Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2025

By Harry Terris and Hussain Shah

Analysts forecast broadening earnings momentum for big US banks in the fourth quarter of 2024 as net interest income lifts off troughs reached earlier during the year, with a potentially light regulatory touch under the incoming Donald Trump administration poised to deliver another boost.

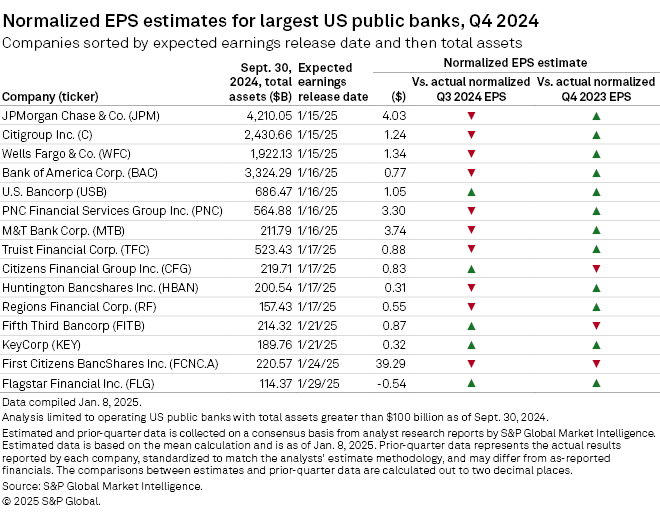

Consensus forecasts anticipate that 12 of the 15 largest publicly traded banks will post year-over-year growth in normalized EPS for the period, according to data from S&P Global Market Intelligence. That compares with eight that posted year-over-year growth in actual normalized EPS in the third quarter, while most of the banks posted year-over-year declines in each of the first two quarters of 2024. The trends are similar for revenue and net interest income forecasts, where analysts are forecasting year-over-year growth for most of the banks, compared with year-over-year declines for most across both measures in the first three quarters of 2024.

Analysts at BofA Global Research project that bank EPS growth will outstrip the S&P 500 overall in 2025 and 2026, and are also optimistic that Trump tax cuts and policies that spur domestic capital expenditure, and bank customer activity, could help further. "We expect a regime shift relative to the post 2008-09 financial crisis years on banking regulations and the interest rate backdrop," they said in a Jan. 7 note. "Structurally higher rates should support improved net interest margins, complement the growth driven by rebounding customer activity."

Analysts at Piper Sandler struck a similar note. "What was previously an inflecting [net interest income] story and not much more now looks like one" that is amplified by a friendlier regulatory outlook and accelerating customer activity levels, they said in a Jan. 2 note. Meanwhile, "credit seems to be melting away as a concern."

|

|

Set email alerts for future data dispatch articles. Download a template to generate a bank's regulatory profile. Download a template to compare a bank's financials to industry aggregate totals. |

NIM noise

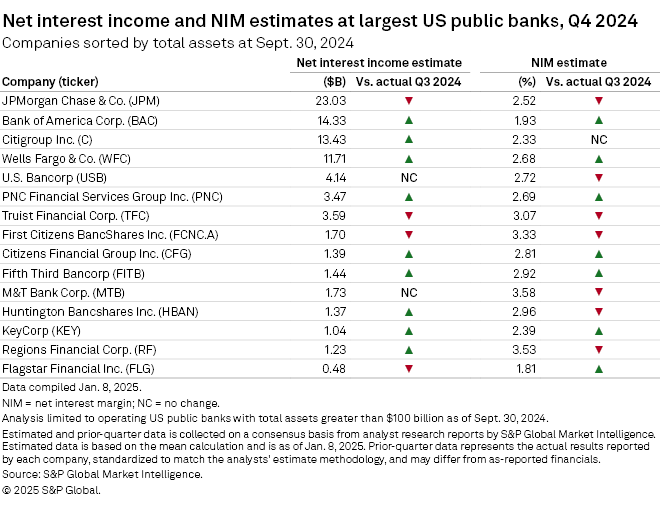

Consensus forecasts do anticipate that about half the banks will post sequential net interest margin (NIM) compression, leaving 11 of them with lower NIMs year over year.

"Fourth quarter results are likely to be noisy as it's the first quarter where the full impact of [Federal Reserve rate] cuts will be realized, and we'll get a glimpse into management's ability to quickly reprice deposits lower," analysts at Raymond James said in a Jan. 8 note. "Anecdotally, betas have seemingly been in line to better than expected, and importantly come with limited attrition." Betas refer to the movement in bank loan and deposit pricing relative to underlying rates.

The Fed cut its target rate by 50 basis points in mid-September, and by two more increments of 25 basis points each in the fourth quarter. Meanwhile, expectations for additional rate cuts have narrowed substantially and medium- and long-term rates shot up.

As of mid-December, JPMorgan Chase & Co., which had expected declining rates to compress its asset yields against its already low-cost deposits, said the shift substantially improved its net interest income outlook for 2025.

For the fourth quarter of 2024, consensus forecasts expect that JPMorgan's NIM will decline 6 basis points sequentially to 2.52%, and that its net interest income will decline about 1.6% to $23.03 billion.

|

Credit worries melt

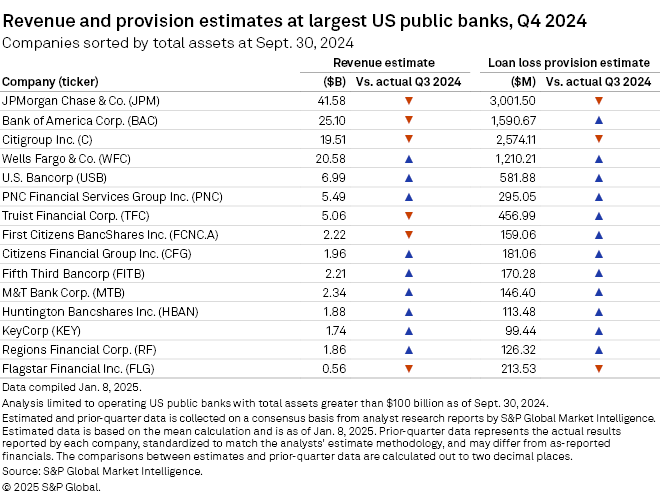

Analysts expect loan loss provision expenses to increase sequentially at 12 of the big banks, even as fears of major bleeding have receded.

"While the worst may be behind us, we still expect some normalization of credit to be conservative," the Piper analysts said. "The group has not had a meaningful credit cycle in 16 years, and we believe the possibility of one this cycle has meaningfully declined over the past year."

The Raymond James analysts said that while commercial and industrial credit quality, where loans are typically tied to short-term rates, should be supported by the Fed cuts, the increase in medium-term rates "would negatively impact [commercial real estate] credit quality on the margin."

"We do not expect any material improvement in credit quality over the next twelve months," the BofA Global Research analysts said. "Rather, we expect relative stability in credit trends as the combination of a slowing US economy ... and elevated interest rates continue to pressure certain customers [and] industry sectors."

|