Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Dec, 2024

Dallas-based Triumph Financial Inc. remains one of the most richly valued US bank stocks despite facing headwinds in 2024, according to S&P Global Market Intelligence data.

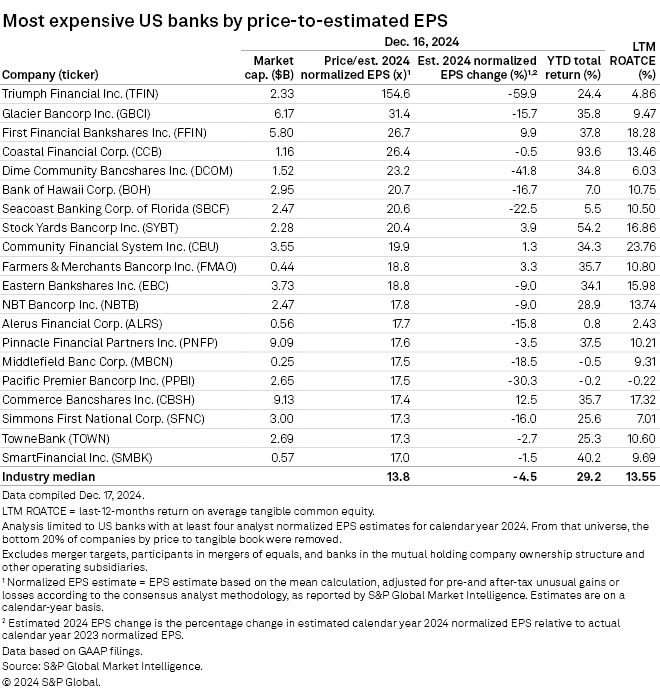

S&P Global Market Intelligence analyzed US banks that appear to be valued more as a multiple of earnings than tangible book value. To be included in this analysis, a company needs to have normalized EPS estimates from at least four analysts available for calendar year 2024. In addition, the bottom 20% of banks by price to tangible book were excluded.

Most highly valued banks

As of Dec. 16, Triumph Financial stood out among its peers with its shares trading at 154.6x estimated 2024 EPS — far exceeding the industry median of 13.8x across the 108 US banks analyzed. However, the company's estimated 2024 EPS represents a sharp decline of 59.9% from the 2023 actual EPS of $1.61, largely due to rising expenses and flat revenue growth.

The broader industry is expected to post a median EPS decline of 4.5% in 2024.

In another Market Intelligence analysis, Triumph was also found to be the most richly valued US bank stock by price-to-adjusted tangible book value.

Kalispell, Montana-based Glacier Bancorp Inc. was the second-highest priced US bank with a 31.4x price-to-estimated EPS multiple, followed by Abilene, Texas-based First Financial Bankshares Inc. with a multiple of 26.7x as of mid-December.

Everett, Washington-based Coastal Financial Corp. and Hauppauge, New York-based Dime Community Bancshares Inc. had price-to-estimated EPS multiples of 26.4x and 23.2x, respectively.

Total returns

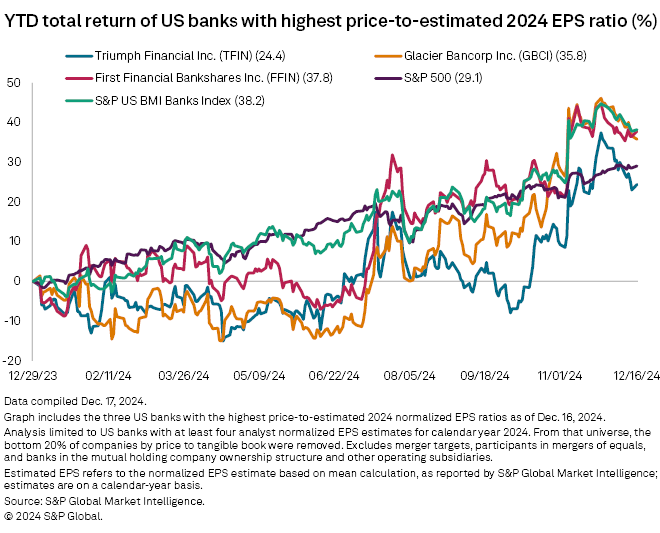

The three highest-valued bank stocks all recorded positive year-to-date returns as of Dec. 16. Leading the pack was First Financial Bankshares Inc. with a return of 37.8%, closely trailing the S&P US BMI Banks Index's return of 38.2% and outperforming the S&P 500's return of 29.1%.

Glacier Bancorp reported a 35.8% return, ahead of Triumph Financial, which posted a return of 24.4% as of mid-December.

Among the 20 most expensive banks by price-to-estimated 2024 EPS, only two reported negative year-to-date total returns: Ohio-based Middlefield Banc Corp. and Irvine, California-based Pacific Premier Bancorp Inc. The banks traded closely at a multiple of 17.5x and posted YTD returns of negative 0.5% and negative 0.2%, respectively. Pacific Premier Bancorp was the only bank among the top 20 with a negative return on average tangible common equity during the last 12 months.