Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jan, 2025

By Audrey Elsberry and Gaby Villaluz

The sharp rebound in bank M&A that many expected in 2024 did not quite materialize as the number of deals remained below historic averages.

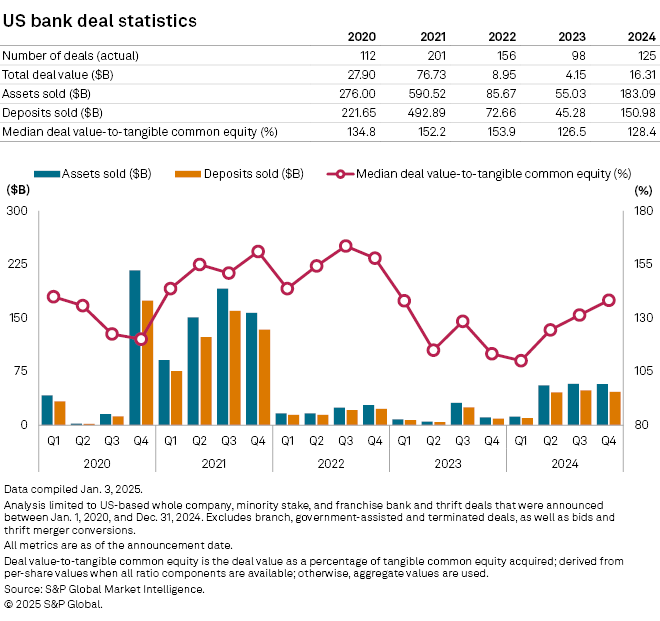

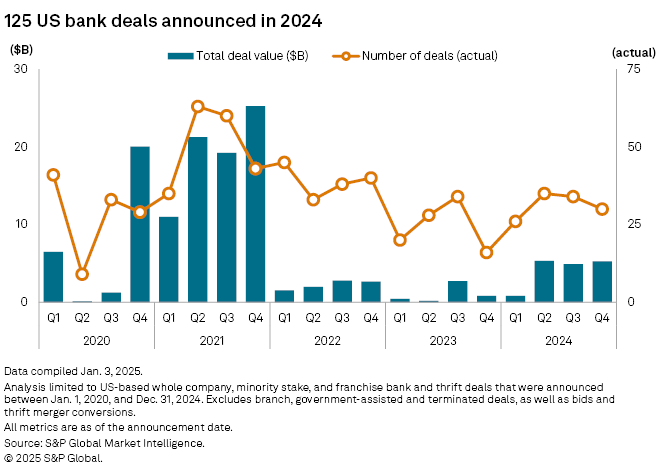

The number of bank M&A announcements jumped to 125 in 2024 from 98 in 2023. However, the 2024 tally trailed 2021's 201 deals and 2022's 156 deals, and total transactions in the sector regularly topped 240 in the pre-pandemic years.

"Was it, the floodgates opened? No," Raymond James Managing Director Brian Nestor said in an interview. "I think maybe there were some expectations that the second half was going to have a lot more deal flow than it did."

Raising confidence

Activity picked up after the first quarter recorded 26 deals with a total value of $796.2 million. The next three quarters recorded 33 deal announcements on average, and the total value averaged $5.17 billion for each period.

