Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Oct, 2025

By Lauren Seay and Zain Tariq

Credit unions are moving away from their consumer focus, encroaching on banks' commercial lending territory.

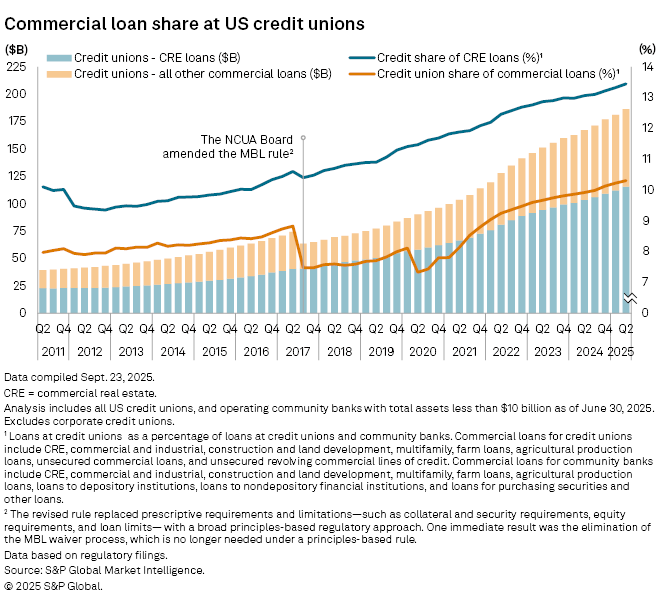

The credit union industry's commercial loan exposure has climbed over the last few years, reaching 11.0% of total loans at June 30, up from 7.7% at the start of 2020. Meanwhile, community banks' commercial loan exposure has remained largely stagnant at about 67% of total loans since the Paycheck Protection Program inflated totals in 2020.

While moving into new lending areas comes with additional risk, credit unions have been willing to take on that risk for the sake of diversification. Many are taking precautionary steps, such as working with a coalition of other credit unions.

"There is a massive amount of sophistication that's happening in the credit union industry," Charley McQueen, president and CEO of McQueen Financial Advisors, said in an interview. "Commercial lending is core to the success of any credit union over $1 billion [in assets]."

Credit unions' commercial lending market share could reach 30% in the next five to 10 years, said Sundip Patel, CEO of Avana CUSO, a credit union service organization (CUSO) focused on commercial lending.

Commercial real estate (CRE) lending segments have grown the most at credit unions over the past five years. Multifamily loans posted the highest growth rate, rising by 179.5% to $43.80 billion in the second quarter from $15.67 billion in the first quarter of 2020.

For credit unions, multifamily feels familiar, making the category a natural extension for those moving into commercial lending.

Multifamily "looks and acts, and in many ways, feels like residential 1-to-4 lending, but just kind of bigger," said Kevin Shaner, managing director of ALM First's loan transaction network.

Nonowner-occupied CRE was the largest portion of the industry's commercial loans at June 30, totaling $80.95 billion.

Banks have been pulling back on CRE lending in the wake of post-COVID-19 concerns about the market, particularly office, and regulators' heightened focus on CRE. That retreat has opened the door for credit unions to take CRE market share, Shaner said.

"Credit unions want to be able to maintain that they're relevant to the community. And a lot of what drives their communities' economies are small to midsized businesses and commercial real estate," Shaner said.

Of all outstanding CRE loans at credit unions and community banks at June 30, credit unions held 13.4%, up from 11.4% at the start of 2020.

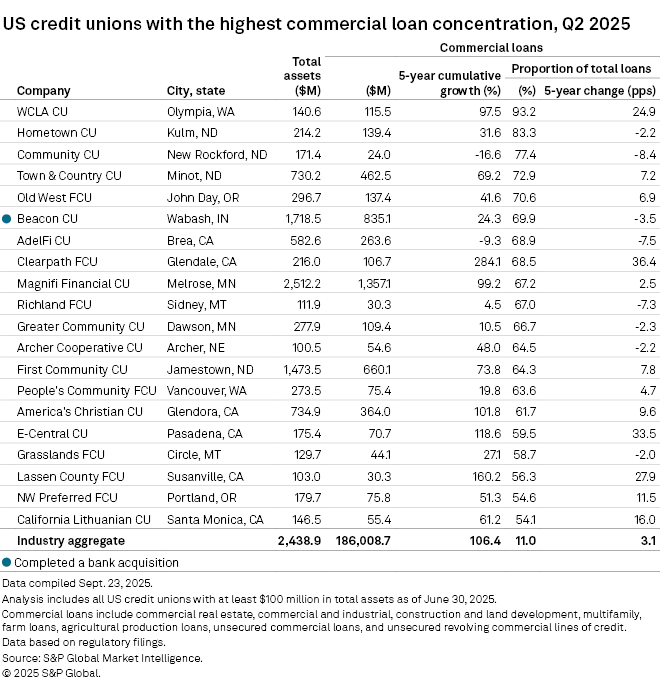

While the industry's proportion of commercial loans to total loans stands at 11.0%, several credit unions hold much higher amounts. WCLA CU had the highest concentration of commercial loans among credit unions with at least $100 million in total assets at June 30, with 93.2% of its total loans in commercial lending — a 24.9-percentage-point increase from five years ago.

