Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2024

By FEDERICA TEDESCHI and Cheska Lozano

Greek banks made further asset quality improvements in what was a strong third quarter for the country's biggest lenders.

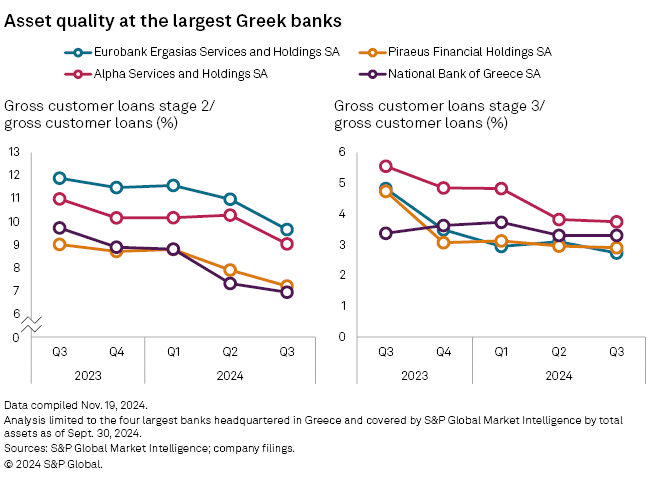

Greece's four largest banks — Eurobank Ergasias Services and Holdings SA, Piraeus Financial Holdings SA, Alpha Services and Holdings SA and National Bank of Greece SA — all reported lower stage 2 and stage 3 loan exposures compared with a year ago. Stage 2 loans are those classified under IFRS 9 accounting rules for which credit risk has increased significantly since origination, while stage 3 represents nonperforming loans.

National Bank of Greece cut its stage 2 exposures to 6.94% of gross customer loans from 9.73% a year ago, the largest year-over-year reduction in the sample. Eurobank was the biggest improver on stage 3 loans, falling to 2.73% of total loans from 4.83%.

Nearly all of the banks improved asset quality quarter over quarter, too, reflecting the sustained progress made on bad loans in recent years. The Hercules Asset Protection Scheme, which encouraged lenders to securitize and sell off portfolios of nonperforming exposures, was a key driver of this trend.

Asset quality improvement is expected to continue, driven by minimal nonperforming exposure formation, ongoing sales and recoveries, further supported by Greece's GDP growth, according to Eleni Ismailou, vice president of the research division at AXIA Ventures Group.

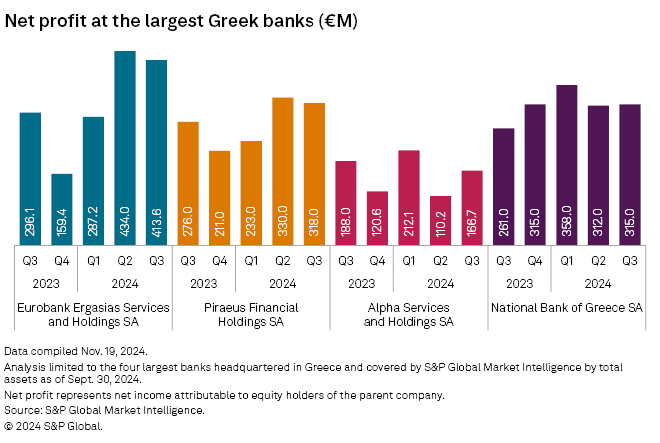

All of the banks bar Alpha also recorded higher earnings than in the year prior, led by Eurobank, which grew net profit to €413.6 million from €296.1 million. Alpha grew profit by more than 40% on a quarter-over-quarter basis.

The results all beat analysts' consensus estimates, some by as much as 25%, according to Andreas Souvleros, equity analyst at Eurobank Equities. Although Greek banks are more sensitive to interest rate cuts than their continental peers, their profitability through 2026 is expected to remain in line with peripheral European bank averages, Souvleros said.

A resilient NII and positive outlook

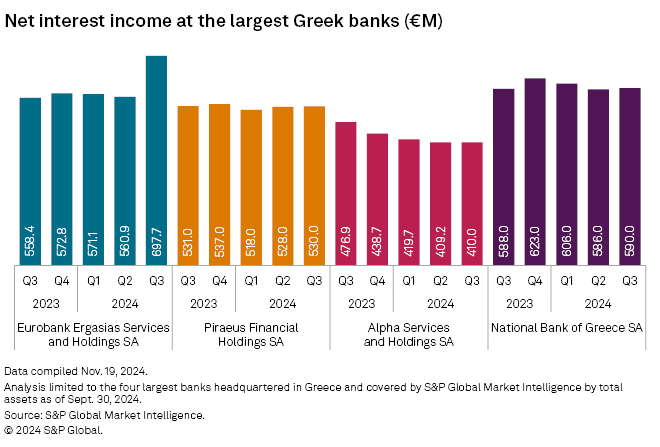

Net interest income (NII) for all major Greek banks increased quarter over quarter, while Piraeus and Alpha posted a slightly decrease year over year.

Eurobank grew NII nearly 25% quarter over quarter to €697.70 million from €560.90 million.

NII — the difference between interest earned on loans and interest paid on deposits — was mostly flat for the four Greek banks over the past five quarters. This was despite interest rates falling from 4% to 3% since the start of 2024.

"The momentum seen in 2024 so far … has reinforced confidence in the Greek banking sector's outlook for the next three years," said Ismailou.

– Access aggregate financial data for Greek banks.

– View the latest earnings transcript for Alpha.