Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Oct, 2025

By Sheikh Rishad and Hussain Shah

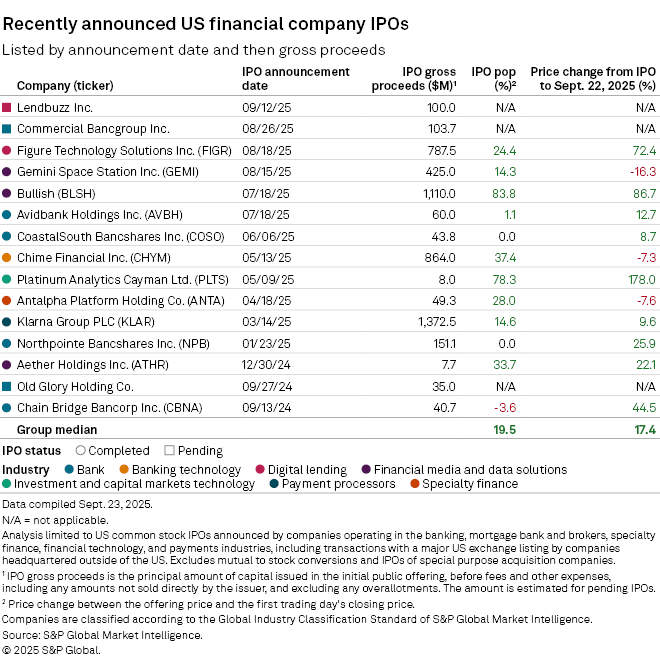

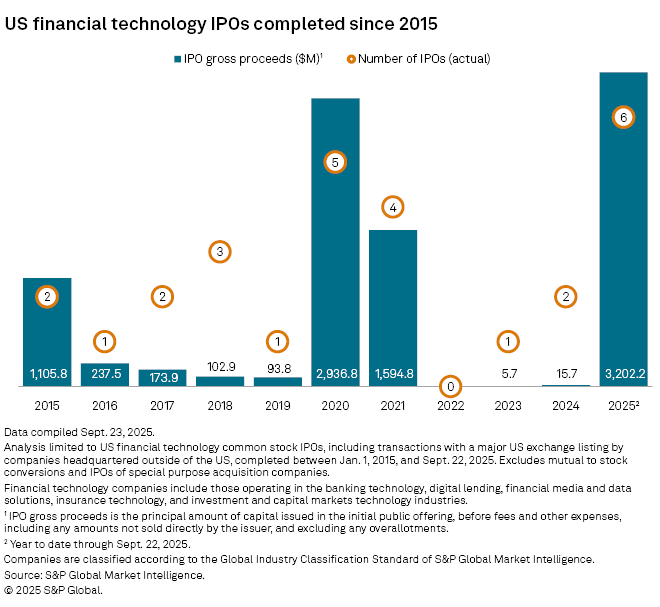

A slow market for initial public offerings in the financial technology industry has reversed in 2025, with six fintech companies completing their public listings so far this year.

As of Sept. 22, six fintech companies raised roughly $3.20 billion through IPOs in 2025, reaching the highest level in at least a decade and exceeding the $2.94 billion raised by five fintech companies in 2020, according to S&P Global Market Intelligence data.

The six fintech offerings to date in 2025 were from Figure Technology Solutions Inc., Gemini Space Station Inc., Platinum Analytics Cayman Ltd., Bullish, Chime Financial Inc. and Aether Holdings Inc.

Boston-based fintech Lendbuzz Inc. filed Sept. 12 for a planned IPO. The company intends to list its common stock on the Nasdaq Global Select Market, and the size and pricing of the offering have not yet been disclosed.

Fintech IPO activity has been minimal over the past three years. There were no fintech IPOs in 2022, and only one company — DeFi Development Corp. — went public in 2023. In 2024, two non-US companies, Powell Max Ltd. and U-BX Technology Ltd., completed their public listings on the NASDAQ Capital Market, generating $15.7 million in total gross proceeds.

In 2025, three fintech companies went public in September alone.

Figure Technology Solutions, a digital lending company, completed its IPO on Sept. 10, raising $787.5 million in gross proceeds. On its first day of trading, the company's stock closed 24.4% higher than its IPO price of $25.00 per share. The stock's strong performance continued, and Figure Technology's stock price rose by 72.4% from its IPO price through the Sept. 22 market close.

Gemini Space Station, a crypto platform developer, raised $425.0 million in gross proceeds through its IPO on Sept. 11. Gemini's stock closed up 14.3% on its first day of trading compared to its IPO price of $28.00 per share. However, by the Sept. 22 market close, the stock had fallen 16.3% below its original offering price.

Singapore-based Platinum Analytics Cayman Ltd. raised $8.0 million in gross proceeds through its Sept. 18 IPO. On its first trading day, the company's stock closed 78.3% higher than its offering price of $4.00 per share. Shares traded 178.0% above the offering price as of the market close on Sept. 22.

Cayman Islands-based market infrastructure provider Bullish raised $1.11 billion in gross proceeds through its IPO on Aug. 12. Bullish's common stock, which was initially priced at $37.00 per share, soared 83.8% during its first day of trading and was trading 86.7% higher than its initial offering price at market close on Sept. 22.

Digital consumer banking solution provider Chime Financial priced its IPO at $27.00 per share and raised $864.0 million in gross proceeds. Chime's stock closed 37.4% above the IPO price on June 12, its first trading day. The share price softened after its debut, closing at $25.04 on Sept. 22, 7.3% below the initial offering price.

Aether Holdings raised $7.7 million in gross proceeds through its IPO, with its common stock priced at $4.30 per share. On its first day of trading, Aether's common stock closed 33.7% above its offering price. At the market close on Sept. 22, the financial technology platform's stock closed at $5.25, up 22.1% from the initial offering price.

London-based payment processor Klarna Group PLC's IPO was another major development in September. The offering, completed on Sept. 9, brought in $1.37 billion in gross proceeds for the company.