Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Oct, 2025

By Brian Scheid

To prevent the US labor market from weakening further, the Federal Reserve will almost certainly cut interest rates by another 25 basis points this week, though much of the data that guides the central bank will be unavailable.

The lack of data, particularly the loss of the government's monthly jobs report, may have limited impact on this week's rate decision on Oct. 29. However, it could have more substantial repercussions on the Fed's next expected rate decision in December and into early 2026.

As the federal government shutdown shows no signs of ending soon, the monthly jobs report is indefinitely delayed and the collection of new data is on hold, Fed officials may not be crafting policy in the dark, but the view is getting far dimmer.

The Fed and Chairman Jerome Powell may take a more "cautious stance" on the central bank's interest rate policy until there is more clarity on the state of the jobs market and the broader economy, said Bret Kenwell, a US investment and options analyst at eToro.

"While markets are holding up quite well despite the second-longest government shutdown in US history, it leaves investors and the Fed flying blind at a time when inflation pressures remain and the labor market has weakened, and puts Powell and company in a tough spot," Kenwell said.

The lack of government data may not be a "sea change" since Fed officials were already challenged with forecasting the post-pandemic economy and the effects of various Trump administration policy changes, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. However, the shutdown may be forcing the Fed to take a more cautious stance on rates.

"While an October cut is virtually a lock, they are probably more tentative about a December cut than they have been letting on," Tang said.

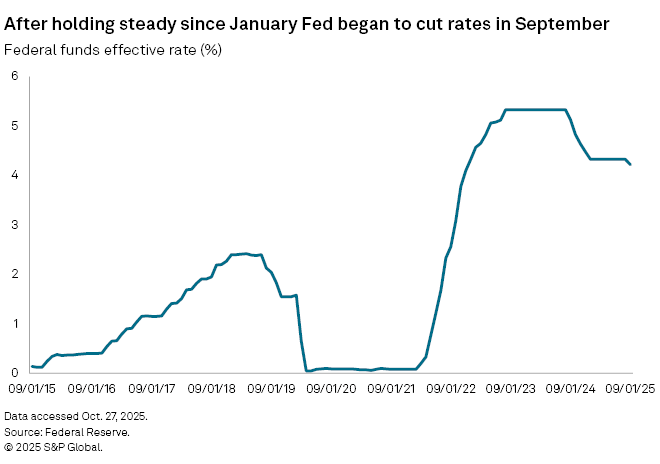

After keeping rates unchanged all year, Fed officials in September agreed to cut rates by 25 bps, the first of an expected policy easing cycle into next year. However, the odds of another cut in December slipped to 91% on Oct. 27 — still highly likely but down from a 99% certainty a week earlier, according to CME FedWatch.

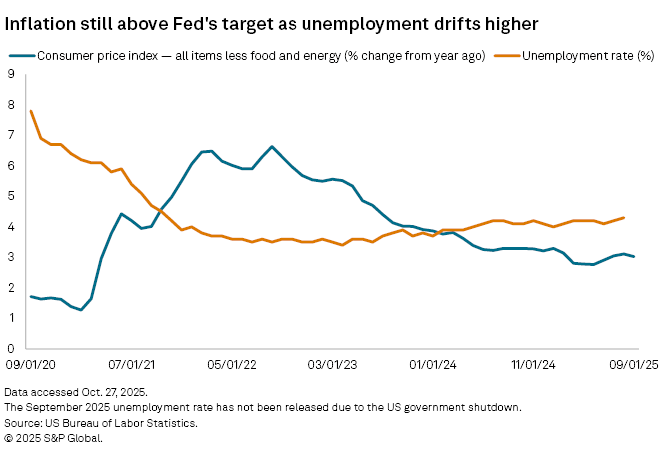

While the US Bureau of Labor Statistics did release inflation data — the consumer price index for September — on Oct. 24, the jobs data for September has not been issued, and data collection for the October report has been halted.

"Of course they would rather have the government data, but this shouldn't stop them from cutting rates again," said Oren Klachkin, a financial market economist with Nationwide.

Fed officials will likely rely more heavily on private sector data and data from regional Fed banks, and official data only went offline at the start of October, meaning the lag is not significant yet, Klachkin said.

Still, dissents from the rate reduction path are likely to increase as some Fed officials push for larger cuts and others may start pushing for a hold as inflation still remains well above the central bank's 2% target, and the full impacts of tariffs have yet to be felt by consumers, Klachkin said.

Forward guidance

As the government shutdown drags on, Powell is likely to grow increasingly reluctant to give insights into where rates are headed into late this year.

"Forward guidance is going to be very difficult to provide in the absence of anything other than [the consumer price index]," said Kathy Jones, chief fixed income strategist with the Schwab Center for Financial Research.

While the Fed has several other data points to draw from, there is no high-frequency data with the government shut down, Jones said.

"My guess is that Powell will hold off on providing guidance for the rest of the year and early 2026," Jones said. "He has indicated that the Fed believes its policy is restrictive, but that is hard to demonstrate with equities near all-time highs and credit spreads still tight."