Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Darren Sweeney and Allison Good

Concerns about a new AI model's impact on datacenter energy demand look set to dominate discussions on US electric utilities' upcoming earnings calls. The dramatic shift in energy policy under President Donald Trump and the fallout from deadly California wildfires are also expected to be major topics.

China-based DeepSeek sent shockwaves through the stock market Jan. 27 following the launch of an open-source reasoning foundation AI model that is cheaper and more energy-efficient than US alternatives. Independent power producers were hit especially hard by the sell-off.

"After stark sell-offs in power, utility, and technology stocks ... the question is whether the [datacenter] boom is done before it even truly started," Jefferies analysts wrote in a Jan. 28 research report.

"We wrote earlier this month about the pervasive bullishness for utilities in 2025 from demand growth and positive estimate revisions culminating in positive long-term guidance updates," the analysts said. Jefferies, however, now expects most guidance updates to wait until after the fourth-quarter 2024 reporting cycle.

"The favorable momentum is intact, and building, throughout the sector but we expect most utilities to wait until deeper in 2025 before formal EPS guidances are refreshed," Jefferies analysts wrote. "That view is even [stronger] after the DeepSeek concerns have manifested."

Morningstar still believes that datacenter growth will materialize and cause an increase in electricity demand, "but not as much as market valuations suggested."

"We still believe [datacenters], reshoring, and the electrification theme will remain a tailwind, but that market expectations went too far," Morningstar analyst Travis Miller wrote in a Jan. 27 report.

Outside of DeepSeek concerns, analysts expect to "learn a lot more about timing of the datacenter growth" on fourth-quarter 2024 earnings calls, Miller told S&P Global Commodity Insights.

"The changes from the new administration and some of the timing delays we're hearing about could have a big impact on the growth trajectory for many utilities that have been talking about datacenters," Miller said in a Jan. 24 interview.

'A lot of constraints'

NextEra Energy Inc. expects US power demand to increase more than 80% in the next five years and sixfold over the next 20 years, management said on a Jan. 24 call to discuss the company's fourth-quarter and full-year 2024 results.

Management also said NextEra has embraced Trump's energy policies as it looks to add gas generation and consider recommissioning the Duane Arnold Energy Center (DAEC) nuclear plant in Iowa, shuttered in 2020, to meet power demand.

"They hit on the same themes in terms of, there is a lot of data interest out there, but there are also a lot of constraints in terms of building enough infrastructure to serve those datacenters in a timely manner," Miller said. "There is a realization across the political spectrum and the industry that the US is going to need an all-of-the-above approach if utilities are going to meet the timelines that these datacenter developers would like."

Renewable energy will need to be part of this solution, Miller added.

"The near-term outlook for renewable energy is strong regardless of what happens in Washington, simply because the equipment is available to build and it is a relatively quick build," Miller said. "Natural gas generation would probably be the best solution for an around-the-clock energy demand source, but everything we're hearing is that won't happen until 2030 or later."

Offshore wind, California fires

Dominion Energy Inc., which serves Northern Virginia's bustling datacenter market, is charged with meeting that intense energy demand while weighing execution risks posed by the Trump administration to its massive offshore wind project.

Dominion officials maintain that the $9.8 billion, 2,587-MW Coastal Virginia Offshore Wind project will move forward despite an executive order halting offshore leasing in federal waters and pausing offshore and onshore permits.

In California, Edison International could be pressed on the financial fallout and liabilities from the deadly wildfires in its service territory.

"The LA fires will be a big test for the policies that California implemented following the [PG&E Corp.] bankruptcy," Miller said.

California Assembly Bill 1054, signed into law in July 2019, created a $21 billion wildfire fund with equal contributions from utility ratepayers and shareholders.

"Edison International can't handle paying the liabilities that have been estimated," Miller said. "We will just say, in general, this will be a test of primarily AB 1054 legislation that kind of involves determining fault, determining the extent of the liability, ... how to handle [damages]."

Searching for growth

Analysts at Scotiabank expect sectorwide EPS growth of 10% year over year and other "impressive updates" from utility companies, but that may not translate into investor enthusiasm.

"We do not expect corresponding increases to EPS guidance ranges, especially not for near-term outlooks or long-term [compound annual growth rates] given management conservatism and the long regulatory processes that companies are required to follow,” Scotia Capital (USA) analyst Andrew Weisel wrote in a Jan. 22 report.

"We worry that investors searching for above-average growth may need to look to different sectors," Weisel added.

Guggenheim, on the other hand, anticipates investors flocking to utility companies in 2025 as the sector transitions into a growth play.

"The old school thought that this sector is a risk-off call, that it's a yield call, is no longer relevant ... the defensive characteristics for the group merely create a floor limiting downside," Guggenheim analysts wrote in a Jan. 23 report.

The industry "is due for a large snapback" and broader market outperformance as its correlation to interest rates continues to break down, they continued.

