Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Oct, 2025

By Brian Scheid

The US Federal Reserve's three-year effort to unwind some of its trillions of dollars in asset holdings will end Dec. 1, but the financial market effects remain unclear.

Fed Chair Jerome Powell announced Oct. 29 that the central bank would end quantitative tightening, the process reducing its asset holdings by not reinvesting proceeds from maturing US Treasurys and mortgage-backed securities it purchased during the pandemic. By ending this effort, the Fed will no longer be shrinking its balance sheet and will stop pulling liquidity from markets, a potentially economically stimulating measure.

However, this move is seen more as fixing the plumbing of the financial system with little potential impact on financial markets, economists and market strategists told S&P Global Market Intelligence.

"Normally, risk appetite rejoices when the Fed pulls forward ... but in this case it might be more a sigh of relief that the Fed is taking note of repo strains," Derek Tang, an economist with LH Meyer/Monetary Policy Analytics, said in an interview.

Fed officials announced the decision along with the widely expected vote to cut interest rates by another 25 basis points to a range of 3.75% to 4%, its second such cut in as many months.

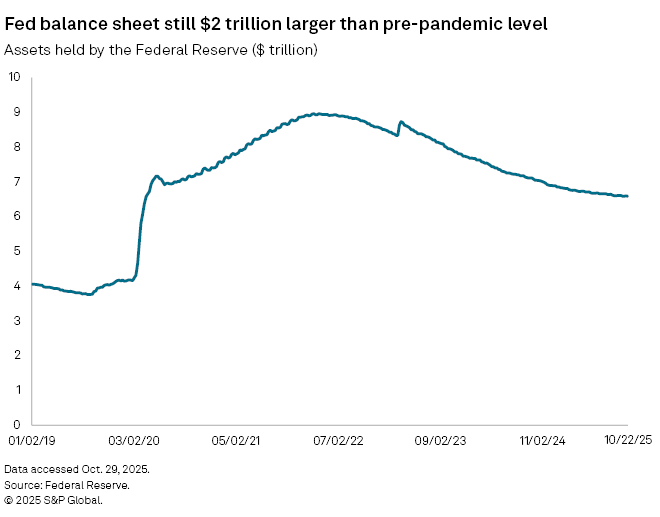

The Fed's decision to keep these securities from rolling off its now $6.59 trillion balance sheet is widely viewed as an economic positive since quantitative tightening (QT) was removing liquidity from the economy and acting as a hurdle to growth. The central bank began slowing the pace of QT in April and has reduced its balance sheet by nearly $2.38 trillion from its peak in April 2022, when it was nearly $9 trillion.

While the imminent end of QT is unlikely to have an immediate impact on markets, investors will be focused on how the central bank manages its balance sheet going forward, said Joseph Wang, a former senior trader on the Fed's Open Markets Desk and the operator of Fedguy.com, a financial markets research blog.

"The Fed seeks to move to an all-Treasury portfolio, and may change the duration of that all-Treasury portfolio," Wang said. "Their decision would impact the supply of duration in the market and could put upward pressure on longer-dated yields."

A long time

During his Oct. 29 press conference, Powell said that once the balance sheet is frozen Dec. 1, the Fed will reinvest maturing mortgage-backed securities into Treasury bills. Powell said the Fed will also later alter the composition of the balance sheet, which he expects will shift to shorter-duration securities.

"This is something that's going to take a long time and move very, very gradually, and I don't think you'll notice it in market conditions," Powell said.

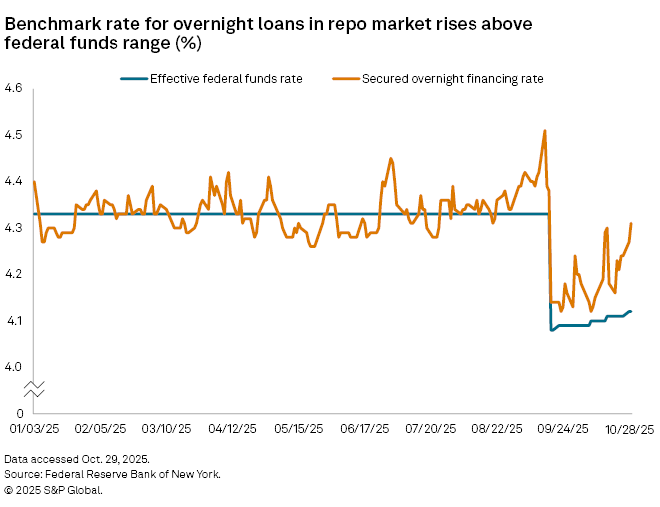

The Fed has carefully prepped for this QT process after its first such effort in 2019 triggered a sudden lack of liquidity in the reverse repo market and a spike in the security overnight financing rate, Tyler Richey, a co-editor at Sevens Report Research, said in an interview.

