Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Dec, 2024

By Zoe Sagalow and Gaby Villaluz

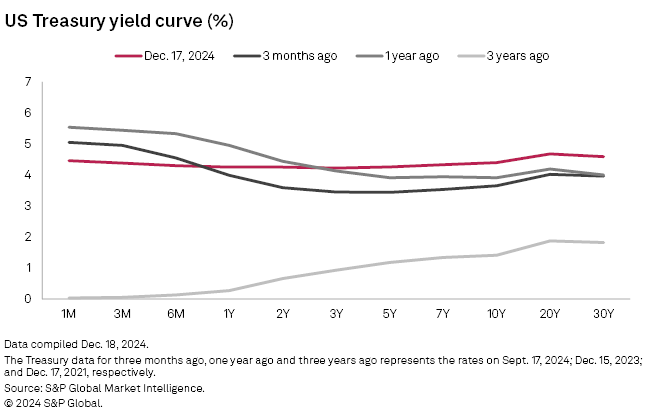

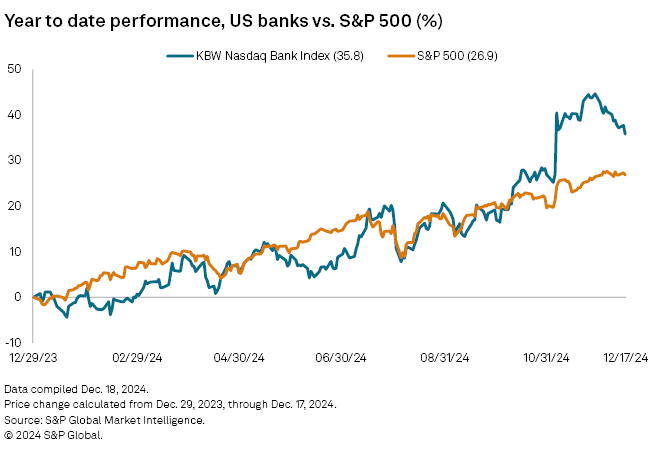

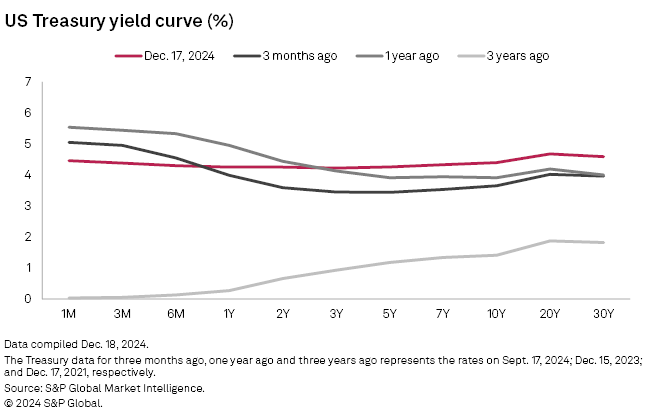

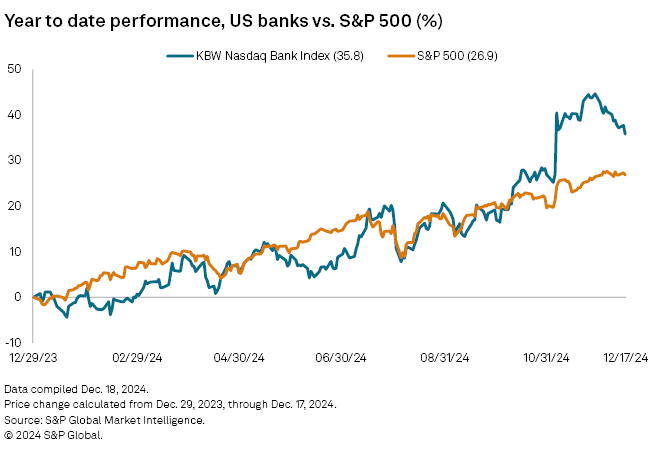

US bank stocks, and equity markets overall, fell sharply after the Federal Reserve cut interest rates again but warned that it will likely be less aggressive on further reductions in 2025.

The Fed lowered the federal funds rate by 25 basis points Dec. 18 to a range of 4.25% to 4.5%.

