Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2025

By John Wu and Cheska Lozano

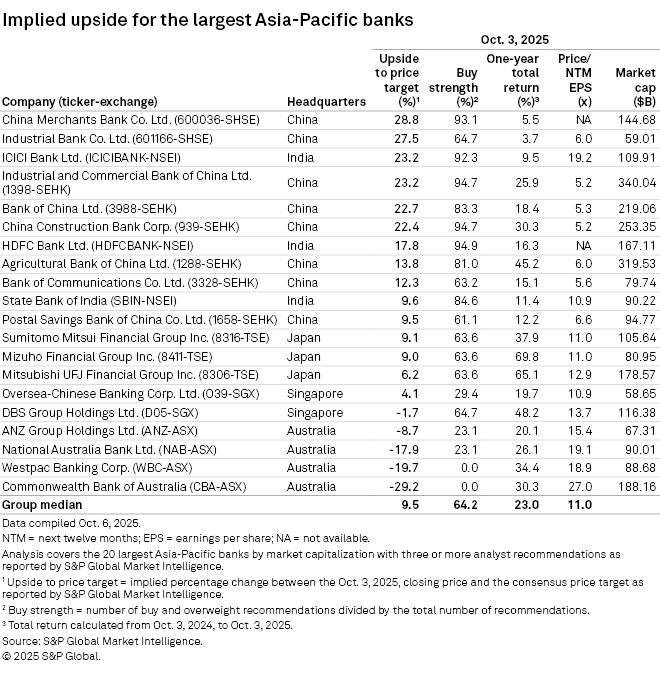

Chinese bank shares trade at the biggest discount to their consensus price estimates among peers in Asia-Pacific, according to S&P Global Market Intelligence data.

China Merchants Bank Co. Ltd. had an implied upside of 28.8%, measured as the percentage gap between the company's current stock price and analysts' consensus target price of the shares for the next year. China Merchants Bank, which topped the Market Intelligence annual performance ranking based on key financial metrics for a second consecutive year, had a buy strength of 93.1% as of Oct. 3, according to data.

A higher upside indicates that analysts see more value in a stock than its current market price, though stocks may not reach analysts' price targets. Buy strength refers to the proportion of buy and overweight recommendations over the total number of recommendations.

Megabanks show upside

Industrial and Commercial Bank of China Ltd. had a potential upside of 23.2% based on its closing price on Oct. 3, according to Market Intelligence data. The world's largest lender by assets had a buy strength of 94.7%.

The other three Chinese megabanks, all state-owned lenders that are also the biggest banks by assets globally, were among the top 10 lenders in Asia-Pacific in the Market Intelligence ranking of lenders based on implied upside. Bank of China Ltd. had a potential upside of 22.7% and a buy strength of 83.3%. China Construction Bank Corp. had a potential upside of 22.4%, while Agricultural Bank of China Ltd. had 13.8%, according to the data.

A pullback in share prices in August may have left many Chinese banks undervalued. This combined with an improving earnings outlook, easing pressure on net interest margins and growing fee income for the lenders, said Morningstar in its October Industry Pulse report.

China is on track to achieve its 2025 GDP growth aim of about 5%, after the economy expanded 5.3% in the first half of the year. While several sectors of the world's second-biggest economy have shown strength, the property market faces challenges. Global trade uncertainties this year posed another challenge for the economy.

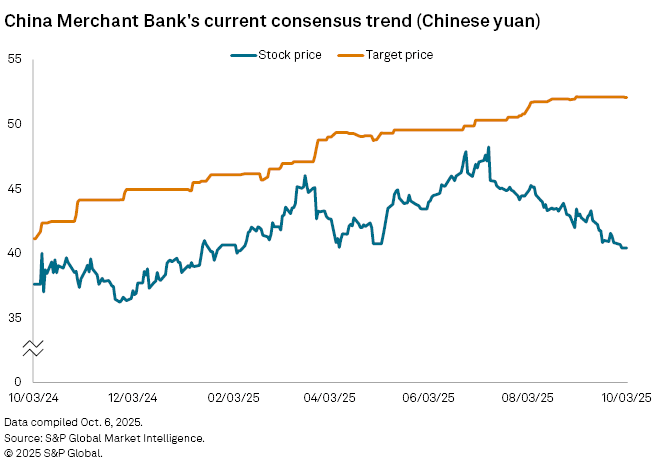

Most large Chinese lenders reported stable first-half earnings, though their share prices were less sanguine. Shares in China Merchants Bank, for example, fell 16.2% from the mid-July peak of 48.24 Chinese yuan, while analysts' consensus target price rose 3.5% during the same period.

