Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2024

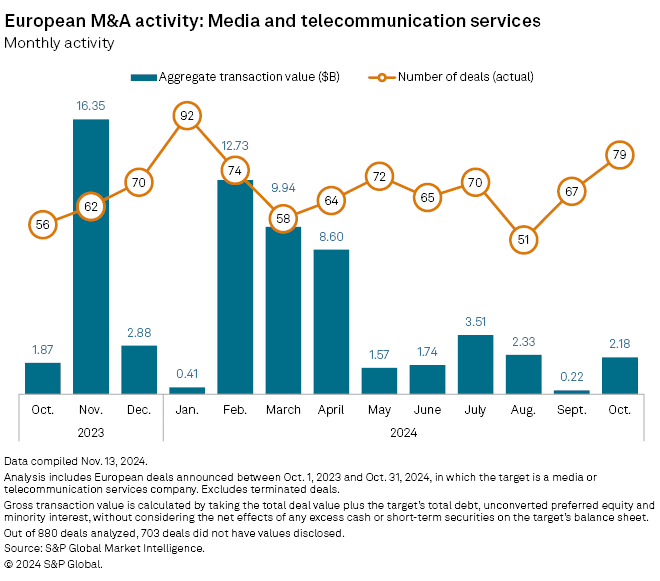

M&A activity in Europe's media and telecom sector bounced back in October after hitting its lowest level in 13 months in September, according to S&P Global Market Intelligence data.

The sector recorded $2.18 billion in aggregate transaction value from 79 deals in October, compared to $220.0 million from 67 deals in September and $1.87 billion from 56 transactions in October 2023.

The biggest transaction of the month was US-based tower operator SBA Communications Corp.'s agreement to acquire Millicom International Cellular SA's portfolio of approximately 7,000 towers for $975.0 million.

The towers are located in Guatemala, Honduras, Panama, El Salvador and Nicaragua. The deal is expected to close in mid-2025, subject to regulatory clearances and other closing conditions.

Ministero dell'Economia e delle Finanze, or the Italian Ministry of Economy and Finance, and Retelit SpA's $774.9 million bid to purchase Telecom Italia Sparkle SpA from its parent company Telecom Italia SpA was the second-largest media and telecom deal in October. This followed Telecom Italia's rejection of the Italian ministry's previous proposal for the submarine cable business in February.

The third-largest deal of October in terms of value was Equitix Investment Management Ltd.'s planned acquisition of an additional 8.33% stake in UK-based Cornerstone Telecommunications Infrastructure Ltd. from VMED O2 UK Ltd. for $234.0 million.

|

– Check out how dealmaking fared in the European media and telecom sector in September. – Use our Transactions Statistics page to run a custom screen of M&A by industry or geography. |

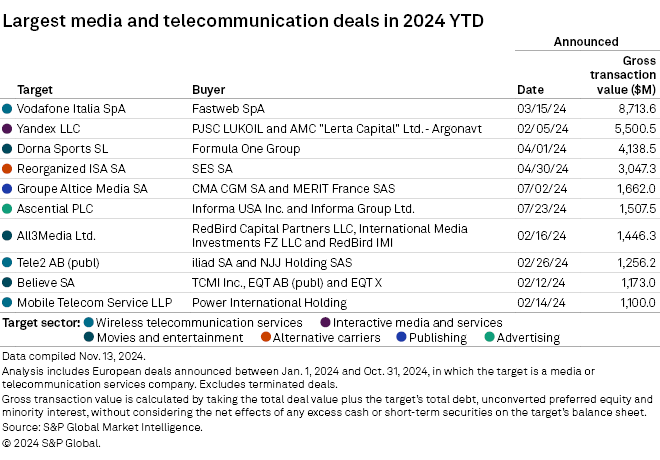

Vodafone Italia SpA's pending $8.71 billion sale to Swisscom AG unit Fastweb SpA is the biggest deal year to date. The transaction was recently cleared by the Italian communications regulator, moving a step closer to its expected completion in the first quarter of 2025.