Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Oct, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

After more than three years of slow exit activity, private equity may be heading for a reckoning.

Speaking at the Barclays Global Financial Services Conference in September, Apollo Global Management Inc. President James Zelter said managers who paid high multiples for portfolio companies just ahead of the slowdown are in trouble. They are unlikely to meet return expectations in a soft exit market, disappointing investors and damaging their ability to raise future funds.

"I don't expect a massive monetization cycle to hit. I think there's many, many [private equity] funds that are out there that have raised their most recent fund and don't realize it's their last fund," Zelter said.

Private equity exit activity was running higher year over year through the first three quarters of 2025, but total disclosed transaction values were lower. The shrinking size of the average exit transaction suggests fund managers may be accepting that some struggling portfolio investments will not hit their marks.

Read more about global private equity and venture capital exit activity in Q3.

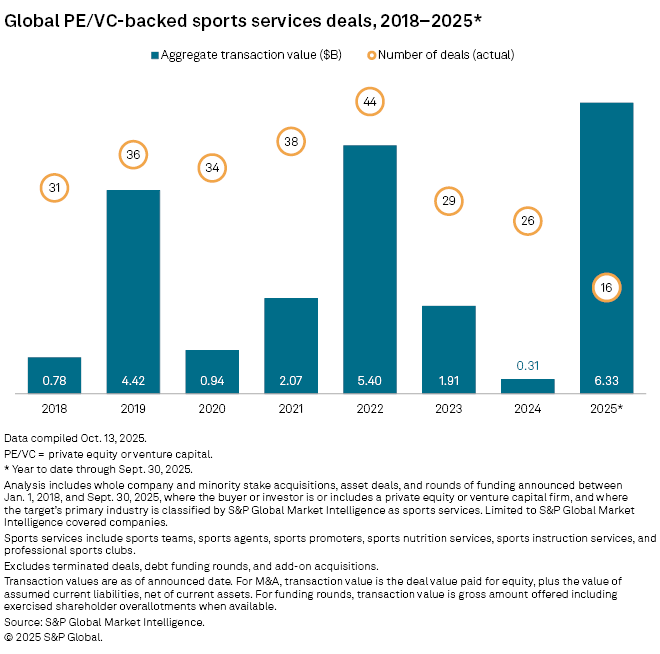

CHART OF THE WEEK: Private equity's growing share of sports services investment

⮞ Private equity and venture capital firms invested $6.33 billion in transactions targeting sports services businesses this year through the end of the third quarter, the highest value in at least eight years, according to S&P Global Market Intelligence data.

⮞ The sports services sector includes not just teams and professional clubs but also agents, promoters, nutrition services and instructional services.

⮞ Private equity firm Sixth Street Partners LLC backed the largest sports services investment of the year through Sept. 30, the $6.10 billion acquisition of Banner Seventeen LLC, owner and operator of the NBA team Boston Celtics.

TOP DEALS

– An investor group including Temasek Holdings (Pvt.) Ltd., BlackRock Inc.'s Global Infrastructure Management LLC, NVIDIA Corp., Microsoft Corp., X.AI LLC, MGX Fund Management Ltd. and Kuwait Investment Authority agreed to acquire Aligned Data Centers LLC from Macquarie Asset Management Pty. Ltd. The transaction values the data center company at approximately $40 billion.

– Lone Star Americas Acquisitions Inc. agreed to acquire industrial equipment company Hillenbrand Inc. for $2.3 billion, with a cash payment of $32 per share.

– Motive Capital Management LLC agreed to sell private markets data provider With Intelligence Ltd. to S&P Global Inc. for $1.8 billion.

– Lee Equity Partners LLC closed a $1.6 billion recapitalization of insurance claims services company McLarens LLC.

TOP FUNDRAISING

– Ardian SAS raised $20 billion for Ardian Infrastructure Fund VI SCS SICAV-RAIF. The vehicle will invest in infrastructure assets across Europe.

– Plexus Capital LLC raised $1.32 billion at the final close of two funds. Plexus Fund VII raised $977 million, while Plexus Equity Fund II LP secured $345 million.

– Shore Capital Partners LLC raised about $850 million in capital commitments across two funds. Shore Capital Healthcare Partners Fund VI LP secured over $625 million, while Shore Search Partners Fund II LP raised almost $225 million.

– INVL Asset Management raised €410 million at the final close of its INVL Private Equity Fund II. The vehicle seeks to invest in companies in the Baltic countries, Poland and the rest of the EU.

MIDDLE-MARKET HIGHLIGHTS

– CCMP Growth Advisors LP bought a majority stake in foodservice wholesaler A1 Cash and Carry Inc. National Foods Ltd. will retain a minority interest in the company. McCarthy Tétrault LLP and Ropes & Gray LLP were the legal advisers to CCMP Growth, and Bank of Montreal was its financial adviser. Bennett Jones LLP and Akbar Sarki Khan & Co. were the legal counsels to National Foods, while TD Securities was the financial adviser to A1.

– Astira Capital Partners LP acquired automotive retail communication intelligence platform CallRevu LLC for an undisclosed amount. Morgan Lewis & Bockius LLP was the legal counsel to CallRevu's leadership team.

– SK Capital Partners LP and Edgewater Capital Management LLC agreed to sell Luxium Solutions LLC, a provider of materials for optics and radiation detection applications, to Excelitas Technologies Corp. Terms of the deal were not disclosed. William Blair & Co. LLC and Houlihan Lokey Capital Inc. are the financial advisers to SK Capital and Luxium, while Latham & Watkins LLP is the legal counsel. Fried Frank Harris Shriver & Jacobson LLP is the legal counsel to AEA Investors and Excelitas.

FOCUS ON: US MIDDLE-MARKET EARNINGS GROWTH

Middle-market companies in the Golub Capital Altman Index, which measures revenue and earnings growth of 150 privately owned companies in the Golub Capital loan portfolio, recorded a 3.3% year-over-year earnings growth in the third quarter, slower than the 7.9% year-over-year increase in the third quarter of 2024, according to a report from Golub Capital LLC.

The firm attributed the increase in the third quarter of 2025 to steady US economic growth and broadly healthy consumer spending.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter