Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Jan, 2025

New York regulators directed Avangrid Inc.'s two upstate multi-utilities to take steps to determine whether they can retire segments of their natural gas distribution systems, part of a push to align future system planning with climate targets.

The New York Public Service Commission told New York State Electric & Gas Corp. (NYSEG) and Rochester Gas and Electric Corp. (RG&E) to workshop ways to avoid leak-prone pipe replacements and other system investments by instead electrifying buildings and deploying other non-pipes alternatives (NPA).

NYSEG and RG&E said they would comply with the order but warned during the proceeding that finding system segments suitable for decommissioning would be challenging (Case No. 23-G-0437).

The Jan. 23 order capped more than a year of work on the companies' first long-term gas system plan, which was filed jointly. The PSC directed gas utility operators in 2022 to file the plans every three years. The plans forecast gas demand over a 20-year period and explore multiple supply scenarios, with a focus on meeting demand through NPAs such as electrification, demand response and energy efficiency rather than contracting for more gas capacity.

The PSC was satisfied with NYSEG and RG&E's demand forecasting in their initial long-term plans and found that both utilities had enough supply assets lined up. However, the PSC issued several directives in response to NYSEG and RG&E's preferred portfolio of decarbonization strategies, which some stakeholders said was overly reliant on low-carbon fuels and undervalued building electrification.

The companies will incorporate the directives into annual updates to the long-term plan, a spokesperson said in an email. These updates will also reflect "the state's mandates regarding this important energy resource" and responses to changes in demand, the spokesperson said.

Strategic pipeline retirement

The PSC ordered the companies to convene a technical conference within 60 days to develop criteria for identifying system segments ripe for strategic decommissioning. The tabletop exercise will focus on Tompkins County, but the criteria could be used to assess potential decommissioning in other parts of New York.

Commissioners directed the companies to identify NPAs that could facilitate decommissioning. The companies should outline funding needs for those resources in their next rate case, the PSC said.

NYSEG and RG&E already consider strategic decommissioning ahead of pipeline replacement projects. They said it is rare to find segments they can retire without impacting downstream service. Another challenge is convincing all customers along the segment to electrify, they said.

In one recent case, RG&E was able to fully electrify three homes in a community north of Rochester, allowing the company to retire 119 feet of leak-prone pipe.

Still, commissioners said they were concerned that the long-term plan did not adequately account for the potential to reduce spending on infrastructure projects, including those replaced by NPAs. Commissioners ordered the companies to update capital expenditure forecasts before they file their next long-term plan in January 2028.

Revisiting full building electrification

The PSC additionally directed the companies to revisit certain assumptions they made in their forecasts for full building electrification. The companies projected that by 2043, 75% of residential customers would convert to hybrid heating systems — or electrification with gas backup — when their gas equipment fails.

After stakeholders raised concerns about the forecast assumptions and the high level of hybrid heating, the PSC said the companies needed to further explore full electrification scenarios in their first annual update to the plan in May 2025.

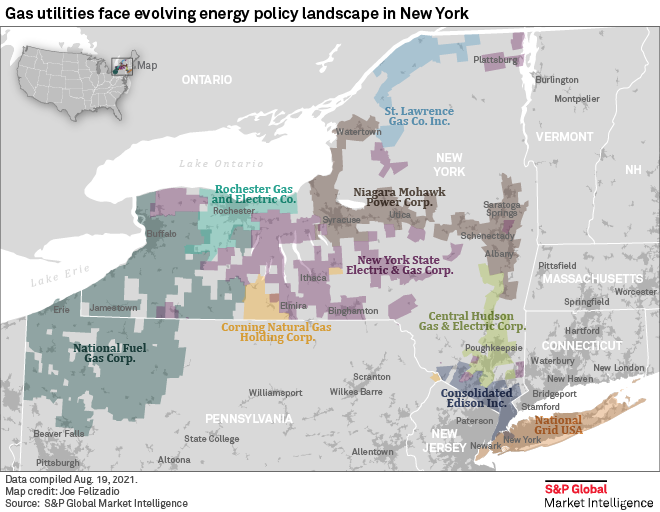

Notably, commissioners ordered the companies to develop a joint-planning approach for their electric and gas systems, an idea that has gained traction in energy transition proceedings. This coordinated system planning would facilitate gas grid downsizing and support electrification, the PSC said. Commissioners noted that NYSEG and RG&E operate overlapping electric and gas service territories for 75% and 85% of their customers, respectively.

The PSC also ordered the companies to file a report within 120 days on their work to implement a whole home electrification program, which could serve as an alternative to leak-prone pipe replacement. Commissioners additionally directed the companies to work with commission staff to develop "more extensive" outreach programs to educate gas customers about heating alternatives including electrification.

Limited role for low-carbon fuels

As for other NPAs, the PSC ordered the companies to file a proposal within 90 days for a residential demand response program. These programs typically offer rate incentives to customers that allow utilities to cap their consumption during periods of peak demand.

The companies' preferred resource portfolio saw a role for low-carbon renewable natural gas and hydrogen to displace fossil gas, but the PSC expressed skepticism. Commissioners said electrification may be a more economical decarbonization strategy due to RNG's premium over fossil gas. They called hydrogen an "unproven technology" in New York's gas grid.

The PSC directed the companies to meet with large commercial and industrial customers to discuss their demand for the low-carbon fuels and report the findings. Commissioners said they were open to hydrogen pilot projects.

The PSC additionally required the companies to issue reports within 120 days to assess whether they could safely reduce costs by restructuring or releasing contracts for gas supply assets and revising their practice of incorporating operating reserve margin into peak demand planning.