The institution, which lends to the forest products industry, was S&P Global Market Intelligence's top-performing credit union in 2024.

Execution risks

While commercial lending brings many benefits to credit unions, expanding into a new business line involves risks. The biggest hurdle for credit unions, whether they are growing lending organically or through a bank acquisition, is securing talent, experts said.

Credit unions must "make sure that you're not just doing this to grow or to say that you're doing the cool thing and doing commercial lending, but you've got the proper people in place that can help you manage and mitigate risks," Shaner said.

Without a long history of commercial lending, it can be hard for credit unions, especially smaller ones, to attract lenders, experts said. Bank M&A is one way to quickly gain expertise, but it is not a sure thing.

"The most important part of the acquisition process is being able to make sure that you're retaining the commercial lenders and the expertise at that bank," said Cole Schulte, a director at Wilary Winn LLC, a financial advisory firm for credit unions and community banks. "Where we sometimes see pitfalls in those deals is when you don't retain the expertise."

Bank deals can also introduce risk even before they are completed if the credit union lacks the existing commercial lending expertise to analyze the bank's commercial book properly.

"That's another piece to think about when you're going through due diligence, is making sure that you have a really good understanding of what you're acquiring," Schulte said.

The National Credit Union Administration has warned credit unions about the importance of commercial lending expertise, writing in its published guides that "commercial lending is not appropriate for all credit unions."

Credit unions also need to ensure their systems are able to support commercial customers. Historically, credit unions' core systems are geared toward a consumer customer, lacking cash management and sweep offerings, Shaner said.

"Most are transitioning, but there's still a number of credit unions' systems that don't handle commercial lending very well," McQueen said.

Lending cap

Perhaps the biggest drag on credit unions' commercial lending appetite is a federally mandated cap on how much commercial loan volume they can extend. Currently, member business loans cannot make up more than 12.25% of federally chartered institutions' total assets.

"While they're getting bigger and bigger into this, they can't get too huge because of some of those limitations," McQueen said.

This can also hinder credit unions' bank deal aspirations if a target could push it over the federal cap. "That ruins a lot of deals," said Glenn Christensen, founder, president and CEO of CEO Advisory Group, an M&A consulting company focused on the credit union industry.

There are exceptions to the cap, such as member business loans below $50,000 or loans fully secured by a one-to-four family home or a federal or state agency. Credit unions designated low-income or a community development financial institution (CDFI) are exempt from the cap.

Credit unions are lobbying to increase the maximum amount for excluded loans, which has been in place since 1998. A bill introduced in the House in March seeks to raise the loan exclusion cap to $100,000 from $50,000.

"There's certainly the opportunity that more credit unions would probably expand the amount of loans that they would do if they have the ability to do so," Christensen said.

Organic opportunities

With the cap in place, banks have only so much commercial loan competition for now. Still, credit unions are making inroads.

The most common way that credit unions are moving into commercial lending is through CUSOs, or for-profit entities owned by coalitions of credit unions. CUSOs provide a way for credit unions to expand services, share expertise and spread costs.

Several CUSOs are focused on commercial lending, including Avana, which currently has 220 credit unions, of which 30 are "more active," Patel said.

CUSOs are an attractive first step into commercial lending because the CUSO has all the in-house expertise and handles underwriting, analyzing and servicing, while the credit union gets the benefit of the loan on its books.

"Credit unions will come together and say, 'Great, this will be our commercial department. We don't have to worry about hiring commercial lenders, commercial analysts or even the servicing aspect of it.' They just outsource all of that," McQueen said. "It's a much easier way to get into commercial lending."

Often, credit unions use CUSOs as a step into commercial lending before building their own expertise in-house.

"It helps them because they're getting exposed to the whole origination, valuation process, and they're building up the competencies. And then that gives them a lot more confidence in building up their own portfolios over time, hiring great expertise to start running a department," Christensen said.

Once a credit union approaches roughly $1 billion in assets, sources said, having in-house commercial lending expertise is crucial. "It makes sense to outsource until you have significant size and strength and then bring it in-house," Patel said.

Market disruption from bank M&A can be advantageous for credit unions looking to poach talent, experts said, and the opportunity is increasing amid an upswing in bank M&A.

