Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jan, 2025

By Harry Terris and Robert Clark

A jump in interest rates in the fourth quarter of 2024 will likely keep an enormous pool of bank assets underwater, even as the industry's net interest income outlook brightens.

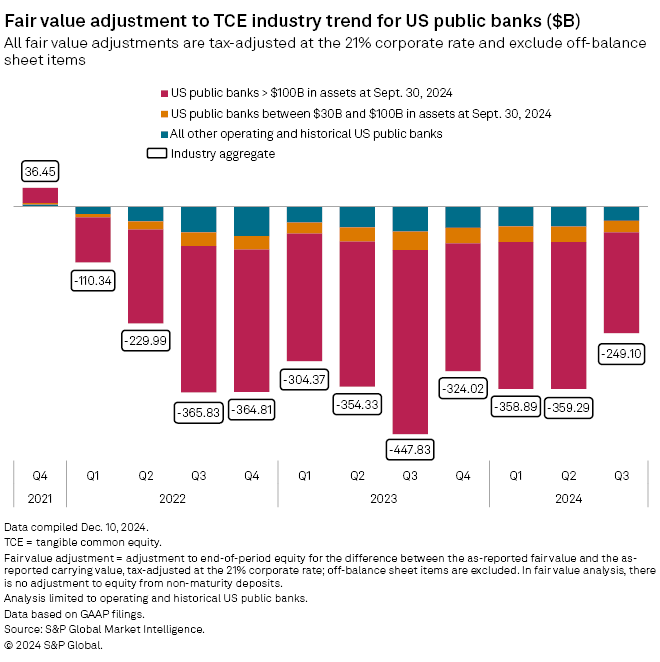

As rates dropped in the third quarter, the negative fair value adjustment shrank by 30.7% sequentially across publicly traded banks in the US, to $249.10 billion, according to data from S&P Global Market Intelligence. That still left more than 30 banks with fair-value adjusted tangible common equity (TCE) to tangible assets ratios of less than 4%, however, and medium- and long-term rates rebounded in the fourth quarter as the Federal Reserve appears headed toward a shallower cutting cycle than previously anticipated.

This data reflects disclosures by banks on securities, loans, time deposits and other items that are not already carried at fair value on balance sheets. Since the Federal Reserve started raising interest rates in 2022, the negative adjustments have topped $100 billion in each quarter.

For many banks, underwater assets due to mature during a higher-rate environment translate into an asset-repricing tailwind, and higher rates, particularly with an upward-sloping yield curve, make low-cost, non-time deposits, which are not subject to fair value adjustments, more valuable. Nevertheless, executives continue to cite volatility in fair values as an impediment to merger activity even as some institutions that were hurt by portfolios assembled when rates were low seek an exit.

|

– Set email alerts for future Data Dispatch articles.

– Download a template to compare a bank's financials to industry aggregate totals.

Progress

Banks have made considerable progress since negative fair values, along with flighty deposits, contributed to a burst of failures in early 2023.

The aggregate negative fair value adjustment for the third quarter of 2024 is well off a peak of $447.83 billion in the prior-year period. Banks continue to restructure portfolios through loss trades, which are frequently paired with capital offerings that have become more attractive as bank stock prices have advanced.

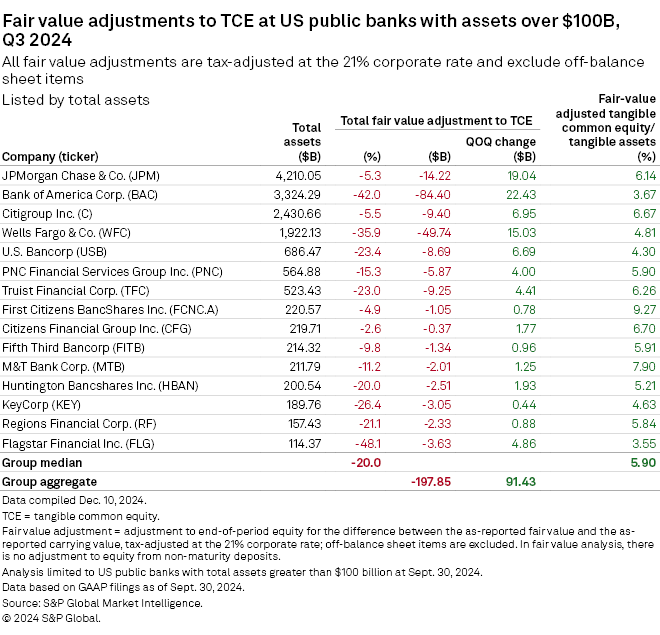

Among publicly traded banks with more than $30 billion of assets at the end of the third quarter, just three had adjusted TCE ratios of less than 4%. These include Bank of America Corp., which has the second-largest deposit franchise in the country and has projected a string of sequential growth in net interest income off a second-quarter trough, reflecting asset repricing and maturing hedges.

In a note dated Dec. 16, 2024, analysts at Keefe Bruyette & Woods named Bank of America and KeyCorp, with an adjusted TCE ratio of 4.63%, according to Market Intelligence data, as their two net interest income growth ideas among large-caps.

|

|

Biggest negative adjustments

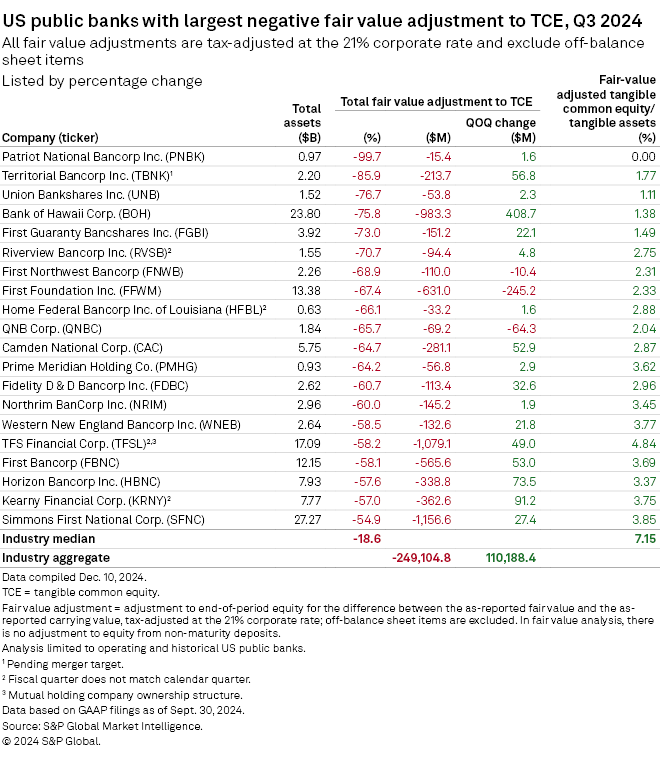

Some fair value adjustments remained acute in the third quarter.

The negative adjustment at Patriot National Bancorp Inc., which posted net losses in the first three quarters of 2024, amounted to 99.7% of its TCE. The bank said in December 2024 that it is evaluating strategic options.

The negative fair value adjustment at Territorial Bancorp Inc. was 85.9% of TCE. The bank has agreed to sell to Hope Bancorp Inc., though the transaction faced opposition from some investors.

Despite two Fed rate cuts of 25 basis points each in the fourth quarter of 2024, medium- and long-term rates moved up sharply during the period, reflecting expectations for inflation and continued strength in economic growth. The average Treasury rate across two- to seven-year maturities increased 72 basis points.

|