Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jan, 2025

Small-cap stocks may be poised for a breakout in 2025 after substantially lagging some of their largest capitalization peers if the Federal Reserve continues to cut rates and inflation drifts lower.

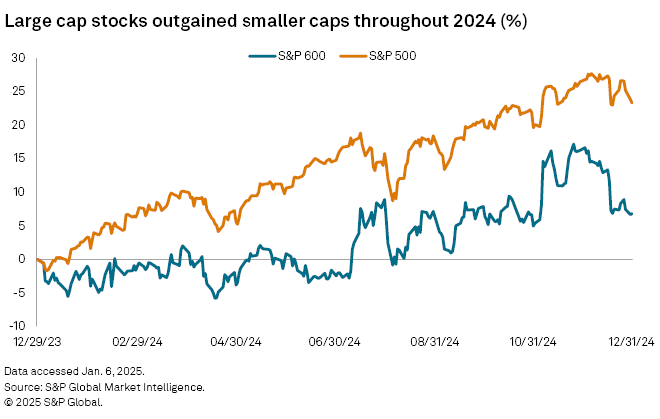

The small-cap S&P 600 index rose 6.8% in 2024, lagging the S&P 500's 23.3% increase. The December stumble in stocks was also far more pronounced in small-caps. The S&P 500 fell 2.5% from the end of November to the end of December while the S&P 600 dropped more than 8.1% over that stretch. The Russell 2000, another small-cap index, fell 8.4% throughout the month, the worst performance of any major US stock index.

Small-cap stocks, those of companies with a total market value of about $250 million to $2 billion, have long been viewed as a riskier investment than their large-cap counterparts. While analysts still see smaller stocks as more of a gamble, conditions are aligning to push this basket of equities higher, perhaps surpassing larger, previously market-dominating players.

"After suffering their worst December since 2018, and lagging large caps last year by the fourth-widest margin in history, things can only get better for small caps in 2025," said Michael Arone, chief investment strategist, US SPDR business, at State Street Global Advisors. "Small caps' outperformance will likely be driven by the solid US economy, lower interest rates, better earnings growth, cheaper relative valuations, and benefiting more acutely from expected Trump administration policy priorities."

Small-cap underperformance is hardly novel. The Russell 2000 has only outperformed the S&P 500 twice in the last decade and has not done so since 2020, said Bret Kenwell, an investment and options analyst at eToro.

"Small caps are the wild card for US equities in 2025," Kenwell said "They have all the underlying fundamentals that would justify a strong showing this year — like lower rates, a solid economy, and strong earnings growth expectations — but inconsistency continues to plague this group."

Still, conditions could be primed for a small-cap comeback this year, said Steve Deppe, chief investment officer with Nerad + Deppe Wealth Management.

Strength will likely emerge in the second half of 2025 and will be driven by continued disinflation, lower interest rates, weaker-than-expected GDP growth, and momentum from small-cap stock valuations that will appear attractive to investors when compared to the relatively high valuations of large-cap stocks.

"I see a 'catch-up' rotational trade and I envision it happening in sharp, fast, spurts, meaning I think the S&P 600 Index will have a few dominant months, price action wise, to derive its relative strength," Deppe said.

'Magnificent 7' effect wanes

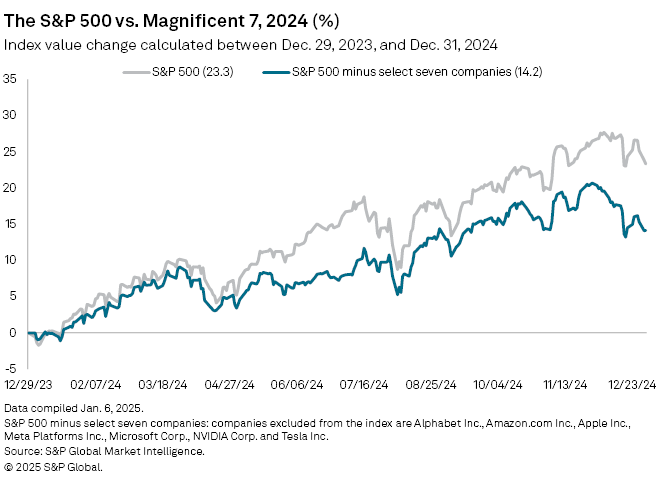

The S&P 500 — largely propelled by seven of its biggest stocks, a group of mega-cap tech stocks — could see that outsized influence wane this year.

In 2024, for example, the S&P 500 rallied 23.3%, but just 14.2% if the Magnificent Seven stocks were removed.

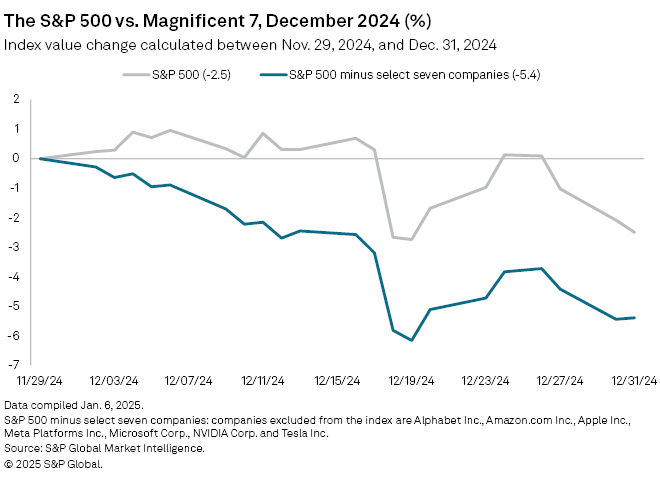

Through December, the large-cap index fell 2.5%, or 5.4% excluding the Magnificent Seven stocks.

Rate cut uncertainty

Investors remain uncertain whether inflation will remain stubbornly above the Fed’s 2% target; what the economic fallout from incoming President Trump's tariff and tax plans will look like; and just how much, or how little, the central bank will ultimately cut rates.

Traditionally, small-cap stocks with good balance sheets, positive earnings, and stable free cash flows have performed far better than those with negative earnings, high debt levels and heavy reliance on lower rates applied to future cash flows, said Phillip Greenblatt, portfolio manager at Easterly Investment Partners.

If the Fed continues to struggle to get to its 2% inflation target, those divergences between small-cap stocks could become more pronounced, Greenblatt said.

"Those more speculative small-cap growth stocks will not get the significant rate cuts they are yearning for, because the Fed can't risk reaccelerating inflation by cutting too much, too fast," Greenblatt said. "I think this is part of what makes the case for active small-cap value, the differentiated return streams within the asset class itself."