Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Oct, 2025

| US President Donald Trump with Australian Prime Minister Anthony Albanese in Washington, DC, on Oct. 20, 2025 Source: Anthony Albanese/X. |

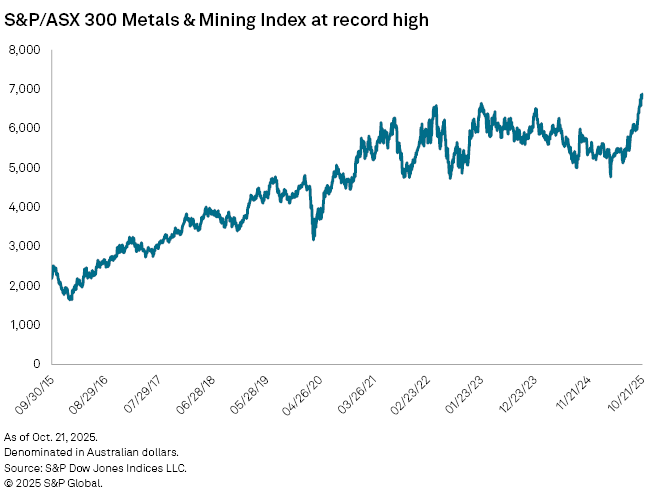

The S&P/ASX 300 Metals & Mining Index hit a record high after the leaders of Australia and the US signed a deal to unlock US$8.5 billion in critical mineral investment, paving the way for funding-challenged miners Down Under to get more development cash.

A flurry of financing offers from Australian and US government agencies flowed the day after the Oct. 20 agreement. The funding targets both Australian companies with critical minerals projects overseas and foreign-headquartered companies with projects in Australia.

The Australian deal shows the White House is willing to lean on allies to diversify supply chains for some metals as the US seeks to rely less on China for crucial materials such as rare earths. President Donald Trump's administration has been heavily focused on protecting the steel, aluminum and copper sectors in the US.

Australia's Association of Mining and Exploration Companies hailed the agreement as a "new era for resources investment and supply chain security for Australia," in an Oct. 21 statement.

Funding inflows in the lead-up to and after the deal are helping boost mining stocks amid a tough market in Australia for initial public offerings in the sector, which have declined for three consecutive years, according to S&P Global Market Intelligence data.

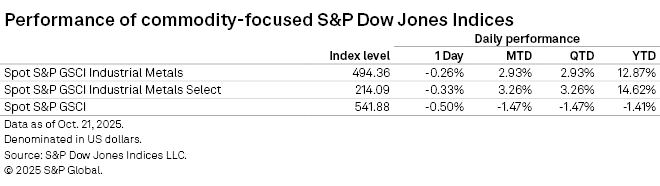

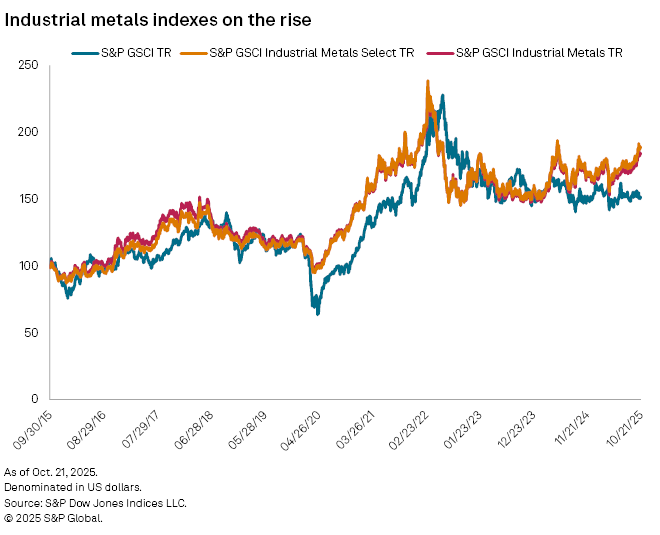

Meanwhile, money is clearly moving into Australia's mining sector. The S&P/ASX 300 Metals and Mining Index outperformed the S&P GSCI Industrial Metals, S&P GSCI Industrial Metals Select and S&P GSCI indexes in the year, quarter and month to date, according to data from S&P Dow Jones Indices LLC. The S&P/ASX 300 Metals and Mining Index was up 30.87% to 6,877.96 for the year to date as of Oct. 21.

The S&P/ASX 300 Metals and Mining Index tracks the performance of Australian companies involved in the sector, while the GSCI indexes track the performance of the global commodity market through futures contracts.

More to come

Western Australia accounts for about 70% of the country's exploration, according to the Association of Mining and Exploration Companies.

"While details of the agreement are still emerging, it reportedly includes a commitment from both countries to accelerate permitting processes and the adoption of pricing frameworks — including price floors and offtake agreements — to provide much-needed certainty to projects," the CME said.

This would help address price volatility and resolve one of the biggest barriers to securing investment for critical minerals projects "especially for rare earths which trade in shallow markets that have been vulnerable to distortion," Anita Logiudice, policy and advocacy director at the CME, said in the Oct. 20 statement.

Australian Strategic Materials Ltd. has "witnessed a seismic shift in the dynamics of the rare earths market" in the past six months, Rowena Smith, the company's managing director and CEO, said in an Oct. 20 news release. The company recently said it had secured commitments for a private placement to raise A$55 million to ramp up its Korean Metals plant and for other downstream expansion options in Korea or potentially the US.

"Geopolitical tensions, trade disputes and tightened export controls have shaken global supply chains — driving governments, manufacturers and investors into action and to seek secure alternative supply chains," Smith said in the Oct. 20 release.

Meanwhile, the Australia/US deal opens the door to cash that can be hard to come by for technical work on earlier stage projects.

|

| David Paterson, CEO of |

"The Australian government hasn't traditionally funded feasibility studies, those sorts of things, which are very hard for most rare earths and other critical minerals projects because the capital cost of them is pretty high," David Paterson, CEO of Latrobe Magnesium Ltd., told Platts, part of S&P Global Commodity Insights.

"[The new agreement] will provide those sorts of funds," Paterson said. Paterson was part of a delegation of Australian critical minerals miners that spoke with US agencies in September.

Refining hope

The agreement could also facilitate more onshoring of Australian metals refining.

The South Australian Chamber of Mines and Energy (SACOME) wants to start talks with the country's state and federal governments. South Australia aims to bolster development of its critical materials riches that include rare earths, antimony, cobalt, lithium, graphite, copper and magnetite.

"Linking South Australian mining, smelting and manufacturing capability with national strategies will grow local refining, processing, and manufacturing to elevate the value of the state's resources sector," SACOME said in an Oct. 21 statement.

As an example of the strategy, SACOME highlighted one of its members, Nyrstar NV. The Belgian company is developing a pilot plant at its Port Pirie processing operations, aiming to produce and export initial batches of antimony metal in the first half of 2026.

Production could reach up to 5,000 metric tons of antimony metal per year by 2028, equivalent to about 15% of the global market, SACOME said. This will be aided by a nonbinding, conditional letter of support from Export Finance Australia on Oct. 21 as part of the pipeline of critical minerals projects announced in the critical minerals deal between the US and Australia.

Australia's mining sector has "been making concentrates that often go to China for refining" but the agreement could help curb some of those flows, Paterson said.