Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Oct, 2025

Delays to renewables and the acceleration of gas capacity additions in Duke Energy Corp.'s latest proposed resource plan for the Carolinas have clean energy and consumer advocates sounding alarms over reliability, emissions and customer costs.

"Duke's previous plans already fell short of what is needed to reduce pollution and minimize rising electricity bills, and this plan is going in the wrong direction," said Maggie Shober, research director for the Southern Alliance for Clean Energy. "The pullback in wind, near-term solar and energy efficiency savings is in direct conflict with Duke's claims that it will likely see significant load growth in the Carolinas over the coming years from data centers and manufacturing."

Representatives from Duke and Dominion Energy Inc., as well as advocates and public regulatory staff, spoke before the North Carolina Utility Commission (NCUC) during an Oct. 15–16 technical conference requested by the Southern Environmental Law Center on behalf of the advocacy groups.

The hearing was an early step for the resource plan, filed Oct. 1, which forecasts customer energy demand to grow eight times the rate observed over the previous 15 years — more than double what the utility anticipated in its 2023 resource plan, resulting in customer bills climbing about 2.1% annually through 2035. The NCUC will likely not vote on the plan until 2026 for Duke operating utilities Duke Energy Carolinas LLC and Duke Energy Progress LLC.

The two utilities serve customers in South Carolina as well, and the resource plan covers needs in both states. South Carolina regulators will review the plan on their own schedule. Separately, Duke proposed combining the two utility subsidiaries into a single entity, saying it would simplify operations and reduce costs. It proposed an effective date of Jan. 1, 2027.

Duke representatives told regulators in May in their spring 2025 update on large-load customer additions in advanced stages of development that the company had seen 43 GW of customer interest as of that time and had nine projects totaling 540 MW with electricity service agreements, 22 projects totaling 4,669 MW with letters of intent, and four projects totaling 705 MW in advance negotiations for letters of intent or service agreements. (Docket No. E-100, Sub 207)

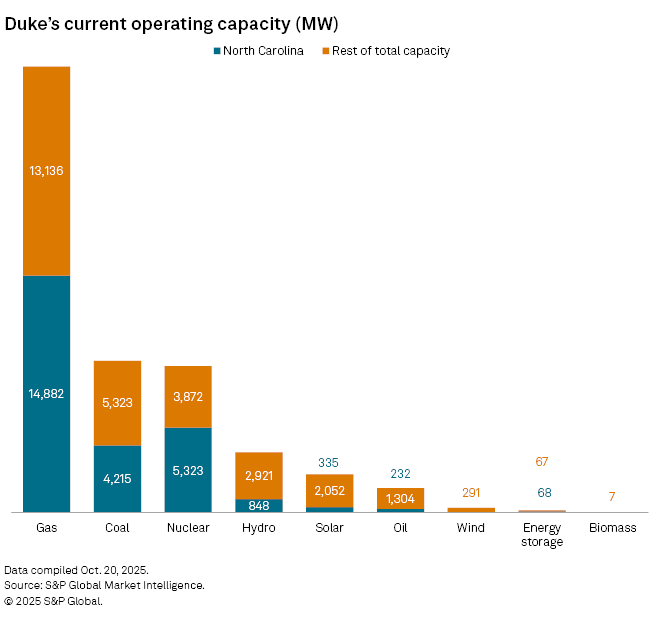

The company's latest proposed resource mix diverges from prior plans by delaying thousands of megawatts of renewable resources such as wind and pumped hydro. Duke's plan does not call for any wind generation until after 2040 at the earliest.

Clean energy and customer advocates said Duke's plan would largely rely on building more expensive, carbon-intensive generation such as gas-fired plants, resources that could face supply chain backlogs and lead to a less diverse — and possibly less reliable — portfolio than under past resource plans.

Advocates have previously pushed for Duke to lift what they consider arbitrary caps on renewable resources each planning year.

Duke is required under North Carolina law to reach carbon neutrality by 2050. Executives have said Duke remains committed to that goal, but advocates have raised concerns that resource plan changes could throw the utility off track.

"Duke has really scaled back its already insufficient energy transition ambition," said David Neal, an attorney with the Southern Environmental Law Center representing other advocates. "A lot of the changes in Duke's plan are an abandonment of the need to be on the path to 2050 compliance."

Changing 'political tides'

The Trump administration supports preserving and increasing fossil generation in the US, and the recent federal budget bill enacted in July included the sunsetting of tax credits for renewable generation. Some advocates believe that utilities may take that as a signal in their generation planning.

