Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jan, 2025

By Alex Graf and Hussain Shah

Uninsured real estate could lead to loan charge-offs at banks affected by the wildfires in Los Angeles County.

Some insurance companies have pulled back from high-risk areas in California, including Pacific Palisades, and the "million dollar question," according to Stephens analyst Andrew Terrell, is whether banks will have any impacted collateral that is not insured and whether any charge-offs will result.

While it is too early to tell the extent of banks' loss exposure, credit will likely be the biggest issue in the short term, Piper Sandler analyst Matthew Clark said in an interview. Banks that Piper Sandler has contacted so far have indicated that their loans must have fire insurance as part of the underwriting process, but banks could suffer losses if the insurance on any properties has lapsed since they originated those loans, the analyst said. Clark added that he expects banks to disclose details on exposure and insurance coverage eventually.

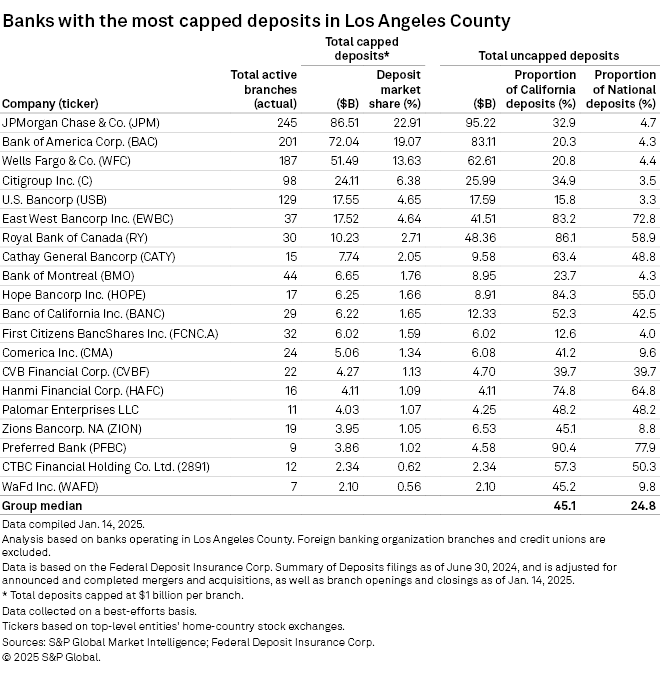

The largest four US banks, JPMorgan Chase & Co., Bank of America Corp., Wells Fargo & Co. and Citigroup Inc., dominate deposit market share in the epicenter of the fires, Los Angeles County. Together, the four banks hold 62.0% of the county's deposits capped at $1 billion per branch and JPMorgan Chase had the most deposits in the area at $86.51 billion, or 22.91% of the deposit market share across 245 total active branches, according to S&P Global Market Intelligence data.

Analysts said the immediate financial impact on banks in the region remains unclear but that the subsequent reconstruction effort could be a long-term opportunity.

Infrastructure investments could stimulate loan growth for banks in the region as Los Angeles rebuilds and prepares to host the 2028 Olympics over the coming years, analysts said.

"There's going to be a big rebuilding effort, so a lot of construction," Clark said. "It's going to take years, but I would suspect all the banks that play in that market are going to want to participate."

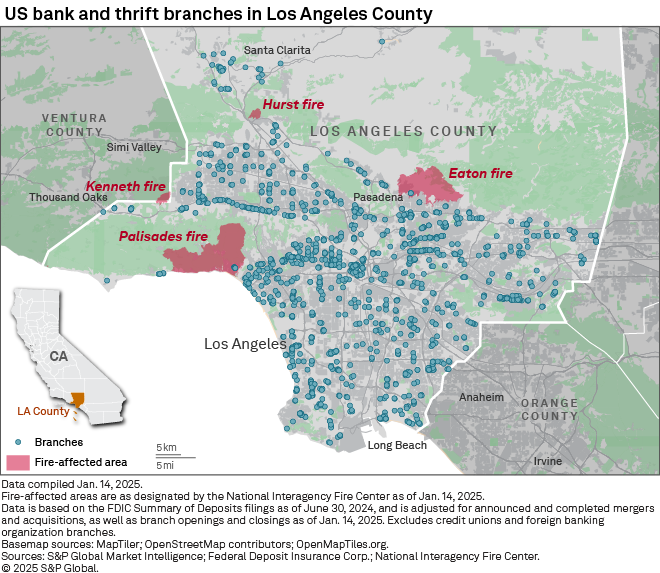

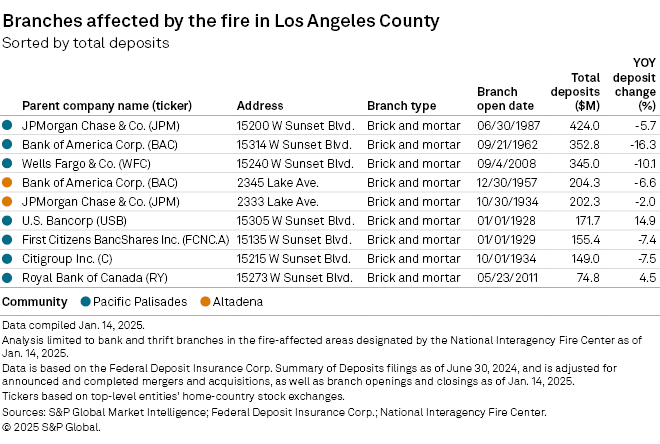

With more than 1,400 bank branches across Los Angeles County, only nine fell within the fire-affected areas designated by the National Interagency Fire Center as of Jan. 14. Of those nine branches, six belonged to one of the four largest US banks.

"There really were not many bank branches in that very specific area," Terrell said. "It was a lot more residential."

Beyond residential properties, there was nearly $1.72 billion worth of commercial real estate within the Palisades, Eaton and Hurst wildfire perimeters as of Jan. 14, according to an S&P Global Market Intelligence analysis.

So far, banks in Los Angeles County have not reported significant losses. Banc of California Inc. reported no damage to any of its facilities or properties as of Jan. 14, according to a company press release. The company also temporarily closed two branches due to their proximity to evacuation areas and the company is monitoring conditions and adjusting branch hours as needed, according to the release.

"We are not aware of any material impact on our loan portfolio or collateral due to the Southern California wildfires," the release reads. "We are currently aware of four commercial properties and three residential properties that have been damaged or destroyed, but all such collateral has insurance coverage in place."

American Business Bank said in a Jan. 14 statement that the impact to commercial buildings in its customer base had been minimal and the few that were impacted had adequate insurance in place.

However, the risk from fires continues to develop. The Hughes fire, near the Castaic Lake State Recreation Area north of Los Angeles, broke out on Jan. 22 and quickly grew to more than 10,000 acres.