Fed Chair Jerome Powell said during a press conference that the central bank's policy is now "significantly less restrictive," which gives it room to be more cautious when it comes to future adjustments.

"We know that reducing policy restraint too fast or too much could hinder progress on inflation," he said. "At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment."

The KBW Nasdaq Bank Index finished the day down 4.28%, while the S&P 500 slid 2.95%.

The biggest movers for the day among bank stocks included Fifth Third Bancorp, which dropped 5.46%, Regions Financial Corp., down 5.36%, Western Alliance Bancorp., off 5.20% and Webster Financial Corp., which tumbled 5.49%.

Powell said the Fed does not need to see additional cooling in the labor market to help move inflation toward its long-term goal of 2%.

Twelve-month core inflation through November was estimated to be 2.8%, down from the 5.6% cycle high. That measure "has actually been moving sideways as we are lapping the very low readings of late last year," Powell said.

The Fed's Summary of Economic Projections, released with the rate decision, showed that Fed officials' average projection for the federal funds rate is 3.9% for 2025, higher than the previous estimate of 3.4%. In addition, 10 FOMC participants predict a rates will be lowered by 50 basis points in 2025, while three participants each predicted reductions of 25 basis points and 75 basis points. One participant projected that the Fed would not reduce rates at all.

Meanwhile, the median projection for unemployment in 2025 is 4.3%, down from 4.4% in September, and the median projection for personal consumption expenditures (PCE) inflation in 2025 is 2.5%, up from 2.1% in September.

The consumer price index, the market's preferred measure of inflation, rose more than 2.7% in the 12 months ended in November. That was the highest yearly increase since July, according to the Bureau of Labor Statistics' Dec. 11 report. In the 12 months ended in October, the index went up 2.6%.

The "core" index, which removes the more volatile energy and food prices, was up 3.3% over the 12 months ended in November, which was about where it has been since August. The labor market has shown signs of weakening, with the unemployment rate rising to 4.2% in November from 3.7% a year earlier.

18 Dec, 2024

US bank stocks, and equity markets overall, fell sharply after the Federal Reserve cut interest rates again but warned that it will likely be less aggressive on further reductions in 2025.

The Fed lowered the federal funds rate by 25 basis points Dec. 18 to a range of 4.25% to 4.5%.

Fed Chair Jerome Powell said during a press conference that the central bank's policy is now "significantly less restrictive," which gives it room to be more cautious when it comes to future adjustments.

"We know that reducing policy restraint too fast or too much could hinder progress on inflation," he said. "At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment."

The KBW Nasdaq Bank Index finished the day down 4.28%, while the S&P 500 slid 2.95%.

The biggest movers for the day among bank stocks included Fifth Third Bancorp, which dropped 5.46%, Regions Financial Corp., down 5.36%, Western Alliance Bancorp., off 5.20% and Webster Financial Corp., which tumbled 5.49%.

Powell said the Fed does not need to see additional cooling in the labor market to help move inflation toward its long-term goal of 2%.

Twelve-month core inflation through November was estimated to be 2.8%, down from the 5.6% cycle high. That measure "has actually been moving sideways as we are lapping the very low readings of late last year," Powell said.

The Fed's Summary of Economic Projections, released with the rate decision, showed that Fed officials' average projection for the federal funds rate is 3.9% for 2025, higher than the previous estimate of 3.4%. In addition, 10 FOMC participants predict rates will be lowered by 50 basis points in 2025, while three participants each predicted reductions of 25 basis points and 75 basis points. One participant projected that the Fed would not reduce rates at all.

Meanwhile, the median projection for unemployment in 2025 is 4.3%, down from 4.4% in September, and the median projection for personal consumption expenditures inflation in 2025 is 2.5%, up from 2.1% in September.

The consumer price index, the market's preferred measure of inflation, rose more than 2.7% in the 12 months ended in November. That was the highest yearly increase since July, according to the Bureau of Labor Statistics' Dec. 11 report. In the 12 months ended in October, the index went up 2.6%.

The "core" index, which removes the more volatile energy and food prices, was up 3.3% over the 12 months ended in November, which was about where it has been since August. The labor market has shown signs of weakening, with the unemployment rate rising to 4.2% in November from 3.7% a year earlier.