Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jan, 2025

By Cathal McElroy and Marissa Ramos

|

AXA is selling its asset management business to French banking giant BNP Paribas in a €5.1 billion deal that will benefit |

European banks' acquisitions of asset managers are set to increase in 2025 following the permanent adoption of regulation, making their ownership more attractive.

The regulation, known as the "Danish compromise" after Denmark's European Union presidency in 2012 when it was created, became a fixed feature of EU law on Jan. 1. The compromise, which was originally designed to reduce the cost of capital for banks to own an insurer, was recently expanded to include assets banks buy through their insurance units.

French banking giant BNP Paribas SA announced in August a €5.1 billion deal to acquire AXA Investment Managers SA through its BNP Paribas Cardif insurance business. Italy's Banco BPM SpA followed in November with a €1.6 billion bid to acquire full ownership of asset manager Ânima Holding SA.

More banks are expected to explore asset management and insurance deals in 2025, according to Nigel Moden, global and EMEA banking and capital markets leader at EY.

"There will be targeted capability acquisitions, particularly where it's less about acquiring a customer base, but more around a particular capability or technology or a platform," Moden said in an interview.

The increasing appetite for capital-light acquisitions comes as EU banks are required to hold more capital under Basel IV regulations, which aim to bolster the global banking sector's stability.

"There's a desire among a lot of banks to reduce the dependence on capital-intensive businesses," said Sonja Forster, senior vice president of European financial institutions, at Morningstar DBRS. "Capital-light, fee-generating business is something they are definitely looking for."

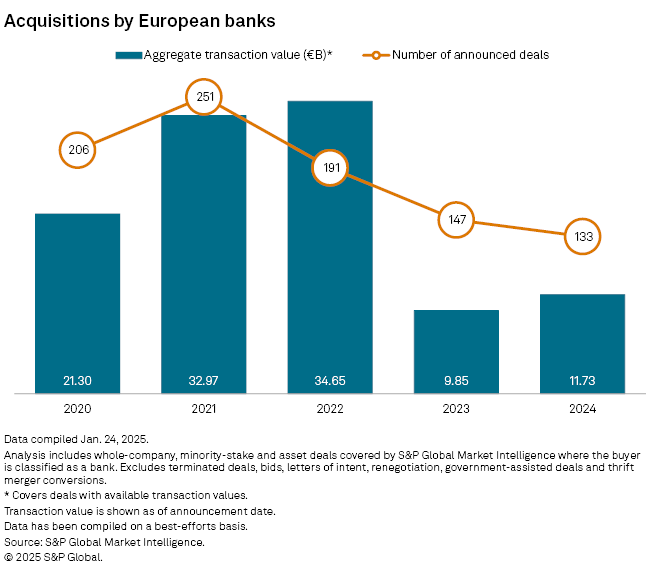

It also comes as European banks are displaying a renewed appetite for M&A more broadly, driven by strong balance sheets and a desire to reduce reliance on interest-rate-sensitive income.

The lack of progress on developing a European banking union continues to limit EU lenders' opportunities to grow their core businesses inorganically beyond their domestic markets, making asset management and insurance deals even more attractive. Banks in the region are reluctant to consider cross-border M&A due to national ring-fencing regulations that prevent multinational lenders from using group capital and liquidity to support banks in individual jurisdictions during a time of crisis.

Political agendas have also made cross-border deals more challenging, as UniCredit SpA has found with its investment in Germany's Commerzbank AG.

"I still don't really see cross-border banking M&A in Europe being a thing," said Moden. "Deal flow will certainly increase, but I think it will all be with a domestic flavor."

Mounting pressure on European asset managers to consolidate in order to cut costs and increase profitability is also driving the increased interest in deals from eurozone banks.

Asset management fees as a percentage of assets under management have fallen in the last decade or more as savers increasingly opted for cheaper passive investment vehicles like exchange-traded funds over active managers. Costs have kept rising at the same time.

"Asset management is very scale-driven, so there is an incentive to grow there," she said. "We don't think there are that many transformational acquisitions, but there are bolt-on acquisitions to drive scale that will continue."

Not for everyone

Still, there could be a limit to the number of deals allowed to exploit the Danish compromise. Several European bank executives warned during their latest earnings calls that overuse of the mechanism could prompt pushback from regulators.

"The Danish compromise is, let's say, an arbitrage," UniCredit CEO Andrea Orcel said during the bank's third-quarter call. "If it's abused too much, it's going to be reviewed."

Executives at CaixaBank SA and Intesa Sanpaolo SpA ruled out using their insurance units to grow their asset management businesses.

The European Central Bank's top supervisor, Claudia Buch, warned in December that the supervisor will apply the Danish compromise to deals on a case-by-case basis.

For banks without insurance businesses, the prospect of developing or acquiring one to benefit from the Danish compromise is challenging, CEO of Austrian lender Erste Group Bank AG Peter Bosek said during his bank's third-quarter earnings call.

"If we started to build up an insurance company right now, this would take ages to have a reasonable contribution to our financial performance," he said. "If we merged with an existing insurance business, the complexity would be overwhelming. So from a risk point of view, I would definitely not touch upon this."

France in focus

Other French banks could be among the most likely to follow their domestic rival BNP in pursuing asset management acquisitions in the coming year. Crédit Agricole SA's Amundi SA, one of Europe's largest asset managers, has already explored a tie-up with the asset management business of German insurance giant Allianz SE. Talks about a deal, which would have created an investment giant with €2.8 trillion of AUM, broke down in December.

Earlier in January, French banking group BPCE SA and Italian insurer Assicurazioni Generali SpA agreed to combine their asset management operations in a joint venture with €1.9 trillion of AUM.

French banks are considered to be the main supporters and beneficiaries of the Danish compromise. Bancassurance, the sale of insurance products through bank distribution channels, was pioneered in France in the 1970s and has since become a key revenue driver for many of France's largest lenders.

"The Danish compromise was created to accommodate the French banks," Sam Theodore, an independent bank analyst, said in an interview. "It was pushed on the insistence of the French banks, so I'd expect French banks to become even more active in finding ways to generate noninterest income through it."