"It's hard not to think that it's profit-driven and taking advantage of the political tides," said Mikaela Curry, Sierra Club Beyond Coal campaign manager. "It's hard not to feel like Duke has been emboldened by the federal shift rather than holding their own course of investing in clean [energy] and getting off coal."

Changes in North Carolina policy also are driving Duke's resource plan changes, Curry said in an interview. State lawmakers this year eliminated a requirement for Duke to meet a 70% reduction in carbon emissions by 2030, though state regulators had already given the utility flexibility on the goal.

"Duke had onshore wind in its last two plans and didn't do anything to procure that resource," Neal said in an interview with Platts, part of S&P Global Commodity Insights. "If they had, if we had steel in the ground, those projects would still qualify for the production tax credit. It's just a wasted opportunity to save customers millions of dollars."

Duke spokesperson Bill Norton confirmed that the utility's recommended portfolio "evolved accordingly" in response to shifting federal and state policy, among other factors.

Customer risk

Duke leaders maintain that the utility is pursuing an all-of-the-above approach to resource planning. But advocates and some state regulators questioned a reliance on what they referred to as unproven technologies, such as investments to make gas generation more reliable and nuclear technologies that are either not yet commercially available or have had cost and schedule issues.

"If they do spend a bunch of money investing in [small modular reactors] and they never come online, ratepayers are still going to have to pay for that with the legislative changes we've had in North Carolina this year," Curry said.

And it is not just new technologies that could pose a risk for customers, according to advocates.

"Because of this insistence to pursue expensive, unproven technology, we're seeing them propose keeping coal plants online longer," Curry said. "Ratepayers are going to be on the hook for these decisions."

"By presenting a very gas-heavy portfolio, they're really saying to the commission, 'Put all the risk on the customers,'" Neal said. "If [new nuclear] is pursued, they've got to mitigate these risks."

Norton said Duke is working to reduce reliance on gas supply when prices are highest through investments in solar, battery storage and gas storage.

"We've long maintained that this would not be a linear path," Norton said. "While the Carolinas' growth may present a near-term challenge to decarbonization progress, we continue to work toward an increasingly clean energy future and remain firmly on target for carbon neutrality by 2050."

Demand forecasts

Advocates also warned that Duke's load forecasts may be based on inflated estimates.

"It's essential that the commission requires Duke to go beyond just customers that have maybe signed some kind of preliminary agreement and only include things that are firmly locked up into take-or-pay contracts," Neal said, adding that advocacy groups aim to protect ratepayers from "being stuck holding the bill for anything that's built to meet speculative load."

"There's a recognition on the part of some commissioners that we've got to look out for the risk that we're in a bubble and that this might all come crashing down and ... the load forecast is going to look very different," Neal said.

To balance the risk of potential uncertainty in the data center market, Dominion representatives emphasized conservative forecasts, requiring cash and collateral in contracts, continuous monitoring, tariffs, exit fees and more to protect the grid and ratepayers from the demands of large-load customers.

Dominion serves customers in Virginia, the largest data center market in the country, and about 25% of the utility's sales today come from data centers, representatives said, with that share to grow to 50% by 2035. Dominion also serves retail electric customers in northeastern North Carolina.

Duke has about 150 active prospective customer projects with a base demand of 50 MW or greater at various stages in its pipeline, but the utility only assumes that "a small fraction of the pipeline actually materializes," Norton said.

Recommendations

The NCUC Public Staff, which represents ratepayer interests at the commission, recommended that regulators require utilities such as Duke and Dominion to submit new large-load tariffs in their next general rate cases to ensure fair cost allocation and protect ratepayers. The NCUC should also require utilities to provide updated load forecasts and interconnection queue status updates as part of annual resource plan filings, the public staff said.

Advocates also supported consideration of a mandatory large-load tariff paired with customer protections while discouraging any net increases to system emissions.

Duke is less transparent than other utilities in areas such as power procurement reference prices and how it evaluates potential demand from large-load customers, according to environmental and customer advocates.

"At Duke, it's all shrouded in secrecy," Neal said.

Staff recommended that the commission open a docket to require utilities to file incident reports of grid instability events involving large-load customers.

Advocates also recommended that Duke consider other options before investing in significant new gas generation, including demand-side management for load flexibility, virtual power plants, and additional renewables and storage.

Commissioners expressed interest in exploring load flexibility and demand response. Duke files updated resource plans for its North Carolina utilities every two years.