC and A Fin Management LLC and Saudi Arabia's sovereign wealth fund Public Investment Fund agreed to acquire video game company Electronic Arts Inc. for $55.18 billion.

The investor group acquiring Electronic Arts is taking on a record-setting $20 billion in debt, the largest amount ever used to finance a private equity-led transaction within the technology, media and telecommunications (TMT) sector, according to Market Intelligence data.

"We have seen a huge amount of available debt financing and strong interest from co-investors," Abramowitz said. "Those factors contribute toward the availability of financing for large deals and interest in pursuing large deals."

In the second-largest deal of the month, KKR & Co. Inc. and Canada Pension Plan Investment Board agreed to buy an additional 45% stake in Sempra Infrastructure Partners LP from Sempra for $19.49 billion.

TMT sector saw most deal activity

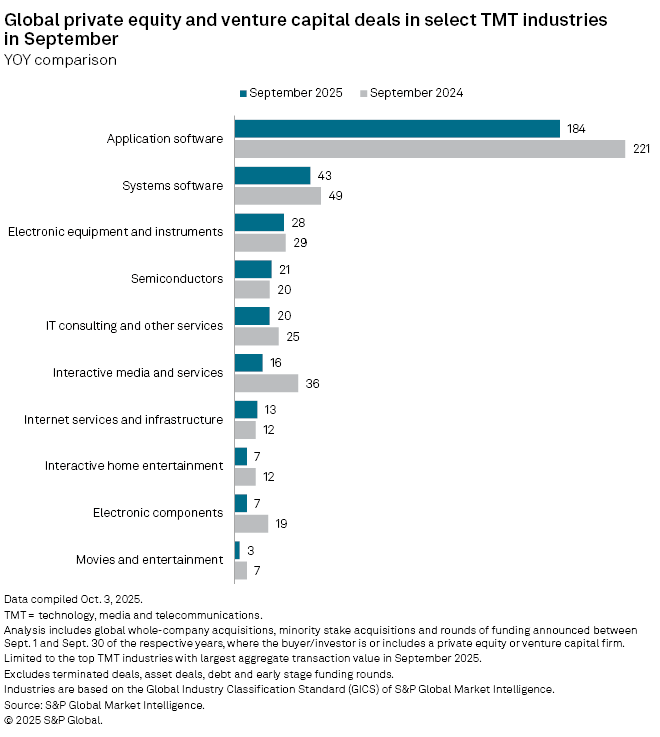

The TMT sector had the most deal activity in September, with 384 private equity-backed transactions announced.

Within the sector, application software had the highest number of transactions at 184, followed by systems software at 43 and electronic equipment and instruments at 28.