Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Oct, 2025

By Iuri Struta and Neil Barbour

Electronic Arts Inc.'s pending buyout is unlikely to trigger further gaming M&A, as investment bankers say the deal is an outlier driven by unique factors and there remain good reasons private equity buyers have typically avoided the video gaming sector.

Under the terms of the deal, EA agreed to be acquired by a consortium including Saudi Arabia's Public Investment Fund, Silver Lake Technology Management LLC and Kushner's A Fin Management LLC in an all-cash transaction valued at $57 billion. The deal includes $20 billion of debt financing solely committed by JPMorgan Chase & Co., $18 billion of which is expected to be funded at close.

The deal took some investment bankers by surprise, as the gaming sector is often perceived as carrying too high a risk. Many new gaming titles fail to gain traction before they are abandoned. The high-profile misfire from the PE-backed Build A Rocket Boy earlier this year is a case in point. The studio had raised $110 million in the run-up to publishing Mind’s Eye, but the game failed to catch on with consumers.

However, EA is a very different company from Build a Rocket Boy. Investment bankers noted that more mature gaming companies like EA can offer steady revenue growth, profitability and predictability — qualities that private equity firms cherish.

"Gaming is not a business PE are excited about, but more mature businesses have very high predictability, and they are out of the capex phase," Paroksh Gupta, an investment banker at AW Capital focusing on sports and gaming, said in an interview with S&P Global Market Intelligence.

"Generally, what PE firms like is high profitability and predictability, and EA fits that description," Michael Metzger, an investment banker at Drake Star focused on gaming, told Market Intelligence.

PIF play

The EA acquisition also involves Saudi Arabia’s sovereign wealth fund, PIF, as a key investor. The PIF already holds large stakes in most major publicly listed gaming companies, including Take-Two Interactive Software Inc. and Nintendo Co. Ltd. The acquisition further complements the fund’s sports investments, given EA’s dominance in sports gaming franchises.

"It seems this deal is premised on subscription, versus needing new games and new franchises. This is what the buyers are looking at here. It follows the typical PE playbook," said Eric Jones, a partner at law firm Honigman who advises private equity groups.

EA is likely to continue to rally around core franchises, such as EA FC, Madden and The Sims. But the company also has a substantive growth opportunity in adding free-to-play touchpoints to its Battlefield series later this year.

Gaming M&A outlook

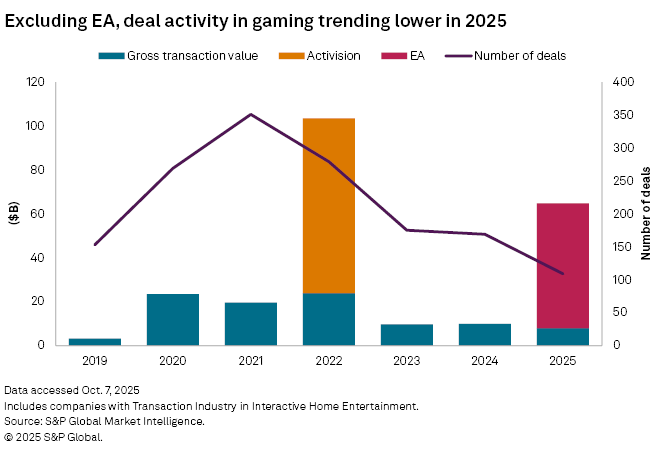

Although EA had unique qualities that made it attractive, investment bankers don't expect the deal to trigger an onslaught of M&A in the gaming space. According to data from Market Intelligence, 2025 gaming M&A is trailing the previous two years when excluding the EA deal.

With the acquisition of EA and Microsoft Corp.'s purchase of Activision Blizzard Inc. three years ago, the pool of large-scale gaming targets for acquisition has declined on public markets. The US is now left with just four major publicly listed gaming companies, trailing Poland, South Korea and Japan in sheer numbers, according to data from Market Intelligence. However, when judged by market capitalization, the US is second only to Japan.

Take-Two is now the last of the Big 3 traditional console publishers to remain independent. The publisher is expected to harvest nearly a decade's worth of investment and development into Grand Theft Auto 6 in early 2026, and management is unlikely to be looking for a deal before it can realize the magnitude of that game's impact.

"I would not necessarily expect that this will lead to a spree of consolidation," Gupta said, arguing the EA and Activision Blizzard deals have unique circumstances associated with them.

While Japan and South Korea are the clear leaders in the number of listed gaming companies, M&A in these markets remains challenging, despite recent capital markets reforms and an increase in PE buyouts. According to Market Intelligence, only 35 deals in the Japanese and South Korean gaming sectors occurred during the past three years, with buyers consisting primarily of local strategic acquirers rather than PE buyout firms.

M&A activity is expected to be concentrated in the small and mid-market segments, driven by strategic acquirers acquiring new titles that show promise and focusing on artificial intelligence in gaming.

"The key theme now is larger players buying capabilities in the GenAI space," Gupta said.