"As Community Bank A buys Community Bank B and there's consolidation and there's displaced lenders, I've seen credit unions go out through recruitment and attract talent, displaced talent and say, 'Hey, we're not as acquisition happy and we're a more stable platform, you can come here and help us build something,'" Shaner said.

Building through M&A

Still, the quickest and most attractive way for a credit union to expand into commercial lending is via bank acquisition, experts said.

"If I want to scale and get people in, the absolute best thing to do would be to buy a bank," McQueen said. "Flip the switch, and it's part of the organization."

Credit union acquisitions of banks have steadily climbed since 2019, reaching a record 21 deals last year, though they still remain a small overall portion of bank M&A. In the vast majority of those deals, gaining commercial lending expertise is a main goal, Schulte said.

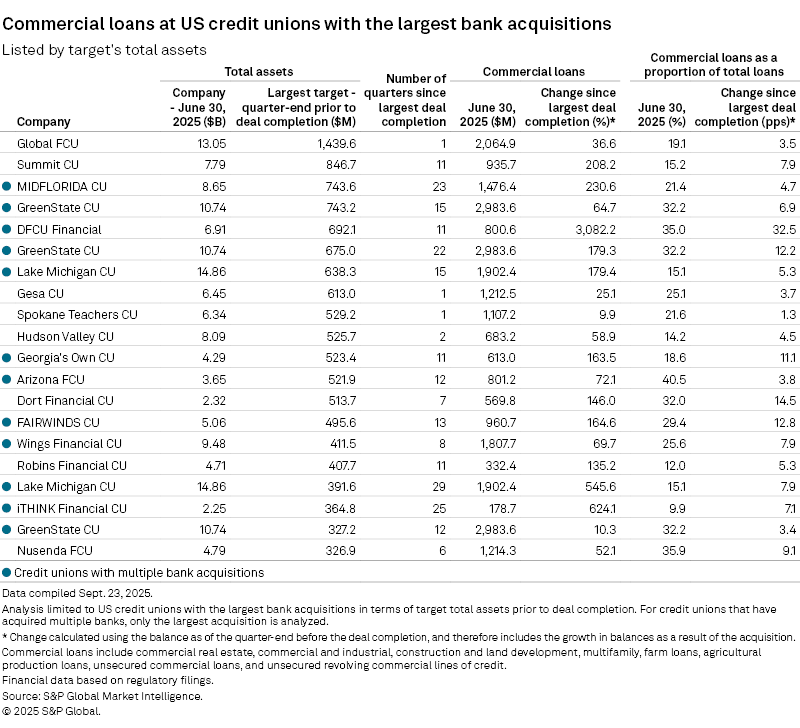

Credit unions that acquired banks have seen big boosts in their commercial loan growth.

Among the 20 credit unions with the largest bank acquisitions, all but one had a proportion of commercial loans to total loans above the industry's 11.0% aggregate at June 30. The only credit union below this was iTHINK Financial CU, at 9.9%, which represented a 7.1-percentage-point increase since its largest deal closed. iThink's total commercial loans were up 624.1% over that period.

DFCU Financial posted the largest increase in total commercial loans since the completion of its largest bank deal, with a gain of 3,082.2% in the 11 quarters since the deal closed. Commercial loans made up 35.0% of the credit union's total loans at June 30.

Arizona FCU had the highest commercial-to-total loan ratio among the group at 40.5%, up 3.8 percentage points since it closed its largest bank deal 12 quarters ago.

Among the 20 credit unions that granted the most commercial loans during the first half of the year, eight have completed a bank acquisition. Most of those eight institutions also had higher-than-average commercial loan sizes compared to their peers in the top 20 and the industry aggregate.

The appeal of diversification

Historically, credit unions' business has been concentrated in consumer segments like auto loans and 1-to-4 family loans. But as online servicers encroach, particularly when it comes to mortgages, credit unions are looking to increase commercial lending.

Credit unions have been motivated to diversify their consumer-heavy books in general to minimize the risks that come with consumer lending as auto lending delinquencies rise.

Commercial lending also helps credit unions diversify the duration of their loan books. Historical consumer lenders often have a lot of short-term loans, such as auto loans, and long-duration loans, like mortgages. Commercial loans "kind of fit right in between there to balance that duration profile," said Michael Tessier, also a director at Wilary Winn LLC.

The result is a "very predictable source of yield and also a great source of cash flow when there's this medium range of duration and they can plan their mortgage lending or consumer lending around that," Tessier added.

Credit unions also must expand their offerings to remain competitive for deposits with their community bank counterparts and to win new deposits. In some cases, credit unions are requiring customers seeking commercial loans to bring over some deposits or even establish full-banking relationships, experts said.

"They're starting to understand the importance of relationship banking and asking for all sides of the relationship," McQueen said.