Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2024

By Rica Dela Cruz and Zain Tariq

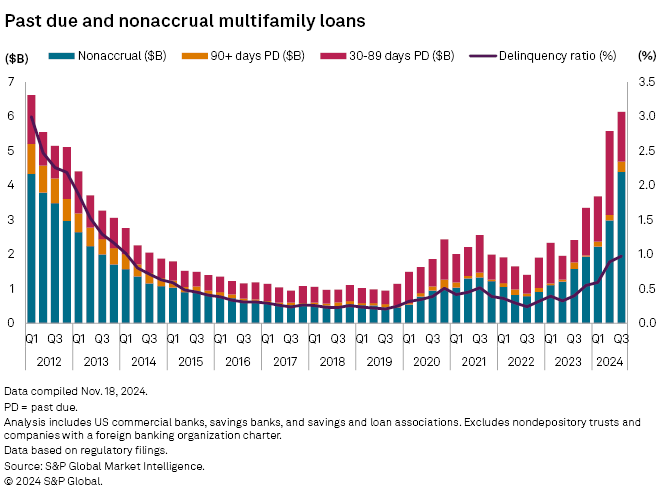

US banks' multifamily delinquency ratio has reached the highest level in a decade.

At the end of the third quarter, the multifamily delinquency ratio at US banks was 1.0%, compared with 0.9% a quarter ago and 0.4% a year ago, according to S&P Global Market Intelligence data. The last time the ratio hit at least 1.0% was before the second quarter of 2014.

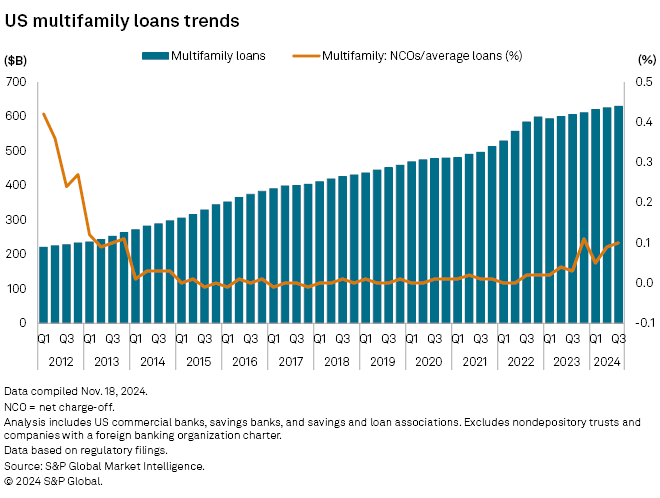

Banks' multifamily loans climbed 0.8% quarter over quarter and 3.9% year over year to $629.73 billion. Net charge-offs (NCOs) on multifamily loans were 0.10% of average loans versus 0.09% a quarter earlier and 0.03% a year earlier.

Some banks tightened lending standards and recorded weakened demand for all commercial real estate (CRE) loan categories in the third quarter, a Federal Reserve survey found.

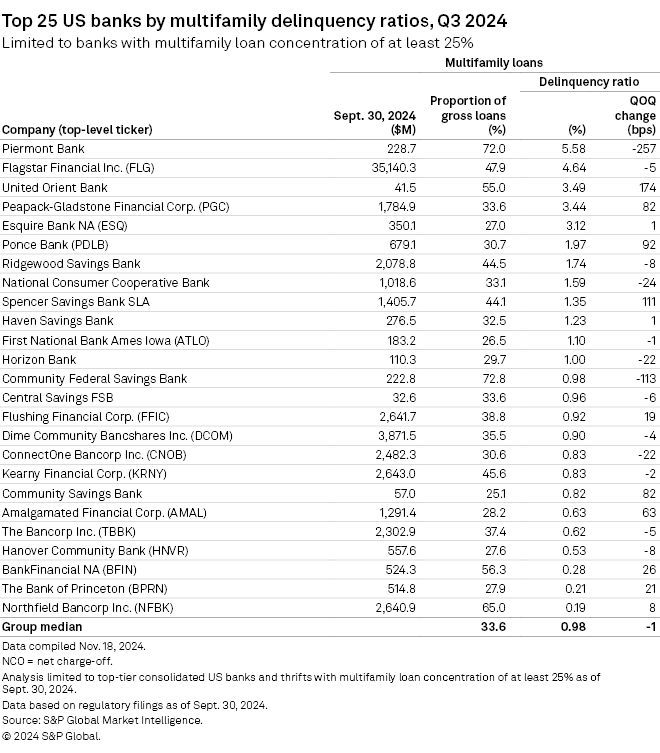

Top banks by delinquency ratios

Of the top 25 US banks by multifamily delinquency ratios for the third quarter, 11 are based in New York, including the top three: Piermont Bank, Flagstar Financial Inc. and United Orient Bank.