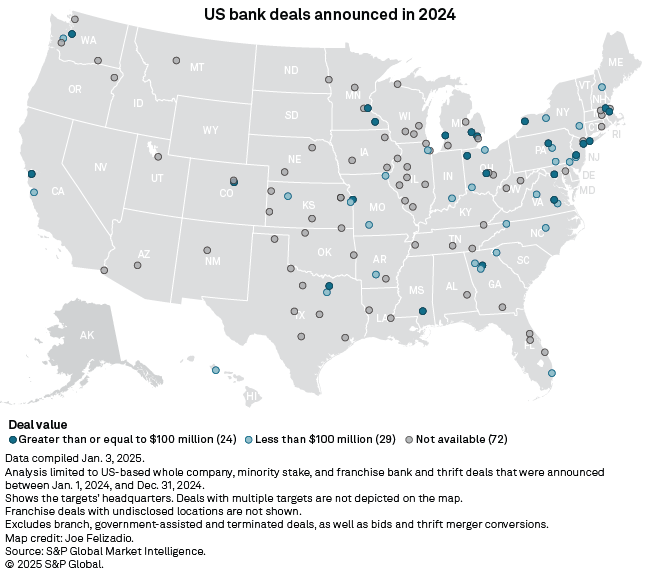

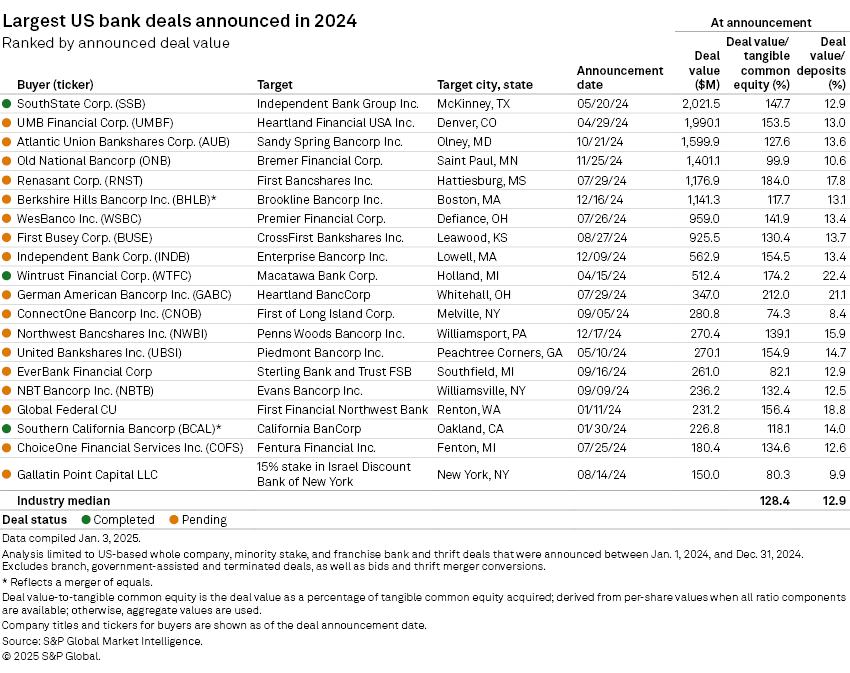

A handful of large deals helped push the total announced value to a three-year high at $16.31 billion, up nearly fourfold from 2023's $4.15 billion, but it was far below 2021's total of $76.73 billion. Based on announced value, the largest deal of the year was SouthState Corp.'s $2.02 billion purchase of Independent Bank Group Inc., followed by UMB Financial Corp.'s $1.99 billion announced purchase of Heartland Financial USA Inc.

The UMB-Heartland deal was one of a number of transactions that included a capital raise in the M&A announcement. Some bank management teams employed a tactic of raising capital in tandem with a deal announcement to ease regulatory capital concerns when announcing a large transaction.

"We started to see transactions occurring where capital was arm and arm alongside the transactions because the entry points feel pretty attractive and then [investors] get to take advantage of the combined company's currency in a meaningful way," Raymond James Managing Director Chris Choate said in an interview.

Market forecast

Available capital can help offset underwater bonds in banks' securities portfolios that ratcheted up after the Federal Reserve started to increase interest rates. But the accounting issue is likely remain a headwind to M&A as Fed officials view elevated interest rates as necessary to combat inflation.

While the Fed signaling a slowdown in interest rate cuts put some pressure on bank stocks, overall the sector enjoyed significant share-price gains in 2024, and the change to a Republican presidential administration led to a rally in bank stocks in the second half of the year.

"The 12% to 13% daily move after the results of the election in favor of banks got people very excited about what nominal prices could look like," Choate said.

|

– Access a list of pending and completed M&A deals announced since Jan. 1, 2014. – Access the S&P Capital IQ Pro M&A summary page for US financial institutions |

Along with better pricing, the industry is also expecting a smoother pathway for deal approval and that has improved expectations for bank M&A in 2025.

"You just can't underestimate the view of a positive regulatory regime for approval of deals," Nestor said. "Your risk becomes a little bit easier to take on when you don't feel as if the regulators are finding reasons to say no."