Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2024

The Federal Reserve will almost certainly cut its benchmark interest rate by another 25 basis points this week.

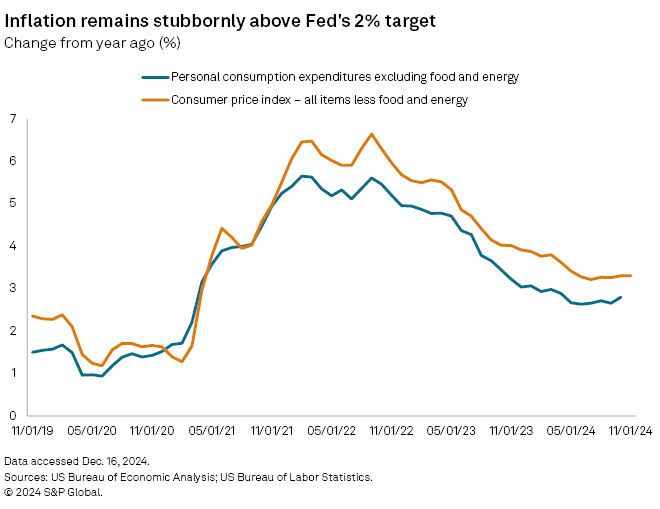

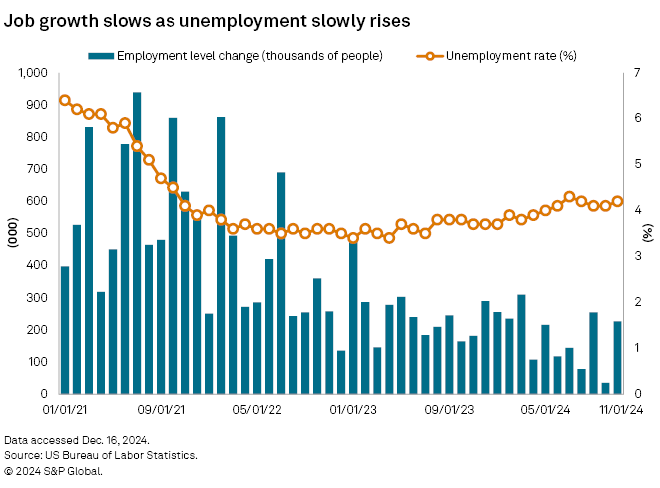

But Fed officials are also likely to signal that the pace of cuts will be slower in 2025 with the economy continuing to grow, the jobs market softening a bit and inflation remaining stubbornly above the 2% target.

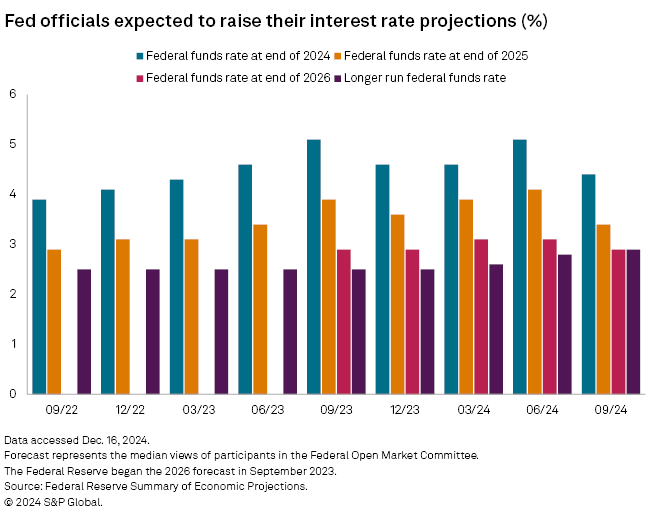

Alongside its rate decision, the central bank on Dec. 18 will release its quarterly summary of economic projections, which include Fed officials' forecasts for GDP, unemployment, inflation and the path forward for the federal funds rate. In its September projections, the median view among Fed officials was for rates to be 3.4% at the end of 2025, 2.9% at the end of 2026 and 2.9% in the longer run. That final figure was the highest forecast for the long-term rate since 2018.

Since September, the Fed has pulled rates down 75 basis points from their highest point in decades. However, a previously anticipated, steady series of cuts now seems less likely. With the expected announcement of the 25-basis-point cut, Fed Chairman Jerome Powell will also likely signal that the pace of cuts will be slower in 2025, though how much slower will likely remain uncertain.

"While the fed funds rate cut seems pretty cut and dry, there are a number of other details that are a bit murkier," said Thomas Simons, chief US economist at Jefferies.

The Fed is now poised to hold rates steady in January 2025, followed by likely cuts in March, June and September, David Mericle, a US economist with Goldman Sachs, wrote in a Dec. 15 note.

Mericle expects the Fed's newest projections to show a median expectation of the longer-run fed funds rate to rise to about 3%.

This median view started 2024 at 2.5% and will likely continue upward throughout next year, said Simons with Jefferies.

"Eventually, we expect this estimate to be above 3% by a decent margin, but the path will be gradual," Simons said.

The Trump question

The Fed is loosening monetary policy as inflation has moved modestly higher and President-elect Donald Trump's victory in November boosted the odds of higher inflation in 2025 as the incoming administration looks to impose new tariffs.

While hotter than expected recently, inflation overall remains "quite mild," said Callie Cox, chief market strategist at Ritholtz Wealth Management.

With clear risks to hiring and unemployment, the Fed will be reluctant to do anything that could slow the jobs market, Cox said.

"The incoming administration's policies are just speculation at this point," Cox said. "The Fed doesn't like to change without concrete evidence in the data, so I doubt they front-run any political stories."