Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Nov, 2024

By Harry Terris and Hussain Shah

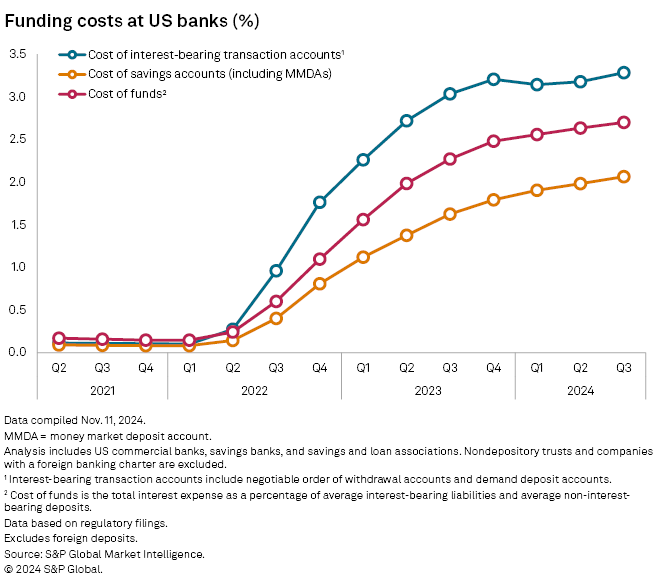

Funding cost increases decelerated across US banks in the third quarter as the Federal Reserve announced its first interest rate cut and the quality of deposit inflows improved.

The aggregate cost of funds increased 7 basis points sequentially to 2.70% in the period, after increases of 8 basis points each in the first and second quarters, according to data from S&P Global Market Intelligence. Funding cost increases have been slowing considerably since a peak sequential increase of 50 basis points in the fourth quarter of 2022, with the Fed's last rate hike in the third quarter of 2023.

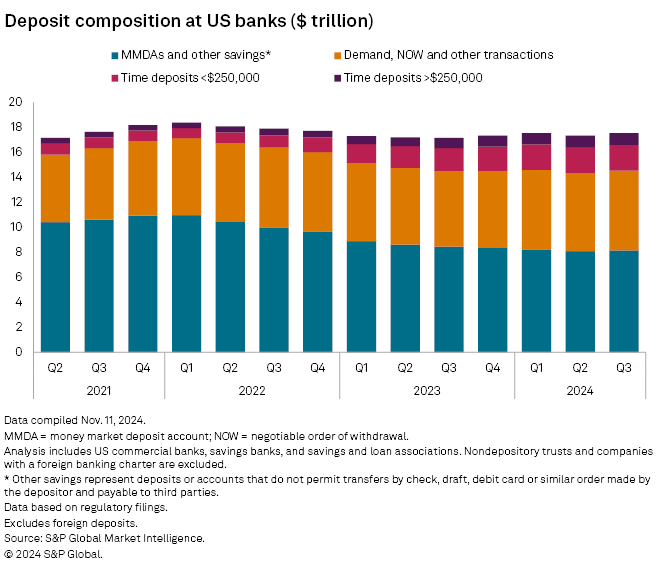

Meanwhile, savings deposits posted their first sequential increase in 10 quarters at 0.8%, and the increase in time deposits continued to slow to 1.0% as the quality of banks' funding base improved.

Funding costs for community banks may have peaked in the third quarter, according to projections from Market Intelligence, though lags in the repricing of time deposits are likely to slow the descent. Expectations for the ultimate size of Fed cuts have also come down.

"Deposit trends remain fine," Piper Sandler analyst R. Scott Siefers said in a Nov. 17 note.

|

|

− Set email alerts for future data dispatch articles. − Download a template to generate a bank's regulatory profile. − Download a template to compare a bank's financials to industry aggregate totals. |

Down cycle

The Fed started the cutting cycle with a reduction of 50 basis points on Sept. 18, or with just under two weeks remaining in the third quarter. Banks have been readying deposit strategies for cuts all year, however, including by pulling back on high-interest time deposits.

By Nov. 1, the number of banks offering certificates of deposit (CDs) with rates higher than 4% had fallen to 600 from 958 at June 28.

In the fourth quarter, deposit costs will also benefit from a Fed cut of 25 basis points on Nov. 7. Banks such as Citizens Financial Group Inc. and M&T Bank Corp. have projected deposit betas, or the change in deposit costs relative to underlying rates, of 40% in the fourth quarter.

A Raymond James survey of bank executives in November found that 42% of respondents expect deposit betas to be lower during the cutting cycle than they were during the hiking cycle, and 32% expect them to be about the same.

|

Better flows

Savings deposits are the largest category of deposits, and the 0.8%, or $102.06 billion, sequential growth in savings deposits during the third quarter to $8.155 trillion accounted for most of the 1.2%, or $199.65 billion, increase in deposits overall to $17.533 trillion.

Time deposits increased 1.0%, or $30.11 billion, to $3.009 trillion. Time deposits had increased by as much as 24.8%, or $424.47 billion, sequentially in the first quarter of 2023.

Deposit growth has firmed modestly so far in the fourth quarter, according to weekly data from the Fed. Year-over-year deposit growth at domestically chartered commercial banks has ranged from 2.0% to 2.7% through Nov. 6. Year-over-year deposit growth resumed in March but stayed below 2% until September.

Year-over-year growth in large time deposits, meanwhile, slowed to 9.8% at Nov. 6, down from a peak of 95.7% in late 2023.