Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2024

Institutional investors continued to aggressively sell equities in November while index and exchange-traded funds boosted their buying as stocks soared to all-time highs in late 2024.

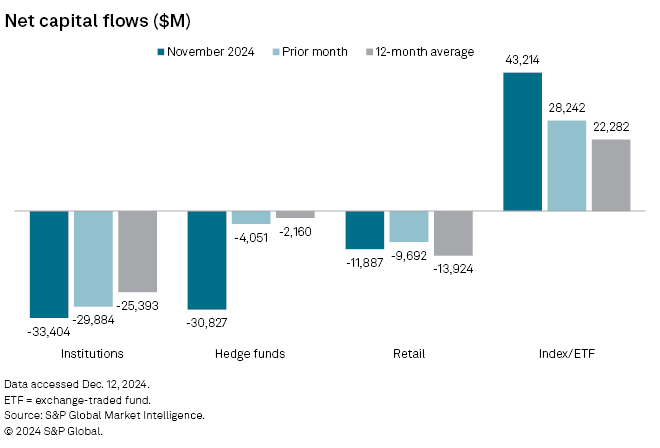

Institutions sold a net $33.40 billion in equities in November, up nearly 12% from the $29.88 billion sold in October and about 32% above the $25.39 billion monthly average sold across the past 12 months, according to the latest data from S&P Global Market Intelligence.

Meanwhile, index and ETF investors purchased a net $43.21 billion of stocks in November, up 53% from the net $28.24 billion bought in October and close to double the $22.28 billion in net purchases this group averaged over the past 12 months, the data shows. November marked the largest monthly inflows by ETFs since Market Intelligence began tracking this data.

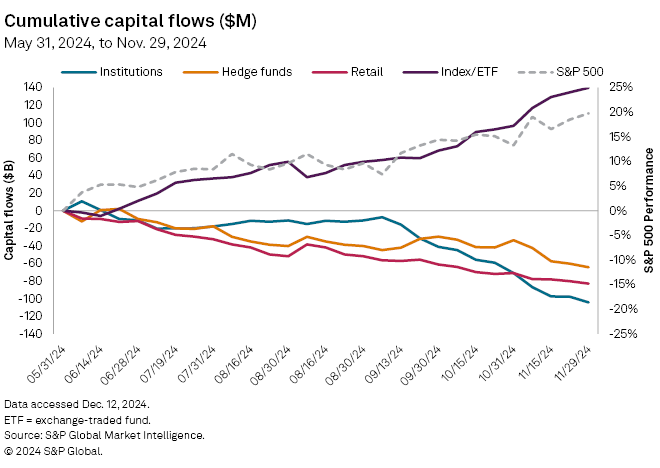

Selling by institutions and buying by index and ETF investors has been an ongoing market theme over the past 12 months as investors moved away from stock picking to betting on the broader market, said Thomas McNamara, a director for issuer solutions at Market Intelligence.

"As the S&P 500 continues to hit all-time highs on what seems like a daily basis, it is a safer strategy to invest in the broader market," McNamara said.

Over the past year, institutions accounted for about $230 billion of supply in the stock market while ETFs drove about $250 billion of the demand.

Institutions are using ETFs to participate in the ongoing market rally, as are hedge funds and retail investors to a lesser degree.

"Our current hypothesis is that as the market continues to rise we will continue to see ETFs on the demand side," McNamara said. "When the market pulls back that is when stock picking will become more important."

Flows by investor group

Institutions sold all sectors except communication services, information technology and real estate, a continuation of the same buying and selling patterns from October.

Index and ETF investors continued buying in all sectors, increasing their positions the most in materials, financials and consumer discretionary.

Hedge fund investors, a group that significantly increased selling stocks from October to November, sold in all sectors except real estate and consumer discretionary. This group decreased their positions the most in communication services, selling 9.5% of stocks held in this sector, the data shows.

"Hedge funds have been selling for the last couple of months, taking advantage of the overarching gains in the space year-to-date," McNamara said.

Retail investors sold in all sectors except consumer staples, utilities and industrials. Retail investors sold a net $11.89 billion of stocks in November, about $2 billion less than the 12-month average.