Guggenheim's top stock pick for 2025 is Constellation Energy Corp. after the independent power producer announced plans to acquire Calpine Corp. for a net purchase price of $26.6 billion from a consortium led by Energy Capital Partners LLC, forming a nuclear and natural gas generation giant.

"[Constellation's] current valuation reflects a potential floor upon which fresh incremental [free cash flow] catalysts can be layered — from incremental hyperscaler contracts to deal synergies to general margin expansion," the analysts noted. "While not all of these pieces may carry quite the same valuations within investor [sum of the parts], we believe the trend of shifting merchant [free cash flow] to contracted FCF retains momentum through the first half, and in our view any contracting within the IPP group will have uplift to [Constellation]."

Results

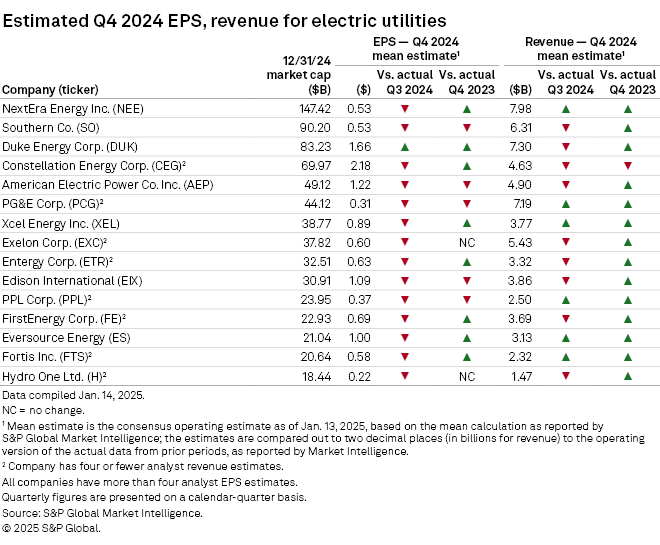

Eight of the 15 largest North American electric companies by market cap are expected to post year-over-year earnings beats, according to an S&P Global Market Intelligence analysis of S&P Capital IQ consensus estimates.

NextEra reported fourth-quarter 2024 adjusted earnings of $1.10 billion, or 53 cents per share, compared to $1.07 billion, or 52 cents per share, in the fourth quarter of 2023. The results were in line with the S&P Capital IQ normalized consensus EPS estimate for the quarter of 53 cents.

Duke Energy Corp., Constellation, Xcel Energy Inc., Entergy Corp., FirstEnergy Corp., Eversource Energy and Fortis Inc. are all forecast to report higher earnings per share in the fourth quarter of 2024 versus actual fourth-quarter 2023 results, the analysis shows.

Southern Co., American Electric Power Co. Inc., PG&E Corp., Edison International and PPL Corp. are all expected to report an earnings miss compared to actual fourth-quarter 2023 results.

Exelon Corp. and Hydro One Ltd. are expected to report earnings in line with the previous year's results.

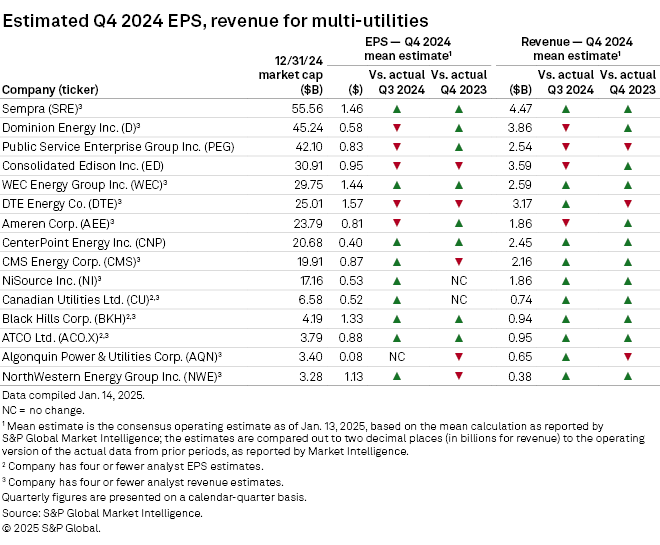

Of the North American multi-utilities, Sempra, Dominion, Public Service Enterprise Group Inc., WEC Energy Group Inc., Ameren Corp., CenterPoint Energy Inc., Black Hills Corp. and ATCO Ltd. are forecast to report higher year-over-year EPS in the fourth quarter of 2024.

Consolidated Edison Inc., DTE Energy Co., CMS Energy Corp., Algonquin Power & Utilities Corp. and NorthWestern Energy Group Inc. are projected to run below the prior year's earnings results, the analysis shows.

There is no change in the estimated year-over-year EPS for NiSource Inc. and Canadian Utilities Ltd.

|

– Access – Follow the latest news on earnings |