Along with the outlook for the CRE sector, the outlook for the rent-regulated New York City multifamily market — which faced new strains after rent regulation laws in the city were toughened in 2019 and was a focus at Flagstar earlier this year — is still challenging.

Some signs of stabilization in market fundamentals have emerged, but "some banks may have not yet felt the full brunt of lower market valuations for this asset class in their financials due to lagging new appraisals," according to an Oct. 8 report from Wedbush Securities analyst David Chiaverini, who cited Seth Glasser, a New York multifamily partner at Marcus & Millichap.

Banks are still pulling back from lending into the New York City rent-regulated market, and the broker opinion of value activity requested by banks has been "very little," the analyst said.

"This could imply, per [Glasser], that some banks may be avoiding getting updated professional appraisals, given the potential impact they could have on provisions and reserve levels," Chiaverini wrote.

Flagstar recorded a multifamily delinquency ratio of 4.64%, down 5 basis points sequentially. The company's multifamily loans, which made up 47.9% of its gross loans as of the end of the third quarter, are performing "quite well," with most nonaccruals current on their payments, CFO Craig Gifford said on an Oct. 25 earnings call.

"The biggest takeaway [for the third quarter] from our perspective is that our multifamily borrowers continue to support their properties," Flagstar President, CEO and Executive Chairman Joseph Otting said during the call.

– View asset quality by loan type for all US banks.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top news and insights from S&P Global Market Intelligence.

Also on the top 25 list was Flushing Financial Corp., with a multifamily delinquency ratio of 0.92%, up 19 basis points quarter over quarter. There will be limited risk and loss as it relates to the company's multifamily book, given that it recorded an improvement in its criticized and classified multifamily loans, among other things, President and CEO John Buran said during an Oct. 25 earnings call.

Dime Community Bancshares Inc. booked a multifamily delinquency ratio of 0.90%, down 4 basis points from the prior quarter, but said it has "no issues in the multifamily portfolio." The Bancorp Inc., in which substandard multifamily loans are heightened but are at or close to a peak, reported a multifamily delinquency ratio of 0.62%, down 5 basis points.

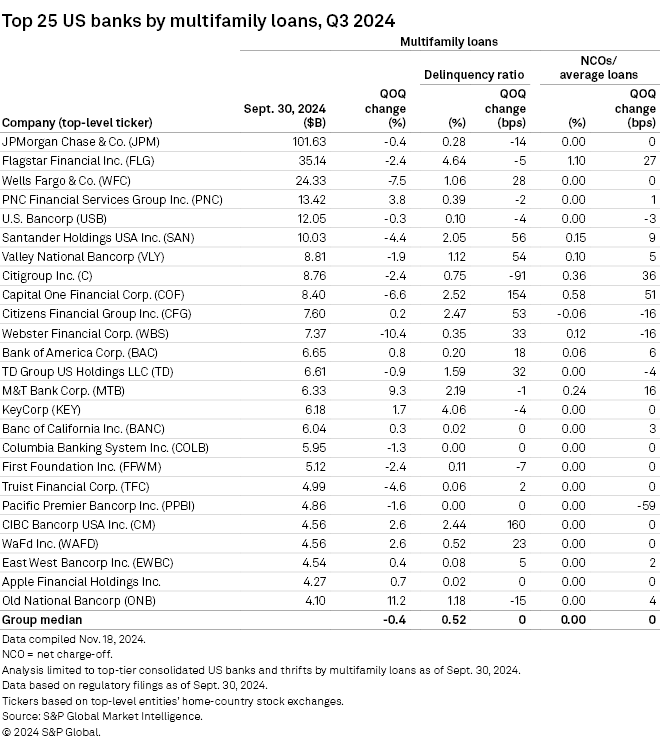

Top lenders

JPMorgan Chase & Co. continued to lead the industry with $101.63 billion of multifamily loans as of Sept. 30. The company, which posted a 14-basis-point sequential decline in its multifamily delinquency ratio to 0.28%, is "seeing encouraging signs" in its multifamily loan originations with lower long-term rates, CFO Jeremy Barnum said during an Oct. 11 earnings call.

Among the top 25 US banks by multifamily loans, Webster Financial Corp. logged the biggest quarter-over-quarter percentage decline in multifamily loans at 10.4% to $7.37 billion. Its multifamily delinquency ratio came in at 0.35%, up 33 basis points.

"While it has been an investor focus, there have been no significant changes in the quality of our rent-regulated multifamily portfolio where credit performance has held up consistently well," Webster Chairman and CEO John Ciulla said during an Oct. 17 earnings call.

Old National Bancorp booked the largest increase in multifamily loans among the banks on the list at 11.2% to $4.10 billion. Valley National Bancorp and First Foundation Inc., which both recently revealed planned CRE loan sales, were part of the list with $8.81 billion and $5.12 billion, respectively, of multifamily loans.