Second on the list of large regional lenders was Industrial Bank Co. Ltd. with a potential upside of 27.5%, while ICICI Bank Ltd. of India ranked third with a potential upside of 23.2%.

Singapore, Australia banks lag

Japan's Sumitomo Mitsui Financial Group Inc., Mizuho Financial Group Inc., and Mitsubishi UFJ Financial Group Inc. had single-digit potential upside, while Singapore's DBS Group Holdings Ltd. had a potential downside of 1.7%, according to data.

Australian lenders had the weakest share price outlook among the 20 biggest lenders in Asia-Pacific by market capitalization. Commonwealth Bank of Australia, with a buy strength at zero, had a potential downside of 29.2%. Westpac Banking Corp. showed a potential downside of 19.7%, with analysts not expecting its shares to rise.

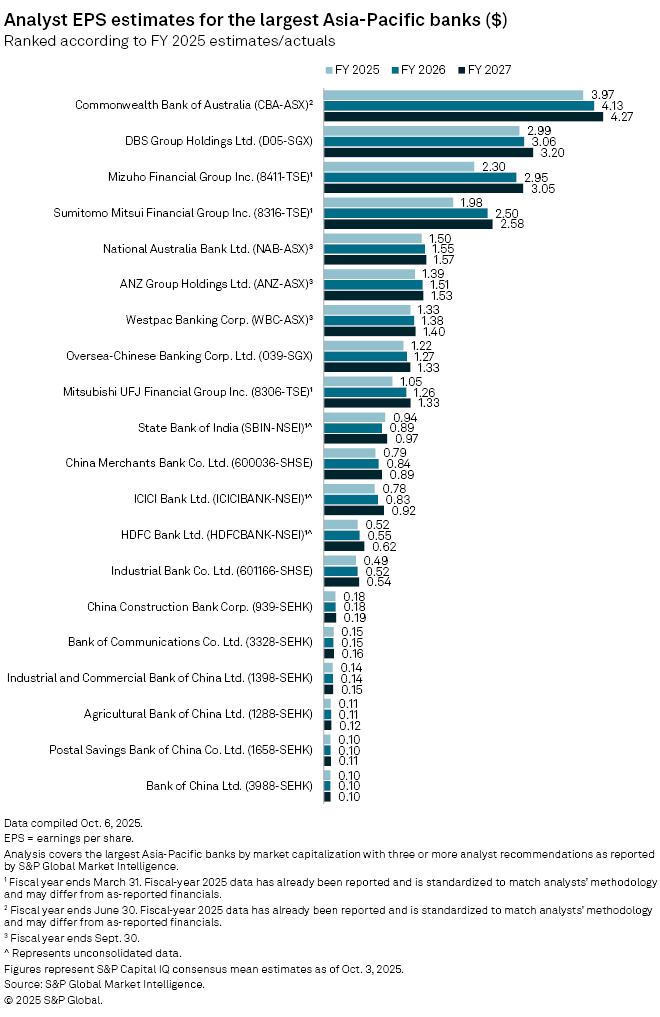

Analysts, however, expect major Australian, Japanese and Singaporean banks to grow their earnings per share over the next three years. Among the 20 biggest regional lenders, Commonwealth Bank of Australia's EPS estimate was US$3.97 for the calendar year 2025, rising to US$4.27 in 2027.

DBS Group, the biggest lender in Southeast Asia by assets, ranked second in EPS estimates, followed by Japan's Mizuho Financial Group and Sumitomo Mitsui Financial Group. The other three Australian majors, Singapore's Oversea-Chinese Banking Corp. Ltd. and State Bank of India, rounded off the list of top 10 regional lenders by EPS estimates.

As of Oct. 10, US$1 was equivalent to 7.13 Chinese yuan.