The end of QT should not have a material impact on stocks, bonds or the dollar, unless sudden signs of stress emerge in the financial system again and liquidity issues boost risks for stocks with stretched valuations and worsen investor uncertainty, Richey said.

"Put simply, the end of QT is widely seen as a positive market development as it marks a level of liquidity that the Fed deems 'above ample,'" Richey said. "If an unforeseen catalyst were to put that thesis at risk and trigger another wave of turmoil in short-term funding markets, we could see volatility reverberate across asset classes including equities and bonds, with risk aversion away from the former and into the latter being the most likely scenario to play out."

The Fed has used QT and its opposite mechanism, quantitative easing, to alter liquidity levels and steer funding conditions. Through quantitative easing, the Fed bought trillions of dollars worth of government bonds and mortgage-backed securities in the early days of the pandemic to stabilize markets and bolster the crumbling economy.

As it shifted to QT and let many of those bonds roll off its balance sheet, the Fed essentially removed liquidity from the banking system, compelling banks to keep fewer reserves at the central bank and potentially pushing up funding costs. The Fed agreed to end QT since it now sees liquidity and reserves at ample levels.

"The end of QT simply signals that the 'abundant' bank reserves environment that persisted since the pandemic has normalized to the 'ample' bank reserves environment the Federal Reserve is targeting," Michael O'Rourke, chief market strategist at JonesTrading, said in an interview.

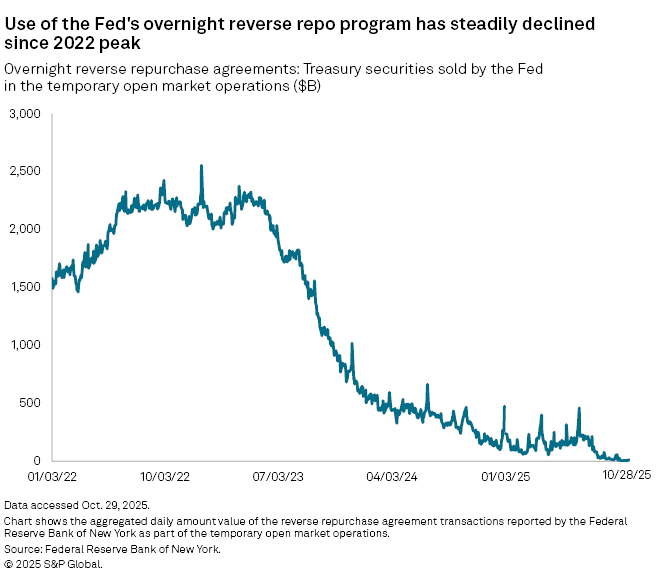

But the end of QT was also likely motivated by recent stress in overnight funding markets and a decline in the use of the overnight reverse repo program. Under reverse repo, the Fed sells securities to banks, allowing them to meet collateral requirements, and then buys them back the next day.

"The strains are being felt in pricing, the rate at which repo is being transacted is creeping higher and higher, indicating scarcity of funds as the Fed keeps shrinking its balance sheet," said Tang with LH Meyer/Monetary Policy Analytics. "Lately, repo rates are trading above where Fed policymakers likely want them to be."

The overall impact of the end of QT on financial markets could prove to be relatively minor, Sonu Varghese, vice president and global macro strategist with Carson Wealth, said in an interview.

Financial conditions are generally easier as equity markets continue to rise to new record high with momentum headed into the end of the year and an expected increase in household revenues with tax cuts going into effect and some tax refunds expected to climb, Varghese said.

"If anything, the implicit signal from the Fed stopping QT would be to assure markets that the Fed has its back from a liquidity perspective, and ensure that there's ample reserves," Varghese said.