Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Apr, 2024

By Aditya Saroha and Cheska Lozano

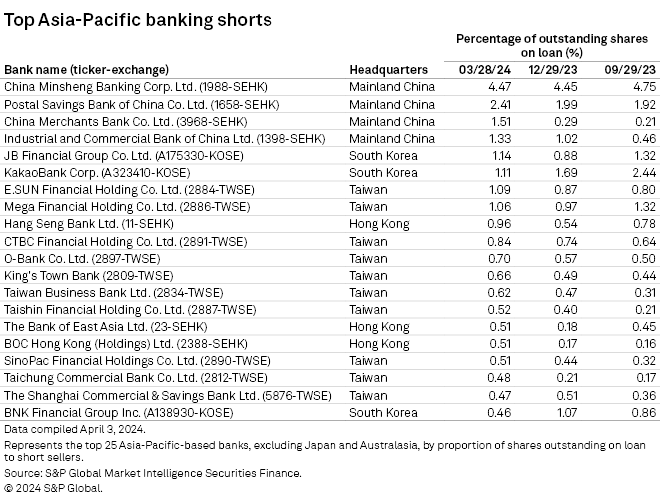

China Minsheng Banking Corp. Ltd. was Asia-Pacific's most-shorted bank in the first quarter, ahead of three other mainland China lenders.

Banks based in Taiwan, meanwhile, occupied half of the spots on the top 20 list of most-shorted banks in the region, excluding Japan and Australasia, S&P Global Market Intelligence Securities Finance data showed.

Short sellers held 4.47% of China Minsheng Banking's shares as of March 28, 2024, versus 4.45% on Dec. 29, 2023, when it was also the most-shorted bank in the region. The Beijing-based lender was also the most-shorted lender as of Sept. 29, 2023, when short sellers held 4.75% of its shares, the data showed.

By comparison, short sellers held 2.41% of second-placed Postal Savings Bank of China Co. Ltd. shares as of March 28, against the 1.99% held on Dec. 29, 2023. Short positions at China Merchants Bank Co. Ltd. rose to 1.51% from 0.29% as of Dec. 29, 2023, S&P Global Market Intelligence Securities Finance data showed, while those at Industrial and Commercial Bank of China Ltd., the world's largest bank by assets, rose to 1.33% from 1.02%.

No other mainland China lenders appeared on the top 20 list.

China Minsheng Banking has considerable exposure to the country's real estate sector, which is in a downturn. Even though the bank cut its exposure in 2023, its real estate loans amounted to 346.30 billion yuan, or 7.90% of its lending book, compared to 363.34 billion yuan, or 8.77% of its book, as of Dec. 31, 2022, according to its annual report. The nonperforming loan (NPL) ratio of the bank's real estate loans was 4.92% in 2023, more than three times higher than its overall NPL ratio of 1.48%.

The low interest rate environment in mainland China will keep net interest margins tight in 2024, CFRA Equity Research analyst Siti Salikin said in an April 13 note. "But stronger growth of high-yield retail loans and China Minsheng Banking's vigorous optimization of its asset-liability structure will ease the pressure," Salikan said.

China Minsheng Banking's NPL ratio of 1.48% at 2023-end was below the banking industry's 1.69%, according to Salikin. "We think stricter risk management, active collection, and disposals will support asset quality and reduce credit impairment losses in 2024."

The downturn in mainland China's real estate sector, which accounts for around a quarter of the country's GDP, continues to pose challenges to its growth potential. The country set its 2024 GDP growth target at about 5% after topping a similar target last year. The International Monetary Fund, however, expects mainland China's economy to grow 4.6% in 2024 and 4.1% in 2025, citing the impact of the real estate downturn on the economy.

Short sellers target East Asian banks

South Korea's KakaoBank Corp. and JB Financial Group Co. Ltd. were among the top seven banks with the highest short positions in the region. Short sellers held 1.11% of Kakao Bank shares and 1.14% of JB Financial Group as of March 28.

Shares at digital bank KakaoBank have dropped more than 18% since the start of the year, even as it reported a jump in its 2023 profit in February. Its net profit rose to 354.9 billion won from 263.09 billion won in 2022, Market Intelligence data showed.

In total, 10 lenders based in Taiwan showed up on the list of top 20 Asia-Pacific banking shorts in the first quarter, the data showed. Barring The Shanghai Commercial & Savings Bank Ltd., short positions at all the Taiwan-based banks rose as of March 28 versus previous quarter.

Short positions at the three Hong Kong-based banks on the list registered increases from a quarter ago. Short sellers held about 0.96% of Hang Seng Bank Ltd. shares as of March 28, up from 0.54% as of Dec. 29, 2023.

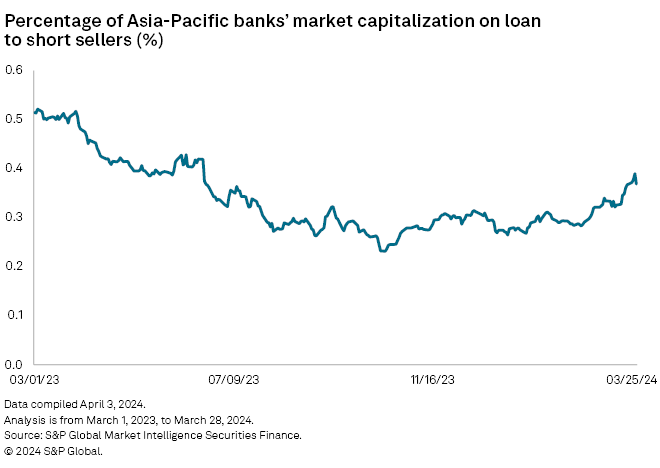

The proportion of Asia-Pacific bank shares on loan to short sellers rose to 0.37% of total market capitalization as of March 28 from 0.27% on Dec. 29, 2023.